16 SGX Delistings Year-to-Date: Analyzing The Impact Of Market Conditions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

16 SGX Delistings Year-to-Date: Analyzing the Impact of Market Conditions

Singapore's stock market, the Singapore Exchange (SGX), has seen a notable increase in delistings this year. With 16 companies already delisted year-to-date, market analysts are scrutinizing the underlying causes and the broader implications for investor confidence and the overall health of the SGX. This surge in delistings raises crucial questions about the current market conditions and their impact on smaller and less liquid companies.

Understanding the Delisting Phenomenon

Company delisting from the SGX occurs for various reasons, often reflecting the company's financial health and strategic direction. Common reasons include:

- Acquisition: A company might be acquired by a private entity, leading to its removal from public trading. This often signals a successful exit strategy for shareholders.

- Financial Distress: Companies struggling financially, experiencing consistent losses, or failing to meet listing requirements may be delisted to avoid further regulatory burdens.

- Mergers and Consolidation: Mergers can result in one entity absorbing another, removing the acquired company from the exchange.

- Private Equity Buyouts: Private equity firms often acquire publicly listed companies, taking them private. This can provide the acquired company with greater flexibility and avoid the scrutiny of public markets.

- Low Trading Volume: Companies with persistently low trading volume may find it difficult to justify the costs associated with maintaining a public listing.

Market Conditions and the Surge in Delistings

The significant increase in SGX delistings in 2024 isn't an isolated event. It's likely a reflection of several contributing factors:

-

Global Economic Uncertainty: The prevailing global economic climate, characterized by inflation, rising interest rates, and geopolitical instability, has created a challenging environment for businesses, especially smaller ones. This uncertainty often makes it harder for companies to secure funding and maintain profitability, leading to delisting.

-

Increased Regulatory Scrutiny: Stringent regulatory requirements in Singapore can impose significant costs on listed companies, particularly those with limited resources. Meeting these requirements may become unsustainable, prompting delistings.

-

Investor Sentiment: Negative investor sentiment can impact share prices, making it difficult for companies to attract investment. This can exacerbate financial difficulties and ultimately lead to delisting.

Analyzing the Impact

The high number of delistings raises concerns about:

-

Market Liquidity: A decrease in the number of listed companies can reduce market liquidity, making it harder for investors to buy and sell shares efficiently.

-

Investor Confidence: A continuous stream of delistings can erode investor confidence in the market, potentially leading to reduced investment.

-

Economic Growth: While not a direct cause-and-effect relationship, a significant decrease in listed companies can be an indicator of broader economic challenges.

Looking Ahead: Future Implications for the SGX

The SGX will need to carefully monitor this trend and consider strategies to attract and retain listed companies. This could include:

-

Easing Regulatory Burdens: A review of listing requirements to make them less onerous for smaller businesses could encourage more companies to remain listed.

-

Promoting Investor Education: Educating investors about the risks and opportunities associated with investing in smaller companies can boost investor confidence.

-

Incentivizing Listings: The SGX could implement incentives to attract new listings, such as tax breaks or reduced listing fees for qualifying companies.

The increase in SGX delistings serves as a crucial reminder of the interconnectedness between global economic conditions, regulatory frameworks, and the vitality of stock markets. Continued monitoring and proactive measures are essential to ensure the long-term health and stability of the Singaporean stock market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 16 SGX Delistings Year-to-Date: Analyzing The Impact Of Market Conditions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New York Yankees Cabrera Carted Off Field Following Hard Slide

