16 SGX Companies Delisted Or Facing Delisting: Analyzing The Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

16 SGX Companies Delisted or Facing Delisting: Analyzing the Impact on Investors and the Market

The Singapore Exchange (SGX) has seen a flurry of delistings and impending delistings recently, with a staggering 16 companies facing removal from the bourse. This significant event prompts crucial questions about the implications for investors and the overall health of the Singaporean market. This article delves into the reasons behind these delistings, analyzes their impact, and offers insights for navigating this evolving landscape.

Why are so many companies delisting from the SGX?

Several factors contribute to the surge in delistings from the SGX. These include:

- Acquisition and Private Equity Buyouts: Many companies are delisted following successful acquisition offers from private equity firms or larger corporations seeking to take them private. This often offers shareholders a premium over the market price, making it an attractive exit strategy.

- Financial Difficulties: Some companies facing persistent financial struggles may opt for delisting to avoid the increased scrutiny and regulatory requirements associated with being a publicly listed entity. This can involve restructuring efforts or seeking alternative funding outside the public market.

- Low Trading Volume and Liquidity: Companies with consistently low trading volume may find the costs of maintaining a listing on the SGX outweigh the benefits. This is particularly true for smaller companies with limited investor interest.

- Strategic Reorganization: In some instances, delisting might be part of a broader strategic reorganization, allowing the company to pursue alternative growth strategies without the constraints of public company reporting obligations.

The Impact on Investors:

The delisting of companies presents both challenges and opportunities for investors:

- Loss of Liquidity: Investors holding shares in delisted companies lose the ability to easily buy or sell their shares on the open market. This can significantly impact their ability to diversify their portfolios or access capital quickly.

- Potential for Higher Returns (in acquisitions): Shareholders who receive a premium offer in an acquisition often benefit from a higher return than they might have achieved by continuing to hold their shares on the open market.

- Increased Risk: Investing in companies facing delisting often carries a higher level of risk, as financial difficulties or other underlying issues may have contributed to the decision. Due diligence is crucial.

Impact on the SGX and the Singaporean Market:

The recent wave of delistings raises concerns about:

- Market Confidence: A high number of delistings can potentially impact investor confidence in the SGX and the overall health of the Singaporean market.

- Market Depth: The removal of companies from the exchange reduces market depth and liquidity, potentially impacting trading activity and price discovery.

- Regulatory Scrutiny: The SGX and regulatory authorities may need to review their listing requirements and processes to address the underlying issues contributing to these delistings.

Navigating the Changing Landscape:

Investors need to adopt a more proactive approach in light of these developments:

- Diversification: Maintaining a well-diversified portfolio across different asset classes and sectors is crucial to mitigate the risk associated with individual company delistings.

- Due Diligence: Thorough due diligence is essential before investing in any company, particularly those exhibiting signs of financial stress or low trading volume.

- Staying Informed: Keeping abreast of market developments and regulatory changes is crucial for making informed investment decisions.

Conclusion:

The recent surge in delistings on the SGX underscores the dynamic nature of the market and highlights the importance of investor awareness and proactive risk management. While some delistings offer opportunities for investors, others signal potential challenges. Understanding the underlying causes and implications is crucial for navigating this evolving landscape and making sound investment decisions. The SGX and regulatory bodies will need to carefully consider the implications of this trend and implement strategies to maintain a healthy and robust market environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 16 SGX Companies Delisted Or Facing Delisting: Analyzing The Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

