$1.5 Billion Revenue Impact: AMD Navigates China Chip Restrictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$1.5 Billion Revenue Impact: AMD Navigates the Turbulent Waters of China Chip Restrictions

Advanced Micro Devices (AMD), a key player in the global semiconductor market, is facing significant headwinds due to increasingly stringent chip export restrictions imposed by the U.S. government on China. The company recently revealed a staggering potential revenue impact of $1.5 billion, a stark illustration of the escalating geopolitical tensions impacting the tech industry. This development sends shockwaves throughout the semiconductor sector, raising concerns about future growth and supply chain stability.

The Impact of China's Chip Restrictions on AMD's Bottom Line

AMD's announcement underscores the severity of the situation. The $1.5 billion figure represents a substantial chunk of the company's projected revenue, highlighting the crucial role the Chinese market plays in AMD's overall success. This revenue loss is primarily attributed to the limitations placed on the export of advanced chips to China, significantly hindering AMD's ability to supply its high-performance computing (HPC) and data center products to this vital market.

Navigating the Complex Geopolitical Landscape

The restrictions, designed to curb China's technological advancements in areas deemed sensitive by the U.S., have placed AMD in a difficult position. The company must now carefully balance its business interests in China with its compliance obligations to U.S. regulations. This delicate balancing act demands strategic maneuvering and significant adjustments to its long-term growth strategy.

AMD's Response and Future Outlook

In response to these challenges, AMD is likely to explore several avenues. These might include:

- Diversification of Markets: Reducing reliance on the Chinese market by focusing on growth in other regions like Europe, North America, and potentially India.

- Investment in R&D: Developing alternative chip designs that comply with export restrictions while maintaining performance and competitiveness.

- Lobbying Efforts: Working with industry stakeholders and governments to advocate for more predictable and transparent regulatory frameworks.

- Strategic Partnerships: Collaborating with other tech companies to navigate the complex regulatory landscape and mitigate the impact of restrictions.

