2 Stocks To Consider Amidst Market Uncertainty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

2 Stocks to Consider Amidst Market Uncertainty: Navigating the Choppy Waters

The current market is a rollercoaster. Economic headwinds, geopolitical tensions, and inflation concerns are leaving many investors feeling uneasy. But for those with a long-term perspective and a carefully curated portfolio, periods of market uncertainty can present unique opportunities. Instead of panicking, savvy investors are looking for resilient companies with strong fundamentals that can weather the storm. Today, we’ll explore two such stocks that might be worth considering amidst this market volatility: consumer staples and technology infrastructure.

Consumer Staples: A Safe Haven in Turbulent Times

When the market dips, investors often flock to defensive sectors like consumer staples. These companies provide essential goods and services that people continue to purchase regardless of economic conditions. Think food, beverages, household products – necessities that are relatively insensitive to economic downturns.

One standout in this sector is Procter & Gamble (PG). PG boasts a diverse portfolio of iconic brands, including Tide, Pampers, and Gillette. Its established market presence, strong brand loyalty, and consistent dividend payouts make it an attractive option for investors seeking stability.

- Key Advantages of PG:

- Recession-resistant business model: People need essentials even during economic downturns.

- Strong brand recognition: Decades of brand building provide a significant competitive advantage.

- Consistent dividend payments: Provides a steady stream of income for investors.

- Diversified product portfolio: Reduces reliance on any single product or market.

Investing in consumer staples like PG offers a degree of insulation against market volatility. While growth might not be explosive, the stability and predictable income stream can provide comfort during uncertain times.

Technology Infrastructure: Powering the Digital Future

While some tech stocks have suffered significant setbacks, the technology infrastructure sector presents a different story. These companies provide the backbone of the digital world, supplying essential services like cloud computing, data centers, and cybersecurity. The increasing reliance on digital technologies means demand for these services remains robust, even during economic slowdowns.

A strong contender in this sector is CrowdStrike Holdings (CRWD). As a leader in cloud-native endpoint protection, CrowdStrike is well-positioned to benefit from the ongoing growth of cloud computing and the increasing need for robust cybersecurity measures.

- Key Advantages of CRWD:

- High growth potential: The cybersecurity market is expanding rapidly.

- Strong competitive advantage: CrowdStrike's cloud-native platform offers superior scalability and efficiency.

- Recurring revenue model: A large portion of revenue is subscription-based, providing predictable income.

- Focus on innovation: Continuously developing new technologies to stay ahead of evolving threats.

Investing in technology infrastructure like CRWD offers exposure to a high-growth sector with a resilient business model. While the stock might experience short-term fluctuations, its long-term prospects look promising.

Disclaimer: Investing in the stock market involves risk, and you could lose money. This article is for informational purposes only and is not financial advice. Always conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Conclusion: A Balanced Approach

Market uncertainty is a fact of life for investors. However, by diversifying your portfolio and carefully selecting companies with strong fundamentals, you can mitigate risk and potentially capitalize on opportunities. Both Procter & Gamble and CrowdStrike represent different approaches to navigating market volatility, offering a blend of stability and growth potential. Remember to perform your own due diligence and tailor your investment strategy to your individual risk tolerance and financial goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 2 Stocks To Consider Amidst Market Uncertainty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Eight Complaints Filed Against Financial Influencers Fin Fluencers A 2025 Mas Report

Apr 08, 2025

Eight Complaints Filed Against Financial Influencers Fin Fluencers A 2025 Mas Report