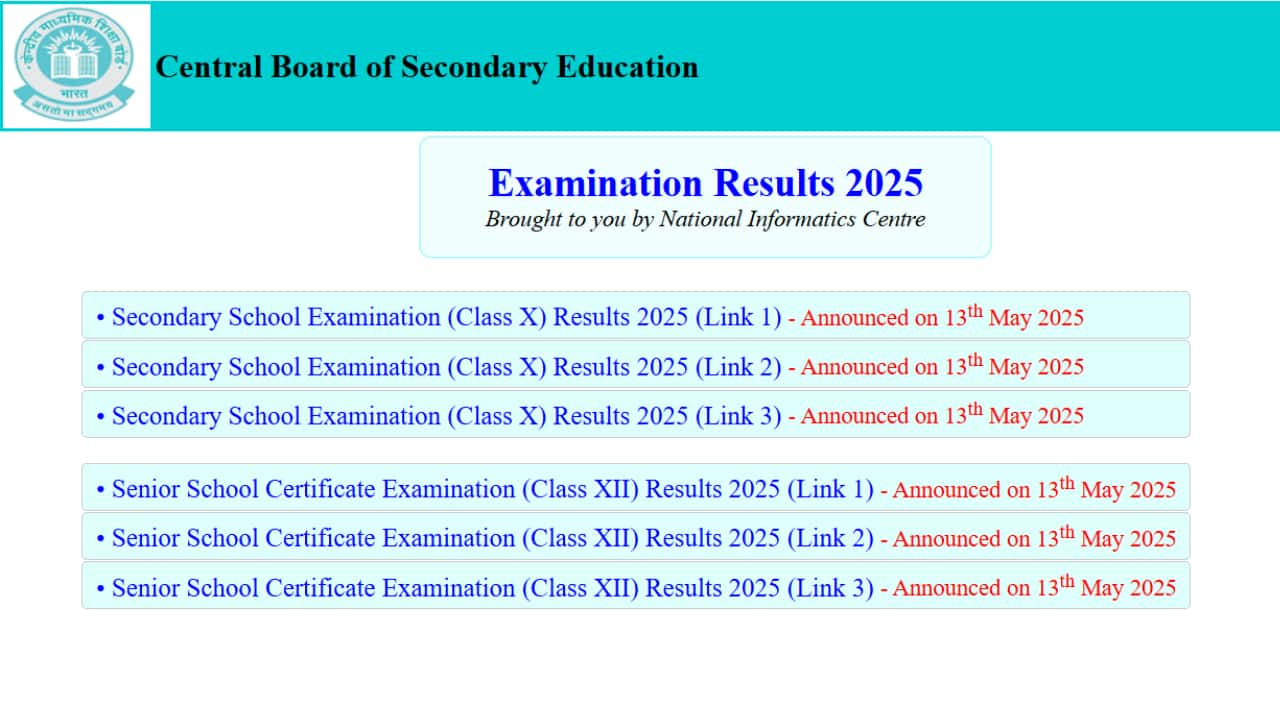

Breaking Cbse Board Exam Results 2025 Released Check Your Results At Cbseresults Nic In

May 14, 2025

Breaking Cbse Board Exam Results 2025 Released Check Your Results At Cbseresults Nic In

May 14, 2025 -

Beyond The Headlines Deconstructing Russias False Euphoria

May 14, 2025

Beyond The Headlines Deconstructing Russias False Euphoria

May 14, 2025 -

Commentary The Alarming Return Of Highly Contagious Measles

May 14, 2025

Commentary The Alarming Return Of Highly Contagious Measles

May 14, 2025 -

Minnesota Timberwolves Fall To Golden State Warriors May 12 2025 Game Summary

May 14, 2025

Minnesota Timberwolves Fall To Golden State Warriors May 12 2025 Game Summary

May 14, 2025 -

Sigue En Directo Alcaraz Khachanov Octavos De Final Roma

May 14, 2025

Sigue En Directo Alcaraz Khachanov Octavos De Final Roma

May 14, 2025

Latest Posts

-

Rise In Measles Cases Expected This Summer What Travelers Need To Know

May 14, 2025

Rise In Measles Cases Expected This Summer What Travelers Need To Know

May 14, 2025 -

New York Yankees Win Behind Grishams Two Home Run Game Against Seattle

May 14, 2025

New York Yankees Win Behind Grishams Two Home Run Game Against Seattle

May 14, 2025 -

Teslas Technological Leap Dojo Ai Training And 4680 Battery Production

May 14, 2025

Teslas Technological Leap Dojo Ai Training And 4680 Battery Production

May 14, 2025 -

Italian Open Last 16 Live Score Updates For Draper Vs Moutet

May 14, 2025

Italian Open Last 16 Live Score Updates For Draper Vs Moutet

May 14, 2025 -

Zohran Mamdani And Rama Duwaji A Look At Their Beautiful Wedding

May 14, 2025

Zohran Mamdani And Rama Duwaji A Look At Their Beautiful Wedding

May 14, 2025