11% ETH Price Drop: Is This The Bottom Or Further Downward Pressure?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

11% ETH Price Drop: Is This the Bottom or Further Downward Pressure?

The cryptocurrency market experienced a significant shakeup today, with Ethereum (ETH) plunging by 11%. This dramatic drop has sent shockwaves through the crypto community, leaving many investors wondering: is this the bottom, or is further downward pressure on the horizon? The sudden price fall raises crucial questions about the future of ETH and the broader cryptocurrency market.

What Caused the Sudden ETH Price Drop?

Pinpointing the exact cause of such a steep decline is challenging, as multiple factors often interplay within the volatile crypto landscape. However, several key elements likely contributed to today's 11% ETH price drop:

-

Regulatory Uncertainty: Increased regulatory scrutiny globally continues to weigh heavily on crypto prices. Recent pronouncements from regulatory bodies in various countries have created a climate of uncertainty, leading to risk-averse investors selling off assets.

-

Macroeconomic Factors: Global macroeconomic conditions, including persistent inflation and rising interest rates, are impacting investor sentiment across all asset classes, including cryptocurrencies. Investors are shifting towards more stable investments, leading to sell-offs in riskier assets like ETH.

-

Market Sentiment: Fear, uncertainty, and doubt (FUD) are powerful forces in the crypto market. Negative news, even if unrelated to Ethereum itself, can trigger widespread selling pressure, exacerbating price drops.

-

Liquidations: Automated liquidations triggered by margin trading can amplify price swings. When prices fall below certain thresholds, leveraged positions are automatically closed, leading to further selling pressure and a downward spiral.

Is This the Bottom for ETH? Analyzing the Possibilities:

Predicting the bottom of a market downturn is notoriously difficult, even for seasoned analysts. However, several factors suggest both potential for further declines and the possibility that we've reached a short-term low:

Arguments for Further Downward Pressure:

- Continued Regulatory Headwinds: Until regulatory clarity emerges, the market will likely remain volatile, with potential for further price corrections.

- Persistent Macroeconomic Challenges: If inflation and interest rates remain elevated, investor confidence in riskier assets may continue to wane.

- Technical Analysis: Some technical indicators suggest further downward potential, though these are not foolproof predictors.

Arguments for a Short-Term Bottom:

- Buying Opportunities: The sharp price drop has created attractive buying opportunities for long-term investors who believe in Ethereum's underlying technology and future potential.

- Strong Fundamentals: Ethereum's underlying technology continues to develop and improve, with ongoing upgrades and advancements. This strengthens its long-term prospects.

- Historical Precedents: Past market cycles have shown that significant price drops are often followed by periods of consolidation and eventual recovery.

What to Watch for in the Coming Days and Weeks:

The coming weeks will be crucial in determining whether this 11% drop marks the bottom or the start of a more prolonged downturn. Investors should closely monitor:

- Regulatory news: Any significant regulatory announcements will have a major impact on ETH's price.

- Macroeconomic indicators: Changes in inflation, interest rates, and other macroeconomic factors will influence investor sentiment.

- Market sentiment: The overall mood of the market will be a key indicator of future price movements.

- On-chain metrics: Analyzing on-chain data, such as transaction volume and network activity, can provide insights into market dynamics.

Conclusion:

The 11% ETH price drop is a significant event, prompting serious consideration from investors. While predicting the future is impossible, a careful analysis of the contributing factors and ongoing developments is crucial for informed decision-making. Whether this marks the bottom or further downward pressure remains to be seen, highlighting the inherent volatility and risk associated with cryptocurrency investments. Remember to conduct thorough research and only invest what you can afford to lose.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 11% ETH Price Drop: Is This The Bottom Or Further Downward Pressure?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

