£1,000 ISA Penalty Sparks Outrage: Is Early Access Truly Unfair?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

£1,000 ISA Penalty Sparks Outrage: Is Early Access Truly Unfair?

The recent case of a saver penalized £1,000 for accessing their ISA funds early has ignited a firestorm of debate. The incident highlights the often-overlooked complexities of Individual Savings Accounts (ISAs) and the potentially harsh consequences of breaching their terms and conditions. But is this level of penalty justified, or is the system unfairly punishing those facing unexpected financial hardship?

Understanding ISA Penalties: A Complex Landscape

Individual Savings Accounts offer attractive tax benefits, making them a popular choice for UK savers. However, different types of ISAs come with varying rules regarding access to funds. While some offer flexible access, others, particularly those designed for long-term savings, impose penalties for early withdrawals. These penalties can significantly impact the overall returns, effectively negating some of the tax advantages.

The recent case involved a saver who, facing unforeseen circumstances, needed to access their funds prematurely. The resulting £1,000 penalty, a substantial sum for many, has fueled a public discussion on the fairness and transparency of ISA penalty structures. Many are questioning whether the potential financial hardship of early access outweighs the principle of upholding the terms of the ISA agreement.

The Arguments For and Against Steep ISA Penalties

-

Arguments in favor of penalties: Proponents argue that penalties deter individuals from using ISAs as short-term savings vehicles, preserving their intended purpose of long-term growth and tax-efficient saving. They also emphasize the importance of adhering to contractual agreements. Financial institutions argue that clear terms and conditions are presented upfront, leaving savers fully aware of the potential consequences of early withdrawals.

-

Arguments against steep penalties: Critics argue that the penalties are disproportionately harsh, particularly in cases of genuine financial hardship. They highlight the lack of flexibility within the system, suggesting that a more nuanced approach is needed, perhaps incorporating hardship clauses or tiered penalty systems. The current system, they argue, unfairly penalizes those facing unexpected job losses, medical emergencies, or other unforeseen events.

The Call for Greater Transparency and Flexibility

The outrage surrounding this £1,000 ISA penalty underscores a growing need for greater transparency and flexibility within the ISA framework. Many are calling for:

- Clearer communication: Financial institutions need to improve communication surrounding ISA terms and conditions, ensuring savers fully understand the implications of early withdrawals.

- More flexible options: Offering a wider range of ISA products with varying levels of access flexibility could cater to different saving goals and risk tolerances.

- Hardship clauses: Incorporating hardship clauses into ISA agreements could provide a safety net for individuals facing genuine financial emergencies.

Navigating the ISA Landscape: Advice for Savers

Before investing in any ISA, carefully review the terms and conditions, paying close attention to rules regarding early access and penalties. Consider your individual circumstances and saving goals to select the most suitable ISA type. If you anticipate needing access to your funds before the agreed-upon timeframe, explore alternative saving options.

The £1,000 ISA penalty saga serves as a stark reminder of the importance of understanding the intricacies of financial products before committing. It also highlights the ongoing debate surrounding the balance between protecting the integrity of long-term saving schemes and providing support for those facing unexpected financial difficulties. The future of ISA regulations may well depend on finding a more equitable solution that balances these competing interests.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on £1,000 ISA Penalty Sparks Outrage: Is Early Access Truly Unfair?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

