$1 Million Bitcoin: Hayes' Prediction Based On US Treasury And Fed Instability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$1 Million Bitcoin: Hayes' Prediction Rides the Wave of US Treasury and Fed Instability

The cryptocurrency world is abuzz with a bold prediction: Bitcoin could hit a staggering $1 million. This audacious forecast isn't coming from a fringe commentator, but from Arthur Hayes, the controversial co-founder of the now-defunct crypto exchange BitMEX. Hayes, known for his insightful (and sometimes provocative) market analysis, bases his prediction on the perceived instability within the US Treasury and the Federal Reserve. But is this a realistic scenario, or just another crypto hype cycle?

The Foundation of Hayes' Prediction: US Economic Uncertainty

Hayes' argument centers on the escalating US national debt and the Federal Reserve's aggressive monetary policy responses. He points to the increasing money supply and the potential for runaway inflation as key factors driving Bitcoin's potential surge. His thesis suggests that a loss of confidence in the US dollar, fueled by these economic anxieties, could lead investors to seek refuge in alternative assets, with Bitcoin being a prime candidate.

Why Bitcoin? A Safe Haven in Turbulent Times?

Bitcoin, with its limited supply of 21 million coins, is often touted as a hedge against inflation. Unlike fiat currencies, which can be printed at will, Bitcoin's scarcity makes it a potentially attractive store of value during periods of economic instability. Hayes believes that as traditional financial systems falter, investors will increasingly flock to Bitcoin, pushing its price to unprecedented heights.

Challenges to the $1 Million Bitcoin Forecast

While Hayes' argument holds some merit, several counterpoints exist. The cryptocurrency market is notoriously volatile, and predicting long-term price movements is inherently risky. Regulatory uncertainty, technological advancements, and the emergence of competing cryptocurrencies could all impact Bitcoin's trajectory.

Furthermore, reaching a $1 million price tag implies a market capitalization exceeding the current value of many global economies – a monumental leap that many analysts deem highly unlikely in the foreseeable future.

The Role of Macroeconomic Factors

The current global macroeconomic environment undoubtedly plays a significant role. Rising interest rates, geopolitical tensions, and the ongoing war in Ukraine all contribute to a climate of uncertainty. These factors could indeed bolster demand for Bitcoin as a safe haven asset, but it's crucial to consider that such demand might be temporary.

Other Experts Weigh In: A Divided Opinion

The crypto community is deeply divided on Hayes' prediction. Some analysts share his concerns about the US economy and see potential for significant Bitcoin price appreciation. Others remain skeptical, pointing to the speculative nature of the cryptocurrency market and the unpredictable influence of regulatory actions.

Conclusion: A Speculative, Yet Intriguing Prediction

While a $1 million Bitcoin might seem like a far-fetched scenario, Hayes' prediction highlights a crucial point: the growing interconnectedness between macroeconomic factors and the cryptocurrency market. The ongoing challenges facing the US economy, coupled with Bitcoin's unique characteristics, create a potent cocktail of uncertainty. Whether or not Bitcoin reaches this astronomical price remains to be seen, but the prediction underscores the need for investors to carefully consider the interplay between global finance and the evolving cryptocurrency landscape. Further analysis and monitoring of macroeconomic indicators will be essential in understanding the future trajectory of Bitcoin's price.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $1 Million Bitcoin: Hayes' Prediction Based On US Treasury And Fed Instability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bridging The Gap How Continuous Cve Practice Improves Response To Ine Security Alerts

May 17, 2025

Bridging The Gap How Continuous Cve Practice Improves Response To Ine Security Alerts