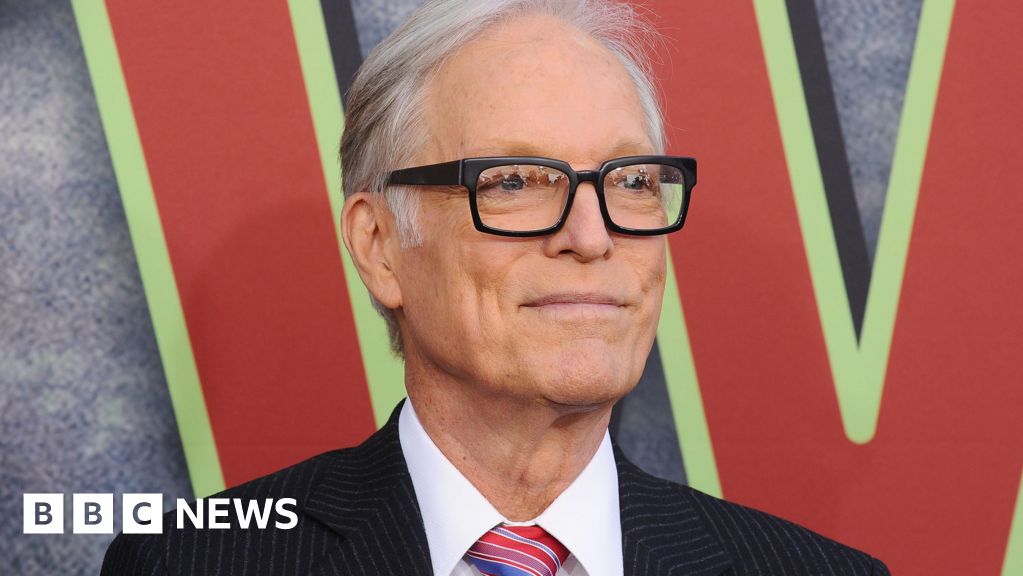

Richard Chamberlain Dead At 90 Fans Mourn The Loss Of Tv Icon

Mar 30, 2025

Richard Chamberlain Dead At 90 Fans Mourn The Loss Of Tv Icon

Mar 30, 2025 -

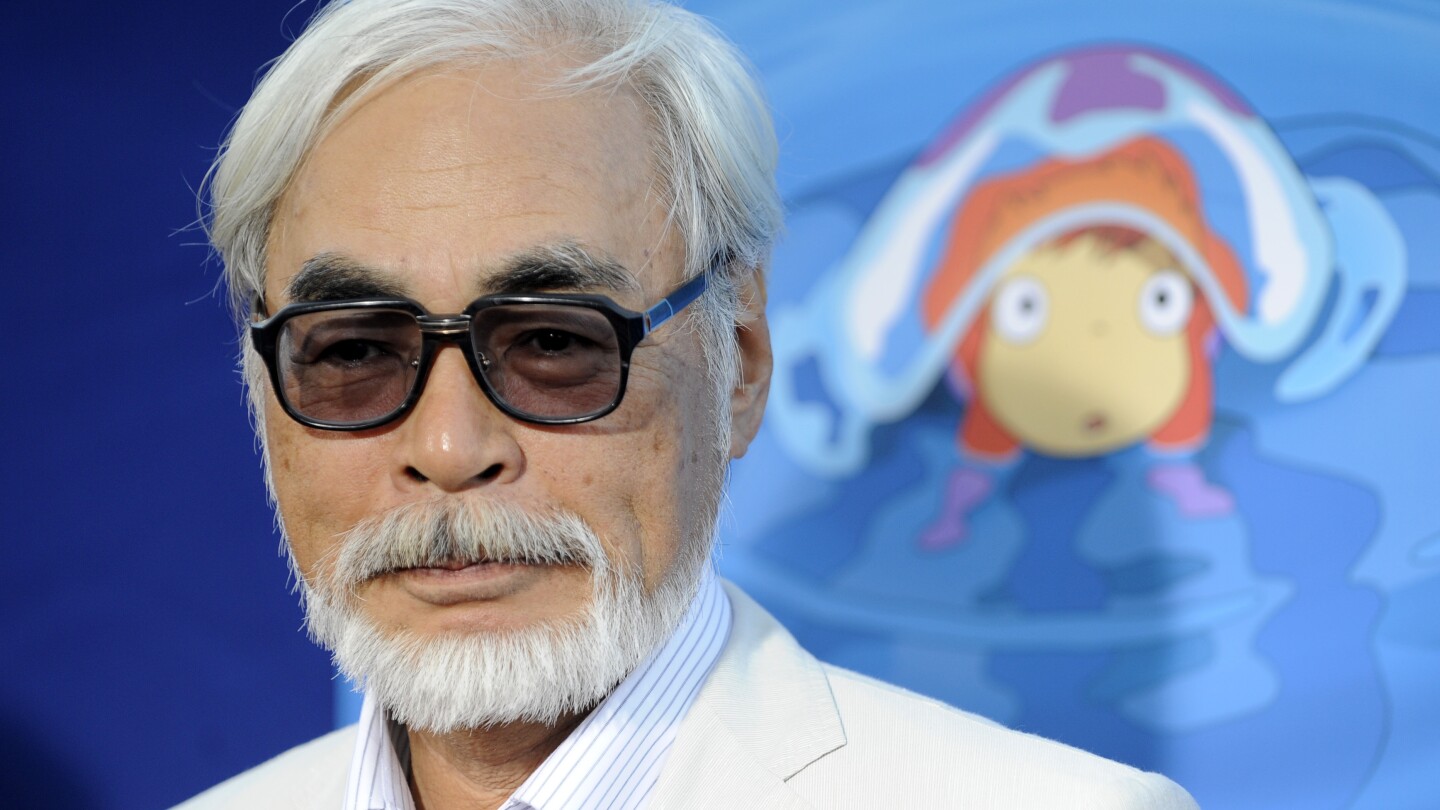

Chat Gpts Ghibli Style Images Spark Ai Copyright Debate

Mar 30, 2025

Chat Gpts Ghibli Style Images Spark Ai Copyright Debate

Mar 30, 2025 -

She Worked With Bollywood Icons Then Quit Acting Her Story

Mar 30, 2025

She Worked With Bollywood Icons Then Quit Acting Her Story

Mar 30, 2025 -

Video Rohits Hug And Words Of Encouragement For Mis Raju

Mar 30, 2025

Video Rohits Hug And Words Of Encouragement For Mis Raju

Mar 30, 2025 -

Bbcs Escape To The Country Emotional Breakdown And Apology From House Hunter

Mar 30, 2025

Bbcs Escape To The Country Emotional Breakdown And Apology From House Hunter

Mar 30, 2025