$1.2 Million AML Fine For OKX In Malta: Further Regulatory Action After US Penalty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$1.2 Million AML Fine for OKX in Malta: Further Regulatory Action After US Penalty

Cryptocurrency exchange OKX faces increased regulatory scrutiny after a hefty fine in Malta. The platform, already grappling with a recent US penalty, has now been slapped with a €1.2 million ($1.2 million USD) fine by the Maltese Gaming Authority (MGA) for anti-money laundering (AML) and combating the financing of terrorism (CFT) violations. This development highlights the growing international pressure on cryptocurrency exchanges to enhance their compliance measures.

The MGA's announcement underscores the increasing global focus on AML/CFT compliance within the cryptocurrency industry. The fine, issued on [Insert Date if available, otherwise remove sentence], represents a significant blow to OKX and serves as a stark warning to other platforms operating in the space. The authority cited several deficiencies in OKX's AML/CFT framework as the basis for the penalty.

Details of the Maltese Fine and OKX's Response

The MGA's statement detailed a series of shortcomings in OKX's compliance program, including [Insert Specific Details from Official MGA Statement if available; otherwise replace with examples like inadequate customer due diligence procedures, insufficient transaction monitoring systems, or a lack of adequate risk assessment]. The €1.2 million fine reflects the severity of these failings and the MGA's commitment to enforcing robust regulatory standards within its jurisdiction.

OKX has yet to issue a comprehensive public statement directly addressing the Maltese fine. However, [Insert any available statement or reaction from OKX]. The company's response, or lack thereof, will be closely scrutinized by investors and regulators alike.

The Wider Implications of the Fine

This latest penalty adds to the regulatory pressure already facing OKX. Earlier this year, the exchange was hit with a [Insert amount and details of the US penalty]. The combined impact of these fines could significantly affect OKX's operations and reputation.

The Maltese action sends a clear message to other cryptocurrency exchanges operating globally: robust AML/CFT compliance is non-negotiable. Regulators worldwide are increasingly scrutinizing the industry, demanding higher standards to prevent the misuse of cryptocurrency for illicit activities. This trend suggests that more significant penalties and regulatory actions are likely to follow.

Key Takeaways:

- Increased Regulatory Scrutiny: The cryptocurrency industry faces intensifying regulatory pressure regarding AML/CFT compliance.

- Significant Fine for OKX: The €1.2 million fine levied by the MGA highlights the serious consequences of non-compliance.

- Global Implications: The action underscores the importance of robust AML/CFT frameworks for cryptocurrency exchanges worldwide.

- Future Regulatory Actions: The case sets a precedent and suggests that more stringent regulatory actions against non-compliant exchanges are likely.

This situation emphasizes the need for cryptocurrency exchanges to prioritize AML/CFT compliance. Investing in robust systems, thorough training, and proactive risk management are crucial to avoiding substantial fines and maintaining a positive reputation in the evolving regulatory landscape. The future of the cryptocurrency industry hinges on the ability of platforms to demonstrate their commitment to responsible and compliant operations. Failure to do so will likely result in further regulatory crackdowns and financial penalties.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $1.2 Million AML Fine For OKX In Malta: Further Regulatory Action After US Penalty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

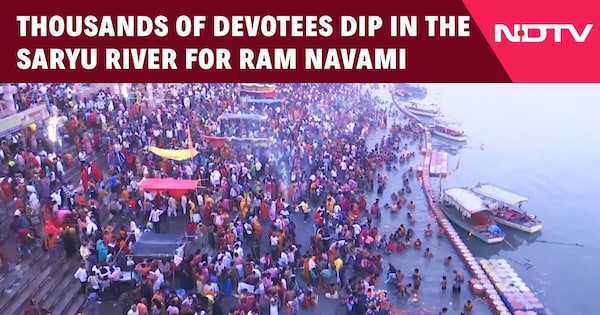

Ram Navami Celebrations Record Number Of Devotees Bathe In Saryu River

Apr 07, 2025

Ram Navami Celebrations Record Number Of Devotees Bathe In Saryu River

Apr 07, 2025 -

Eus Ai Ban How Will It Impact X Ais Grok Model Development

Apr 07, 2025

Eus Ai Ban How Will It Impact X Ais Grok Model Development

Apr 07, 2025 -

Dow Futures Plunge Over 1000 Points Trump Tariffs Fuel Market Crisis

Apr 07, 2025

Dow Futures Plunge Over 1000 Points Trump Tariffs Fuel Market Crisis

Apr 07, 2025 -

Angels Pummel Guardians In Commanding Offensive Display

Apr 07, 2025

Angels Pummel Guardians In Commanding Offensive Display

Apr 07, 2025 -

Impact Of Dazns 3 4 Billion Foxtel Buyout Analysis And Predictions

Apr 07, 2025

Impact Of Dazns 3 4 Billion Foxtel Buyout Analysis And Predictions

Apr 07, 2025