2014 Tax Code Stifles Maturing Cryptocurrency Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

2014 Tax Code Stifles Maturing Cryptocurrency Market: A Decade of Uncertainty

The cryptocurrency market, now a multi-trillion dollar behemoth, continues to grapple with the legacy of the 2014 IRS guidance on virtual currency taxation. This outdated framework, initially designed for a nascent industry, is increasingly seen as a significant impediment to the market's maturation and wider adoption. Ten years on, the ambiguity and complexity of the existing rules are stifling innovation and hindering institutional investment.

The 2014 Guidance: A Foundation of Confusion

In 2014, the IRS issued Notice 2014-21, classifying Bitcoin and other cryptocurrencies as "property" for tax purposes. While seemingly straightforward, this classification opened a Pandora's Box of complexities. Transactions, including buying, selling, trading, and even using cryptocurrency for goods and services, are subject to capital gains taxes, potentially leading to significant tax liabilities. The lack of clarity around specific scenarios, especially those involving staking, DeFi protocols, and NFTs, has created a landscape of uncertainty for both individuals and businesses.

Challenges for Investors and Businesses:

The 2014 tax code presents several significant challenges:

- Complex Reporting Requirements: Tracking every cryptocurrency transaction, including the fair market value at the time of each trade, is a Herculean task for many. This often leads to underreporting, unintentional errors, and increased vulnerability to IRS audits.

- High Tax Liabilities: The capital gains tax structure, coupled with the volatile nature of cryptocurrencies, can result in unexpectedly high tax bills, discouraging investment and hindering long-term growth strategies.

- Lack of Clarity on Specific Transactions: The rapid evolution of the cryptocurrency market has outpaced the 2014 guidance. New technologies like DeFi lending and staking present unique tax challenges, with no clear-cut IRS interpretation. This ambiguity creates a significant risk-aversion factor for institutional investors.

- International Tax Implications: The global nature of cryptocurrency transactions adds another layer of complexity, particularly concerning cross-border transactions and tax residency rules.

The Need for Regulatory Clarity and Modernization:

Experts widely agree that the 2014 guidance is no longer fit for purpose. The industry demands clearer, more comprehensive, and modern regulations that account for the advancements in blockchain technology and the diversification of the crypto market. This includes:

- Simplified Tax Reporting: Streamlined reporting mechanisms, potentially incorporating blockchain technology itself, could significantly reduce the burden on taxpayers.

- Clearer Guidance on Emerging Technologies: The IRS needs to proactively address the tax implications of newer technologies such as NFTs, DeFi, and DAOs.

- Harmonized International Standards: Collaborating with international regulatory bodies to establish common standards for cryptocurrency taxation is crucial for fostering global market growth.

The Future of Cryptocurrency Taxation:

The current situation represents a significant bottleneck for the cryptocurrency market's maturation. Until the outdated 2014 tax code is addressed, the market will continue to face hurdles in attracting mainstream adoption and institutional investment. A move towards clearer, more modern, and comprehensive regulation is not just desirable, it is essential for the long-term health and growth of the entire cryptocurrency ecosystem. The future of cryptocurrency hinges on resolving this decade-old challenge. The hope is for a regulatory framework that promotes innovation, attracts investment, and ensures fair and efficient tax collection.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 2014 Tax Code Stifles Maturing Cryptocurrency Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Googles Bard Ai Now Serving Ads To Startup Founders

May 03, 2025

Googles Bard Ai Now Serving Ads To Startup Founders

May 03, 2025 -

Apples App Store Update Spotifys Readiness Test

May 03, 2025

Apples App Store Update Spotifys Readiness Test

May 03, 2025 -

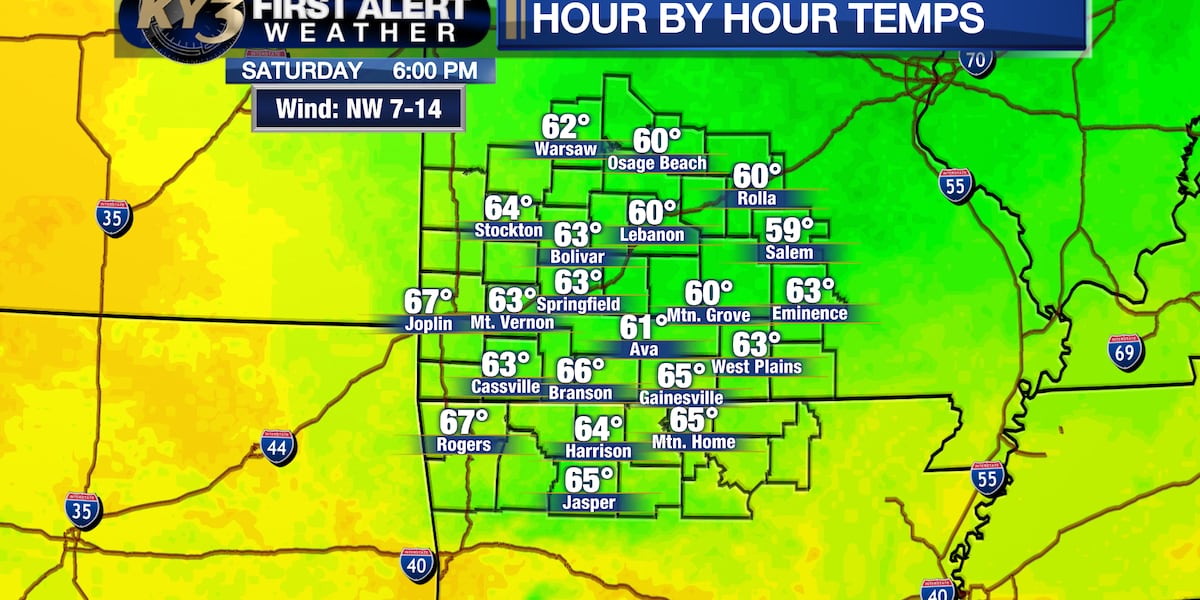

Severe Weather Alert Heavy Rain And Thunderstorms Friday

May 03, 2025

Severe Weather Alert Heavy Rain And Thunderstorms Friday

May 03, 2025 -

May Showers And Thunderstorms Met Service Forecast For Early May

May 03, 2025

May Showers And Thunderstorms Met Service Forecast For Early May

May 03, 2025 -

Barboza Falls To Lopez In Times Square Title Fight

May 03, 2025

Barboza Falls To Lopez In Times Square Title Fight

May 03, 2025

Latest Posts

-

Egalite Entre Boussac Et Montbazens Rignac

May 03, 2025

Egalite Entre Boussac Et Montbazens Rignac

May 03, 2025 -

Between A Rock And A Hard Place Australias Foreign Policy Challenges

May 03, 2025

Between A Rock And A Hard Place Australias Foreign Policy Challenges

May 03, 2025 -

Jakara Jackson Released From Wwe A Career Update And Future Prospects

May 03, 2025

Jakara Jackson Released From Wwe A Career Update And Future Prospects

May 03, 2025 -

Australias Evolving Threat Landscape Assessing The Biggest Security Challenge

May 03, 2025

Australias Evolving Threat Landscape Assessing The Biggest Security Challenge

May 03, 2025 -

Week 12 College Softball Shakeup Whos Number 1 After Recent Games

May 03, 2025

Week 12 College Softball Shakeup Whos Number 1 After Recent Games

May 03, 2025