$18,000 Investment: Generate $3,100 Annual Dividends With These 3 Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>$18,000 Investment: Generate $3,100 Annual Dividends with These 3 Stocks</h1>

Looking for ways to boost your passive income? Tired of low interest rates leaving your savings stagnant? Investing in dividend-paying stocks could be the answer. With a strategic $18,000 investment, you could potentially generate a healthy $3,100 in annual dividends. This article explores three high-yield dividend stocks that could help you achieve this goal. Disclaimer: Investing in the stock market always involves risk, and past performance is not indicative of future results. Consult with a financial advisor before making any investment decisions.

<h2>Understanding Dividend Investing</h2>

Dividend investing is a popular strategy that focuses on acquiring shares in companies that regularly distribute a portion of their profits to shareholders. These payouts, known as dividends, provide a steady stream of income, supplementing other investment returns. High-yield dividend stocks, in particular, offer attractive dividend yields, potentially generating significant passive income over time.

<h2>Three Stocks for a $3,100 Annual Dividend Income</h2>

While we cannot guarantee specific returns, let's examine three stocks with a history of strong dividend payouts that, based on current yields (always check current yields before investing!), could collectively contribute to a roughly $3,100 annual dividend income from an initial $18,000 investment. Remember, these are examples, and thorough research is crucial before investing.

Note: Dividend yields fluctuate, and the amounts shown below are estimations based on current market conditions and historical dividend payouts. This is not financial advice.

<h3>1. Real Estate Investment Trust (REIT): (Example: [Insert a well-known, stable REIT with a history of strong dividends - e.g., a specific ticker symbol])</h3>

- Why it's attractive: REITs often offer high dividend yields because they are required to distribute a significant portion of their taxable income to shareholders. They provide exposure to the real estate market without the need for direct property ownership.

- Potential Dividend Contribution (Example): Assume a $6,000 investment at a 5% dividend yield. This could generate approximately $300 in annual dividends.

<h3>2. Energy Sector Stock: (Example: [Insert a well-known, stable energy company with a history of strong dividends - e.g., a specific ticker symbol])</h3>

- Why it's attractive: The energy sector can be a source of stable dividends, particularly from established companies with extensive infrastructure and consistent cash flow.

- Potential Dividend Contribution (Example): A $6,000 investment at a 4% dividend yield could potentially generate approximately $240 in annual dividends.

<h3>3. Consumer Staples Stock: (Example: [Insert a well-known, stable consumer staples company with a history of strong dividends - e.g., a specific ticker symbol])</h3>

- Why it's attractive: Companies in the consumer staples sector (food, beverage, household goods) often demonstrate resilience during economic downturns, making them attractive for dividend investors seeking stability.

- Potential Dividend Contribution (Example): A $6,000 investment at a 4% dividend yield could yield approximately $240 in annual dividends.

<h2>Total Estimated Annual Dividend Income:</h2>

By combining these three examples, a $18,000 investment could potentially yield approximately $780 in annual dividends. While this is lower than the $3100 target, it is important to note that this is a simplified example for illustrative purposes and the actual yield will vary depending on the specific stocks chosen and market conditions. Achieving a higher dividend income would likely require a more diversified portfolio with different yield targets and potentially including higher-risk stocks with higher dividend yields.

<h2>Important Considerations</h2>

- Dividend Sustainability: Always check a company's dividend payout ratio to ensure the dividend is sustainable. A high payout ratio can indicate the dividend may be at risk of being reduced or eliminated.

- Diversification: Don't put all your eggs in one basket. Diversifying across multiple sectors and companies mitigates risk.

- Tax Implications: Dividends are taxable income. Factor this into your investment strategy.

- Professional Advice: Consult a financial advisor to tailor a dividend investment strategy that aligns with your risk tolerance and financial goals.

This article provides an overview and illustrative examples. Conduct thorough due diligence and seek professional guidance before making any investment decisions. Remember that investing in the stock market involves risk, and there's no guarantee of achieving a specific return.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $18,000 Investment: Generate $3,100 Annual Dividends With These 3 Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

India Pakistan Conflict Which Defence Stock Hal Bel Or Mazagon Dock Offers The Best Investment

May 13, 2025

India Pakistan Conflict Which Defence Stock Hal Bel Or Mazagon Dock Offers The Best Investment

May 13, 2025 -

Ginny And Georgia Season 3 Trailer Release Date And Everything We Know So Far

May 13, 2025

Ginny And Georgia Season 3 Trailer Release Date And Everything We Know So Far

May 13, 2025 -

Nba Draft Combine 5 On 5 Evaluating Cooper Flagg And Other Key Prospects

May 13, 2025

Nba Draft Combine 5 On 5 Evaluating Cooper Flagg And Other Key Prospects

May 13, 2025 -

Reuniao Anual Berkshire Hathaway 2024 Cobertura Ao Vivo E Exclusiva Da Info Money

