12% Surge In Trump-Related Assets: Institutional Investors Buy In

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

12% Surge in Trump-Related Assets: Institutional Investors Buy In

A surprising shift in the market reveals a 12% surge in assets linked to former President Donald Trump, fueled by significant investments from institutional players. This unexpected upward trend challenges prevailing narratives surrounding the Trump brand and its post-presidency trajectory. Experts are scrambling to understand the driving forces behind this investment boom, sparking debate and speculation across financial circles.

The rise isn't limited to a single sector. Instead, it spans various Trump-branded properties and ventures, suggesting a broader confidence in the long-term viability of these assets. This includes increases in the value of Trump Organization properties, shares in Trump-endorsed companies, and even a renewed interest in the former president's merchandise. The 12% figure, derived from aggregated data across multiple financial platforms, represents a substantial increase over the past quarter, significantly outpacing broader market growth.

<h3>What's Driving the Investment Surge?</h3>

Several factors are contributing to this unexpected surge in Trump-related assets. While the exact motivations remain complex and multifaceted, several key elements stand out:

-

Political Polarization: The deeply polarized political landscape could be a major factor. For some investors, the association with a controversial figure like Trump is a calculated risk, potentially offering high returns in a volatile market. This strategy hinges on the belief that Trump's enduring influence on a significant portion of the population translates into sustained market demand.

-

Brand Resilience: Despite facing numerous controversies and legal challenges, the Trump brand continues to exhibit remarkable resilience. This resilience suggests that the brand's inherent value remains strong, attracting investors who believe in its long-term potential for profit, irrespective of the negative publicity.

-

Institutional Investor Confidence: The most significant development is the involvement of institutional investors. These large-scale players, with their sophisticated analytical capabilities, are unlikely to invest based solely on speculation or sentiment. Their participation indicates a level of due diligence and a perceived opportunity for significant returns, lending credibility to the upward trend.

-

Potential for Future Political Influence: Speculation abounds regarding Trump's potential return to the political scene. Investors might be anticipating a resurgence of Trump's political influence, which could positively impact the value of associated assets. This is a high-risk, high-reward bet, dependent on uncertain future political events.

<h3>Analyzing the Risks</h3>

While the current trend is positive for Trump-related investments, significant risks remain. These include:

-

Ongoing Legal Battles: The numerous legal challenges faced by Trump and his businesses pose a considerable risk to the value of these assets. Adverse legal outcomes could significantly impact investor returns.

-

Market Volatility: The overall market remains volatile, and any significant shift in the economic climate could negatively affect the value of Trump-branded assets.

-

Reputational Damage: Further negative publicity or controversies surrounding Trump could erode the value of his brand and associated investments.

<h3>The Future of Trump-Related Assets</h3>

The recent surge in Trump-related assets presents a fascinating case study in market dynamics. While the 12% increase is undeniable, the long-term sustainability of this trend remains uncertain. The interplay between political polarization, brand resilience, and the potential for future political events will continue to shape the trajectory of these investments. Investors are urged to proceed with caution, carefully weighing the potential for substantial returns against the inherent risks associated with this highly volatile asset class. Further research and analysis are crucial to fully understand the implications of this surprising market shift.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 12% Surge In Trump-Related Assets: Institutional Investors Buy In. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

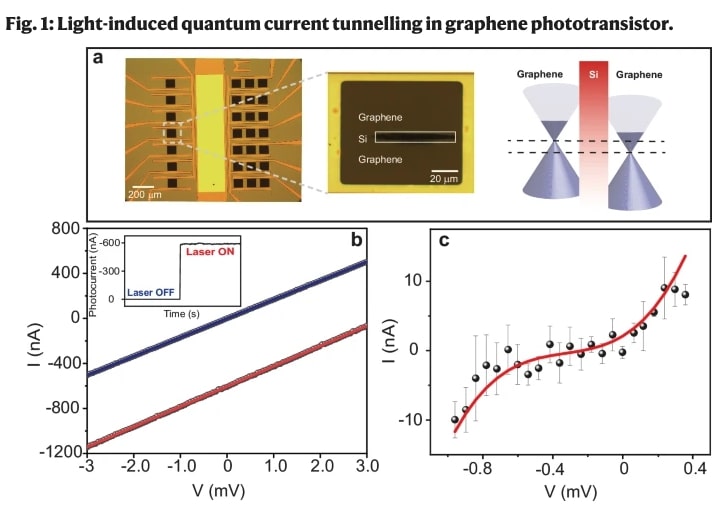

Worlds First Room Temperature Petahertz Phototransistor Created

May 23, 2025

Worlds First Room Temperature Petahertz Phototransistor Created

May 23, 2025 -

Linked In Mix Up Piyush Guptas Viral Post And Soaring Mentions

May 23, 2025

Linked In Mix Up Piyush Guptas Viral Post And Soaring Mentions

May 23, 2025 -

Peter De Boer Strategies Successes And Setbacks In Hockey Coaching

May 23, 2025

Peter De Boer Strategies Successes And Setbacks In Hockey Coaching

May 23, 2025 -

Uber Implements Rider Rating System Low Scores Lead To Account Termination

May 23, 2025

Uber Implements Rider Rating System Low Scores Lead To Account Termination

May 23, 2025 -

Silence Broken Marners Mom Addresses Maple Leafs Future Following Second Round Exit

May 23, 2025

Silence Broken Marners Mom Addresses Maple Leafs Future Following Second Round Exit

May 23, 2025

Latest Posts

-

New Hampshire And Arizona Outpace Texas In Bitcoin Reserve Race

May 23, 2025

New Hampshire And Arizona Outpace Texas In Bitcoin Reserve Race

May 23, 2025 -

Haedal Haedal On Sui Blockchain Sees 100 M Trading Volume Post Binance Listing Speculation

May 23, 2025

Haedal Haedal On Sui Blockchain Sees 100 M Trading Volume Post Binance Listing Speculation

May 23, 2025 -

Comedian Amy Schumers New Orleans Dream Home A Real Estate Investment

May 23, 2025

Comedian Amy Schumers New Orleans Dream Home A Real Estate Investment

May 23, 2025 -

Can Laos Overcome Economic Headwinds Assessing The Asian Laggard

May 23, 2025

Can Laos Overcome Economic Headwinds Assessing The Asian Laggard

May 23, 2025 -

Netflixs Controversial Anime Adaptation A Streaming Success Despite Negative Reviews

May 23, 2025

Netflixs Controversial Anime Adaptation A Streaming Success Despite Negative Reviews

May 23, 2025