May 14, 2025

New York Yankees Cabrera Carted Off Field Following Hard Slide

May 14, 2025 -

Brisbane Roar Lose Zadkovich Newcastle Jets Sign Milligan A League News

May 14, 2025

Brisbane Roar Lose Zadkovich Newcastle Jets Sign Milligan A League News

May 14, 2025 -

Deconstructing Spielberg 11 Defining Minutes From His War Movies

May 14, 2025

Deconstructing Spielberg 11 Defining Minutes From His War Movies

May 14, 2025 -

Arnold Schwarzenegger On A Dinosaur Unexpected Kung Fury 2 Clip Surfaces

May 14, 2025

Arnold Schwarzenegger On A Dinosaur Unexpected Kung Fury 2 Clip Surfaces

May 14, 2025 -

Six Covid Related Deaths In Past Week Trigger Health Alert

May 14, 2025

Six Covid Related Deaths In Past Week Trigger Health Alert

May 14, 2025

Latest Posts

-

Everything Revealed In Supermans Second Official Teaser

May 14, 2025

Everything Revealed In Supermans Second Official Teaser

May 14, 2025 -

Solve The Nyt Mini Crossword Clues And Answers For May 13 2025

May 14, 2025

Solve The Nyt Mini Crossword Clues And Answers For May 13 2025

May 14, 2025 -

Jordon Hudson Speaks Out Separating Her Life From Unc Football And Bill Belichick

May 14, 2025

Jordon Hudson Speaks Out Separating Her Life From Unc Football And Bill Belichick

May 14, 2025 -

Space X Targeting Nine Day Countdown For Next Starship Launch

May 14, 2025

Space X Targeting Nine Day Countdown For Next Starship Launch

May 14, 2025 -

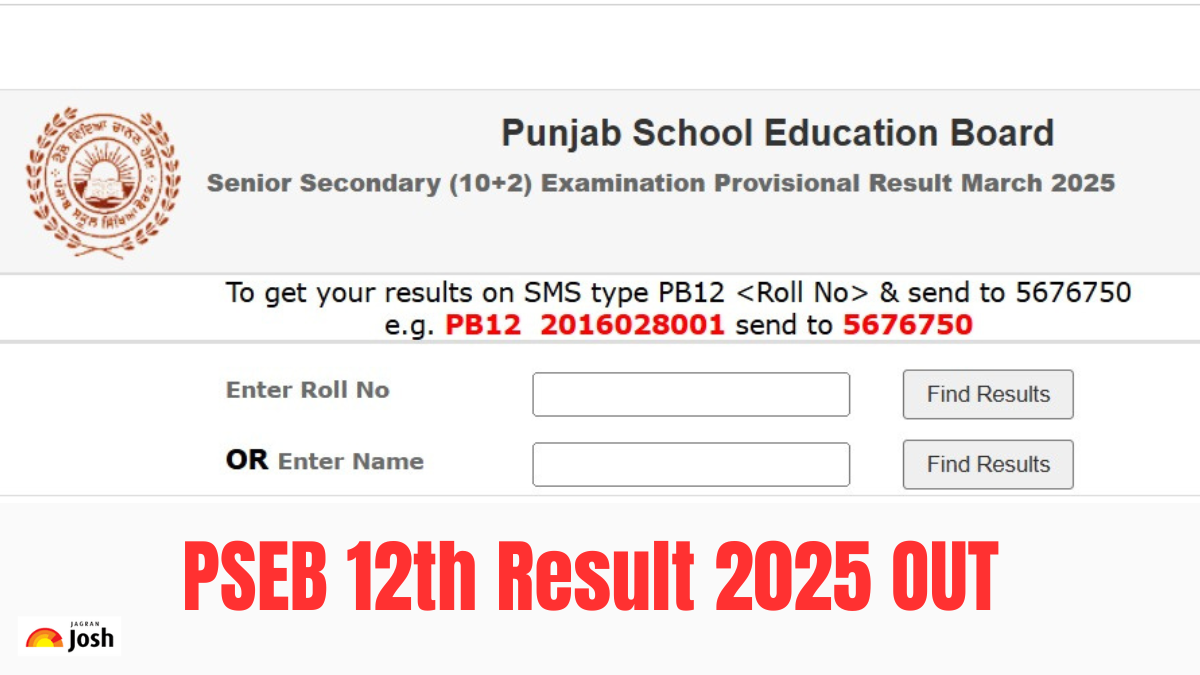

Pseb 12th Senior Secondary Marksheet 2025 Download From Pseb Ac In

May 14, 2025

Pseb 12th Senior Secondary Marksheet 2025 Download From Pseb Ac In

May 14, 2025