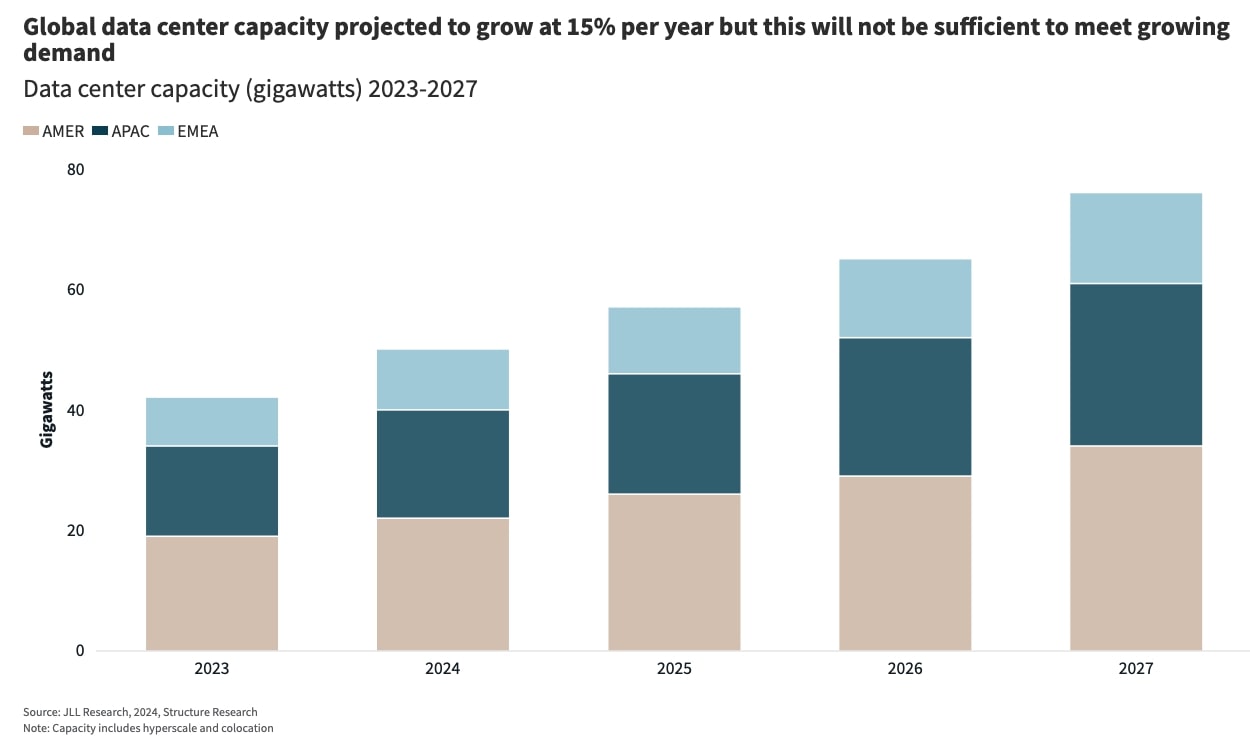

The Broader Implications for the Semiconductor Industry

The impact on AMD extends beyond the company itself. The situation highlights the increasing vulnerability of the global semiconductor industry to geopolitical factors. This uncertainty creates challenges for investors, manufacturers, and consumers alike. The ongoing restrictions raise concerns about:

- Supply Chain Disruptions: The potential for further constraints on the availability of advanced chips, impacting various industries reliant on semiconductors.

- Increased Costs: The need for companies to adapt to new regulations could lead to increased production costs, ultimately affecting the price of electronics.

- Geopolitical Instability: The escalating tensions between the U.S. and China could further destabilize the global semiconductor market.

Conclusion: A Shifting Landscape for Tech Giants

The $1.5 billion revenue impact on AMD serves as a stark reminder of the growing influence of geopolitical factors on the tech industry. The company’s ability to successfully navigate these challenges will be a key determinant of its future success. The broader implications for the semiconductor industry are significant, and the coming months will be crucial in determining how the industry adapts to this new, complex reality. The situation demands close monitoring as it continues to unfold, impacting not only AMD, but the entire global technological landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $1.5 Billion Revenue Impact: AMD Navigates China Chip Restrictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sustained Crypto Rally Billions In Inflows Extend To A Third Consecutive Week

May 08, 2025

Sustained Crypto Rally Billions In Inflows Extend To A Third Consecutive Week

May 08, 2025 -

Russell Westbrook Trade Will The Nuggets Gamble Pay Off

May 08, 2025

Russell Westbrook Trade Will The Nuggets Gamble Pay Off

May 08, 2025 -

Le Tapis Rouge De Fanny Un Defile De Vedettes

May 08, 2025

Le Tapis Rouge De Fanny Un Defile De Vedettes

May 08, 2025 -

Warriors Eliminate Rockets In Game 7 Houstons Road To Contention

May 08, 2025

Warriors Eliminate Rockets In Game 7 Houstons Road To Contention

May 08, 2025 -

May 7 2025 Nba Game Nuggets Vs Thunder Full Game Score

May 08, 2025

May 7 2025 Nba Game Nuggets Vs Thunder Full Game Score

May 08, 2025

Latest Posts

-

Final Destination Bloodlines A Controversial Stunt And A World Record Claim

May 08, 2025

Final Destination Bloodlines A Controversial Stunt And A World Record Claim

May 08, 2025 -

Sonos And Ikea End Highly Anticipated Collaboration What Happens Now

May 08, 2025

Sonos And Ikea End Highly Anticipated Collaboration What Happens Now

May 08, 2025 -

The Future Of Global Ai Data Centers Navigating Adjustments From Major Players

May 08, 2025

The Future Of Global Ai Data Centers Navigating Adjustments From Major Players

May 08, 2025 -

Boston Celtics At New York Knicks Full Box Score From May 7 2025

May 08, 2025

Boston Celtics At New York Knicks Full Box Score From May 7 2025

May 08, 2025 -

Pakistani Minister Faces Intense Scrutiny Over Terror Allegations On Uk Television

May 08, 2025

Pakistani Minister Faces Intense Scrutiny Over Terror Allegations On Uk Television

May 08, 2025