£1.1 Billion Profit For Revolut: Analysis Of The London Fintech's Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

£1.1 Billion Profit for Revolut: A Deep Dive into the London Fintech's Explosive Growth

Revolut, the London-based fintech giant, has announced a staggering £1.1 billion profit, solidifying its position as a major player in the global financial technology landscape. This remarkable achievement underscores the company's rapid expansion and innovative approach to banking, prompting a closer look at the factors driving its success and the implications for the future of finance.

The Numbers Speak Volumes: A Breakdown of Revolut's Success

The £1.1 billion profit figure represents a monumental leap forward for Revolut, showcasing exceptional growth and profitability. While the company hasn't released a full financial breakdown, industry analysts point to several key drivers behind this success:

-

Massive User Base: Revolut boasts a substantial and rapidly growing customer base, exceeding 30 million users worldwide. This vast network provides a significant foundation for revenue generation through transaction fees and premium subscription services.

-

Premium Subscription Model: Revolut's tiered subscription model, offering various features and benefits at different price points, has proven highly effective in attracting and retaining customers. The premium tiers offer enhanced services, attracting users willing to pay for added convenience and value.

-

Expansion into New Markets: Revolut's aggressive expansion into new geographical markets has significantly broadened its reach and revenue streams. The company continues to target underserved markets and offer its services in regions where traditional banking may be less accessible or efficient.

-

Diverse Product Offerings: Beyond its core banking services, Revolut offers a range of additional products, including currency exchange, investment services, and crypto trading. This diversification minimizes reliance on any single revenue stream and caters to the evolving needs of its diverse customer base.

Challenges and Future Outlook for Revolut

Despite its impressive growth, Revolut faces ongoing challenges:

-

Increased Competition: The fintech sector is highly competitive, with numerous established players and emerging startups vying for market share. Maintaining its competitive edge will require ongoing innovation and adaptation.

-

Regulatory Scrutiny: As a major player in the financial sector, Revolut is subject to increasing regulatory scrutiny. Navigating complex regulations and maintaining compliance will be crucial for its continued success.

-

Maintaining Profitability: Sustaining this level of profitability will require continued growth and efficient management of operational costs. The company will need to balance expansion with the need for responsible financial management.

The Impact on the Fintech Landscape

Revolut's success story has significant implications for the broader fintech industry. It demonstrates the potential for disruptive technology to challenge traditional financial institutions and redefine the customer experience. Its growth also highlights the increasing demand for accessible, convenient, and technology-driven financial services.

Conclusion: A Fintech Giant's Continued Ascent

Revolut's £1.1 billion profit is a testament to its innovative approach, strategic expansion, and ability to adapt to the evolving needs of its customers. While challenges remain, the company's strong foundation and forward-thinking strategy suggest a promising future in the dynamic world of fintech. The journey of this London-based company serves as a compelling case study for aspiring fintech entrepreneurs and a clear indication of the transformative potential of technology in the financial sector. The coming years will undoubtedly reveal how Revolut continues to navigate the competitive landscape and consolidate its position as a global financial powerhouse.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on £1.1 Billion Profit For Revolut: Analysis Of The London Fintech's Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Austin Reaves Case For Nba Most Improved Player A Deep Dive

Apr 24, 2025

Austin Reaves Case For Nba Most Improved Player A Deep Dive

Apr 24, 2025 -

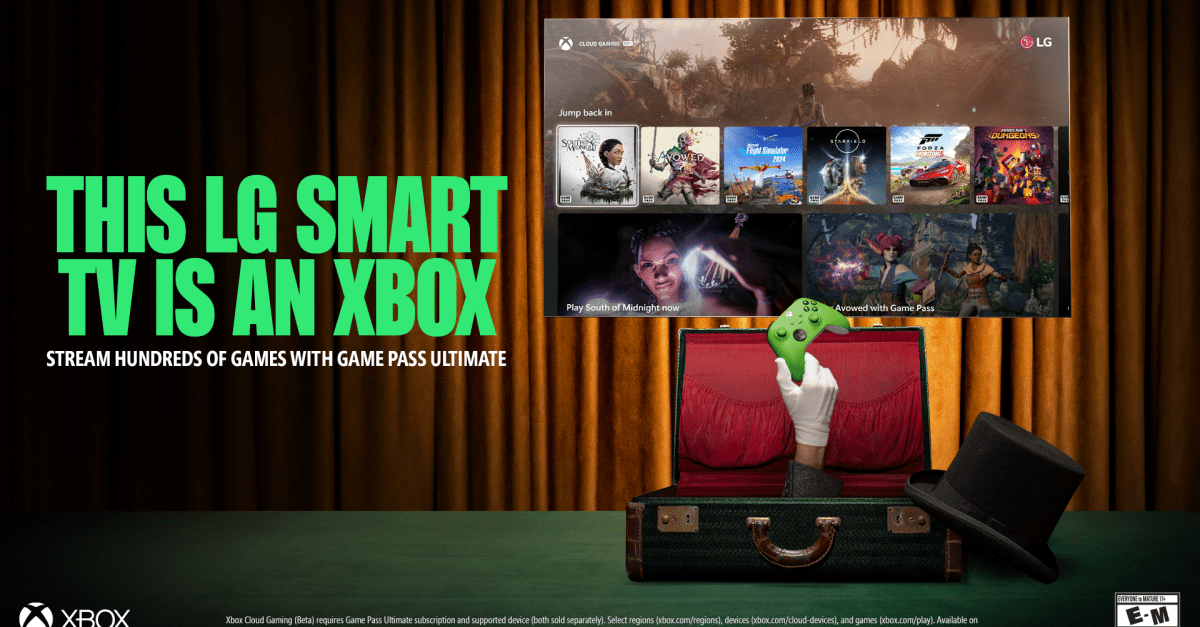

Microsoft Xbox App Launches On Lg Smart Tvs Stream Games Now

Apr 24, 2025

Microsoft Xbox App Launches On Lg Smart Tvs Stream Games Now

Apr 24, 2025 -

Adaptability Limits How Climate Change Affects Bird Populations

Apr 24, 2025

Adaptability Limits How Climate Change Affects Bird Populations

Apr 24, 2025 -

Competition Heats Up Space X Palantir And Anduril Bid On Us Missile Defense

Apr 24, 2025

Competition Heats Up Space X Palantir And Anduril Bid On Us Missile Defense

Apr 24, 2025 -

Non Mi Prendere Per Il C La Protesta Di Inzaghi Diventa Virale

Apr 24, 2025

Non Mi Prendere Per Il C La Protesta Di Inzaghi Diventa Virale

Apr 24, 2025