May 13, 2025

Reuniao Anual Berkshire Hathaway 2024 Cobertura Ao Vivo E Exclusiva Da Info Money

May 13, 2025 -

Australia News Coalition Leadership Contenders Vie For Top Spot Public School Funding Slashed In Victoria

May 13, 2025

Australia News Coalition Leadership Contenders Vie For Top Spot Public School Funding Slashed In Victoria

May 13, 2025

Latest Posts

-

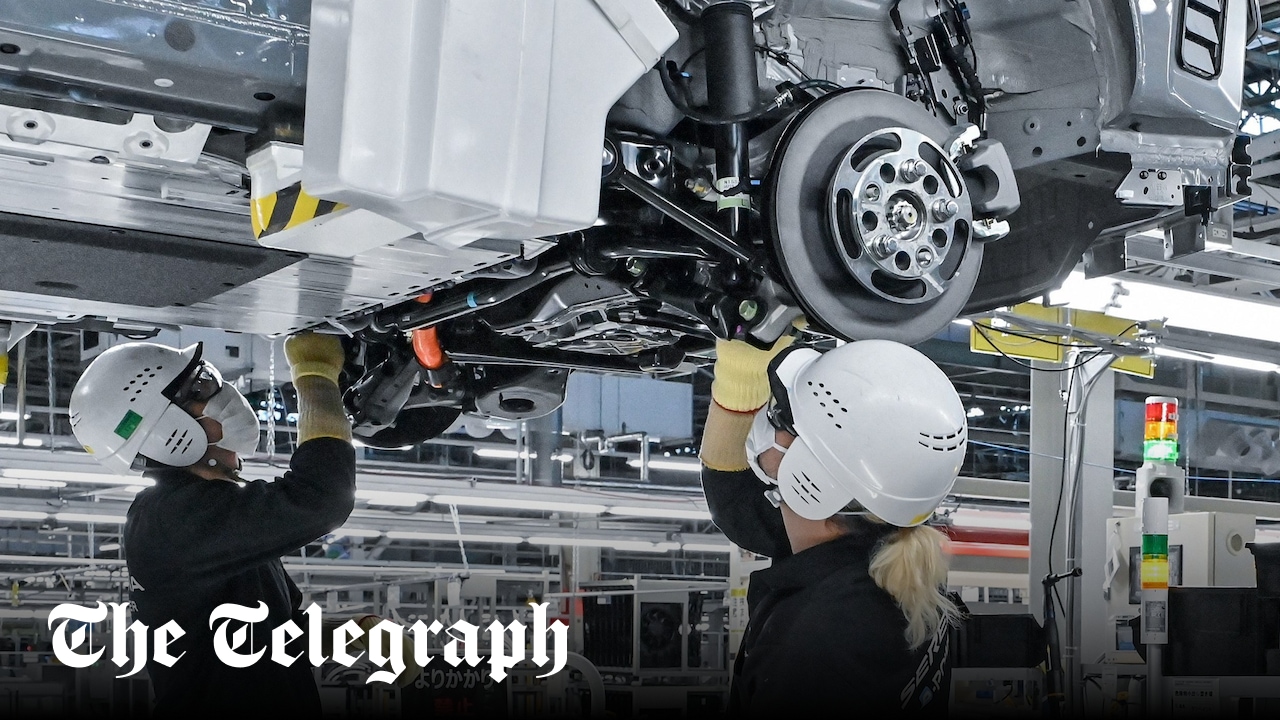

Major Restructuring Nissan To Eliminate 20 000 Positions Worldwide

May 13, 2025

Major Restructuring Nissan To Eliminate 20 000 Positions Worldwide

May 13, 2025 -

Alcaraz Vs Khachanov Sigue En Vivo Los Octavos De Final De Roma

May 13, 2025

Alcaraz Vs Khachanov Sigue En Vivo Los Octavos De Final De Roma

May 13, 2025 -

Urgent Evacuation Warning Large Fire Engulfs Barkerend Building

May 13, 2025

Urgent Evacuation Warning Large Fire Engulfs Barkerend Building

May 13, 2025 -

The Farmer And The Housemate Thomas And Clarettes Living Situation

May 13, 2025

The Farmer And The Housemate Thomas And Clarettes Living Situation

May 13, 2025 -

Celtics Collapse Tatum Injury Doms Game 4 Loss To Knicks

May 13, 2025

Celtics Collapse Tatum Injury Doms Game 4 Loss To Knicks

May 13, 2025