40 Aniversario De Espana En La Ue Una Mirada Retrospectiva Y Hacia El Futuro

May 10, 2025

40 Aniversario De Espana En La Ue Una Mirada Retrospectiva Y Hacia El Futuro

May 10, 2025 -

Inclusion Redefined Zaras Groundbreaking Fashion Campaign

May 10, 2025

Inclusion Redefined Zaras Groundbreaking Fashion Campaign

May 10, 2025 -

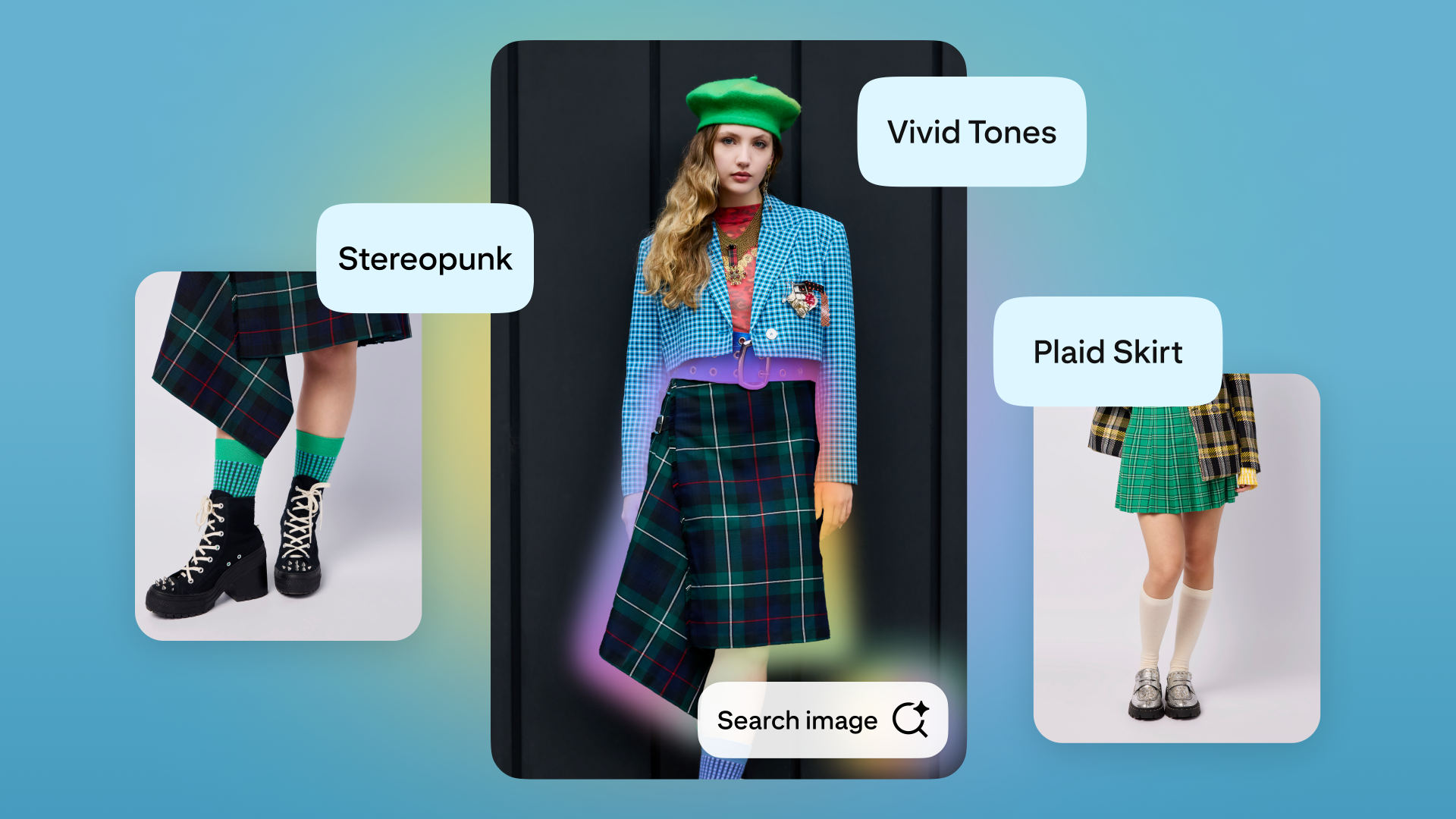

Pinterest Launches Ai Tools For Vibe Driven Visual Shopping

May 10, 2025

Pinterest Launches Ai Tools For Vibe Driven Visual Shopping

May 10, 2025 -

The Old Guard 2 Trailer Charlize Theron And The Immortals Face New Danger

May 10, 2025

The Old Guard 2 Trailer Charlize Theron And The Immortals Face New Danger

May 10, 2025 -

Confirmed Indian Superstars Career Ends The Retirement Announcement

May 10, 2025

Confirmed Indian Superstars Career Ends The Retirement Announcement

May 10, 2025

Latest Posts

-

Us Navy F 18s In Yemen Assessing Combat Losses From All Sources

May 10, 2025

Us Navy F 18s In Yemen Assessing Combat Losses From All Sources

May 10, 2025 -

Two Pakistan Air Force Jets Shot Down Indias Srinagar Missile Response

May 10, 2025

Two Pakistan Air Force Jets Shot Down Indias Srinagar Missile Response

May 10, 2025 -

Starmer Faces Backlash Over Controversial Disability Benefit Changes

May 10, 2025

Starmer Faces Backlash Over Controversial Disability Benefit Changes

May 10, 2025 -

Biden And Trump A Study In Contrasting American Leadership

May 10, 2025

Biden And Trump A Study In Contrasting American Leadership

May 10, 2025 -

Summer Recreation At Oklahoma Lakes Halted By Federal Hiring Freeze

May 10, 2025

Summer Recreation At Oklahoma Lakes Halted By Federal Hiring Freeze

May 10, 2025