Apr 08, 2025 -

Key Changes To Standard Chartereds Share Capital And Voting Rights Announced

Apr 08, 2025

Key Changes To Standard Chartereds Share Capital And Voting Rights Announced

Apr 08, 2025 -

Champions League 2024 Will Real Madrids Winning Streak Continue

Apr 08, 2025

Champions League 2024 Will Real Madrids Winning Streak Continue

Apr 08, 2025 -

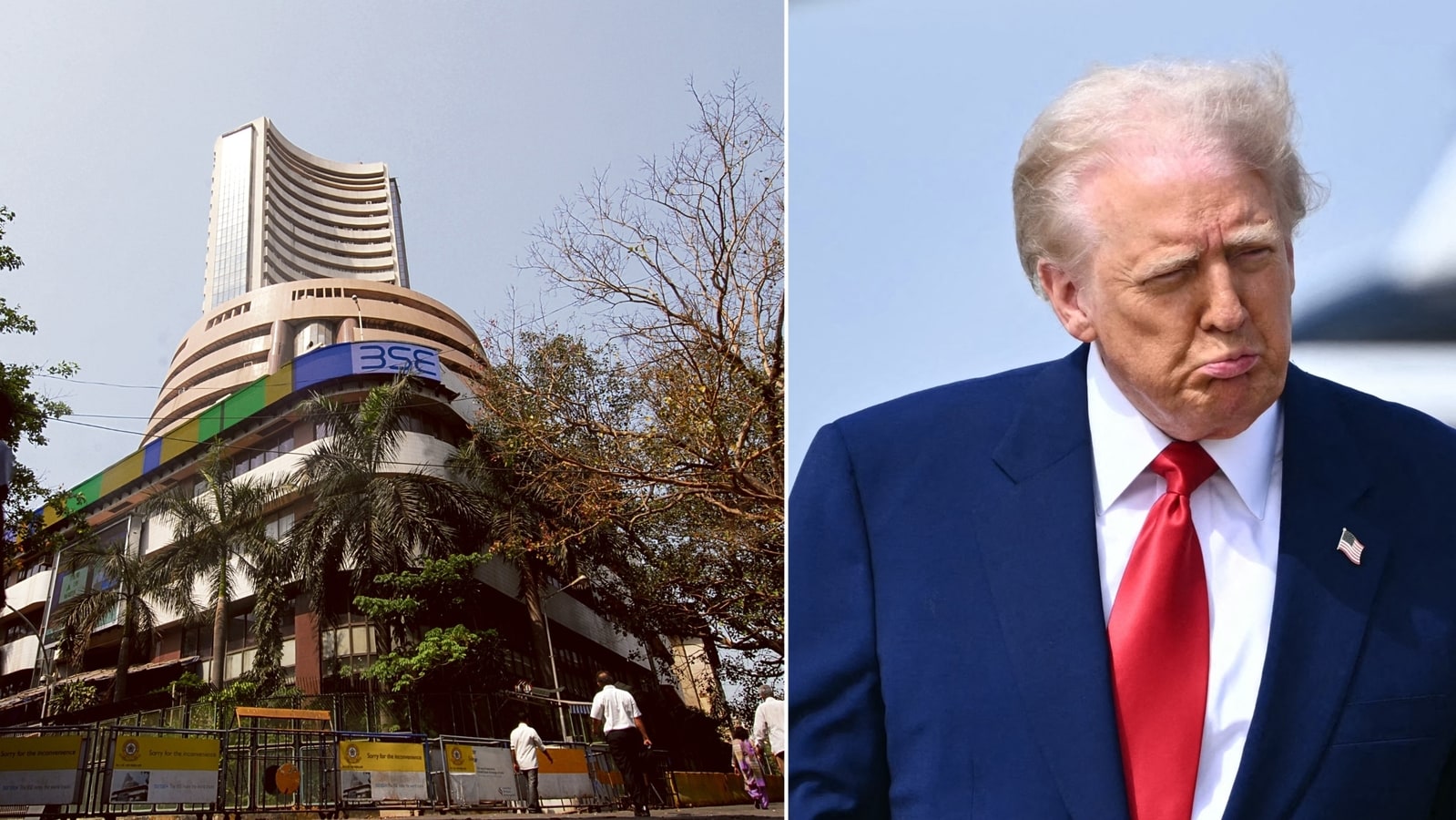

Indian Stock Market Down Today Causes Of The Sensex And Nifty Fall

Apr 08, 2025

Indian Stock Market Down Today Causes Of The Sensex And Nifty Fall

Apr 08, 2025 -

Celebrate Sg 60 With Lower Prices 140 Coffee Shops Join The Festivities

Apr 08, 2025

Celebrate Sg 60 With Lower Prices 140 Coffee Shops Join The Festivities

Apr 08, 2025