May 17, 2025 -

Alcaraz Vs Musetti Rome Semifinal Match Preview And Viewing Guide

May 17, 2025

Alcaraz Vs Musetti Rome Semifinal Match Preview And Viewing Guide

May 17, 2025 -

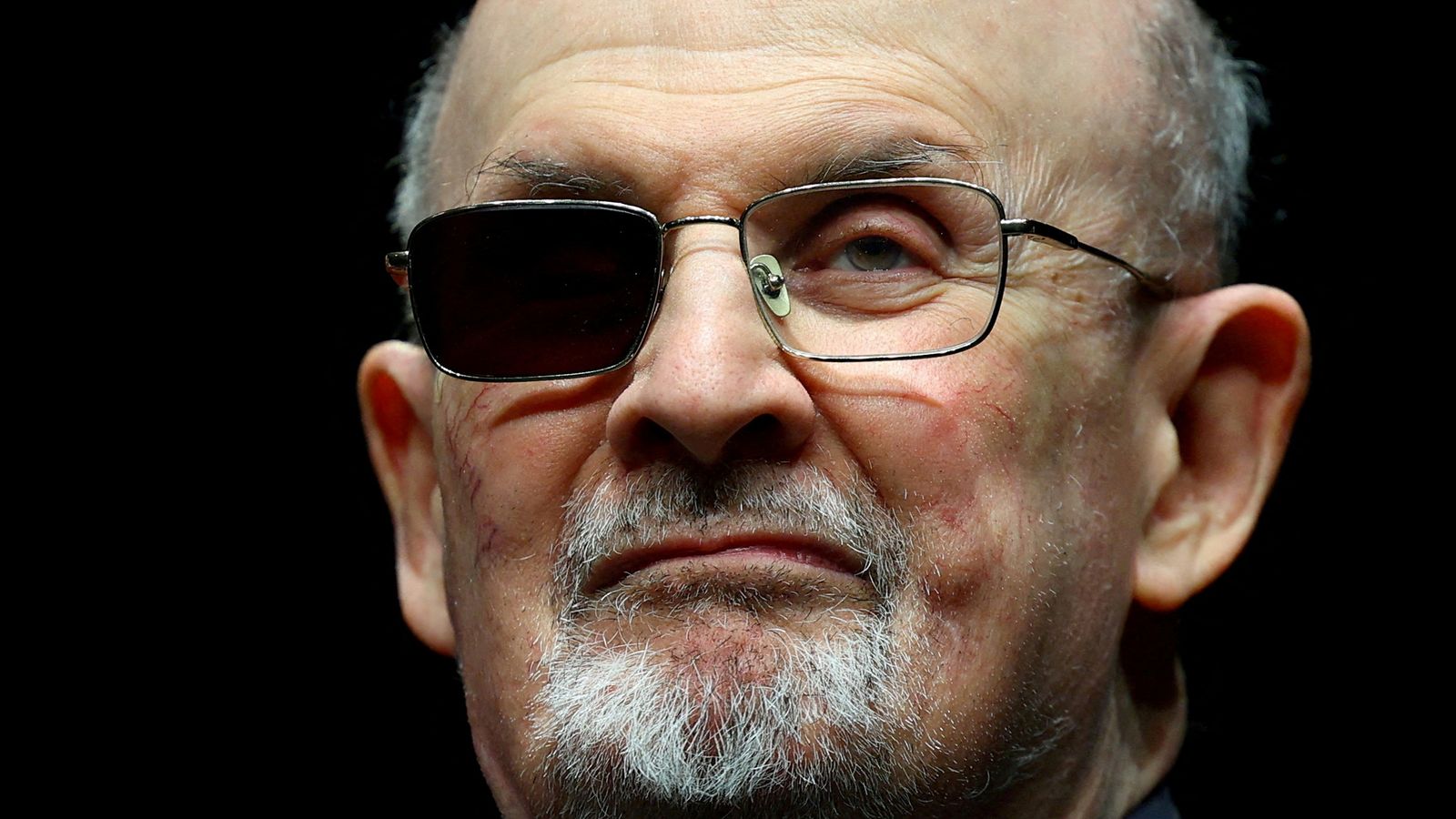

Hadi Matar Jailed For Stabbing Salman Rushdie Authors Injuries And Aftermath

May 17, 2025

Hadi Matar Jailed For Stabbing Salman Rushdie Authors Injuries And Aftermath

May 17, 2025 -

Western United Squad Update Ins And Outs For Crucial Semi Final

May 17, 2025

Western United Squad Update Ins And Outs For Crucial Semi Final

May 17, 2025 -

Country Music Icons At Cma Fest 2025 Fan Fair X Yearwood Rascal Flatts Lead The Charge

May 17, 2025

Country Music Icons At Cma Fest 2025 Fan Fair X Yearwood Rascal Flatts Lead The Charge

May 17, 2025