1000+ Point Drop: Dow Futures React To Worsening Trump Tariff Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

1000+ Point Drop: Dow Futures Plunge on Worsening Trump Tariff Impact

The Dow Jones Industrial Average futures experienced a dramatic plunge of over 1000 points in early trading, fueled by escalating concerns over the economic fallout from the Trump administration's tariffs. This significant market reaction underscores growing anxieties about the impact of trade wars on global economic growth and corporate profitability. The steep drop signals a potential shift in investor sentiment, moving from cautious optimism to outright fear about the future.

This unprecedented market volatility follows a week of increasingly negative economic indicators, including weakening manufacturing data and a slowdown in consumer spending. The escalating trade dispute with China, coupled with newly imposed tariffs on other countries, has created a perfect storm of uncertainty that is shaking investor confidence.

H2: Understanding the Dow Futures Drop

The dramatic 1000+ point drop in Dow futures is not an isolated incident. It reflects a broader concern among investors about several interconnected factors:

-

Increased Tariffs: The Trump administration's persistent imposition of tariffs on imported goods, particularly from China, is significantly impacting American businesses. These tariffs increase the cost of goods, leading to higher prices for consumers and reduced profit margins for companies.

-

Global Economic Slowdown: The ongoing trade war is contributing to a broader global economic slowdown. Uncertainty about future trade relations is causing businesses to postpone investments and reduce hiring, further dampening economic growth.

-

Weakening Consumer Confidence: As prices rise due to tariffs and economic uncertainty increases, consumer confidence is waning. This decline in consumer spending is a major drag on economic growth and further contributes to market volatility.

-

Impact on Corporate Earnings: Many companies are already reporting reduced profits due to the impact of tariffs. The prospect of further tariff increases is causing investors to reassess the future earnings potential of numerous publicly traded companies, leading to sell-offs.

H2: What Does This Mean for Investors?

The significant drop in Dow futures raises serious questions about the short-term and long-term outlook for the US and global economies. Investors are understandably concerned, and many are likely to adopt a more cautious approach in the coming weeks. This could lead to:

-

Increased Market Volatility: We can expect to see continued fluctuations in the stock market as investors react to further news and developments related to the trade war.

-

Shift in Investment Strategies: Some investors may shift their portfolios towards safer assets, such as government bonds, to protect against further market declines.

-

Pressure on the Federal Reserve: The market downturn could put pressure on the Federal Reserve to intervene with further monetary easing measures, such as interest rate cuts, to stimulate economic growth.

H3: Looking Ahead

The situation remains fluid, and the ultimate impact of the Trump administration's tariff policies remains to be seen. However, the 1000+ point drop in Dow futures serves as a stark warning about the potential consequences of escalating trade tensions. Close monitoring of economic indicators, trade negotiations, and Federal Reserve actions will be crucial for investors in the coming weeks and months. Experts predict further market fluctuations are highly probable until there's a resolution to the ongoing trade disputes. The coming days will be critical in determining the next steps for investors and the overall direction of the global economy. The implications extend far beyond the stock market, potentially impacting everything from employment rates to consumer spending. This situation warrants careful attention from everyone involved in the global financial system.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 1000+ Point Drop: Dow Futures React To Worsening Trump Tariff Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Angels Pummel Guardians In Commanding Offensive Performance

Apr 08, 2025

Angels Pummel Guardians In Commanding Offensive Performance

Apr 08, 2025 -

Hud And Ice Data Sharing Agreement Impact On Nyc Immigrants And Housing

Apr 08, 2025

Hud And Ice Data Sharing Agreement Impact On Nyc Immigrants And Housing

Apr 08, 2025 -

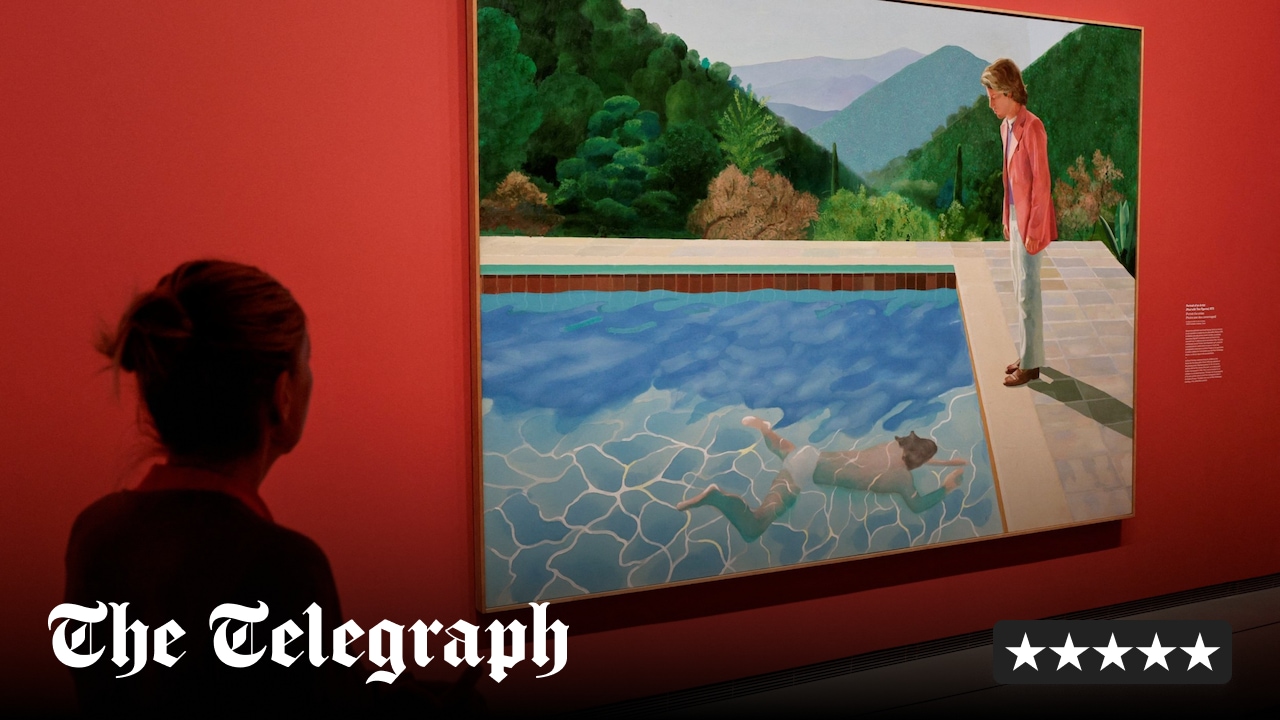

David Hockney 25 Years Of Art At The Fondation Louis Vuitton

Apr 08, 2025

David Hockney 25 Years Of Art At The Fondation Louis Vuitton

Apr 08, 2025 -

Trump Tariffs Trigger Dow Freefall Live Market Updates And Analysis

Apr 08, 2025

Trump Tariffs Trigger Dow Freefall Live Market Updates And Analysis

Apr 08, 2025 -

Gather Round Key Crows Midfielder Faces Fitness Test

Apr 08, 2025

Gather Round Key Crows Midfielder Faces Fitness Test

Apr 08, 2025