2014 Tax Codes: Anachronistic Regulations Stifling Crypto Innovation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

2014 Tax Codes: Anachronistic Regulations Stifling Crypto Innovation

The explosive growth of the cryptocurrency market has collided head-on with the archaic tax codes of 2014, creating a regulatory quagmire that is actively stifling innovation and hindering the industry's potential. While the technology powering cryptocurrencies has advanced at breakneck speed, the legal frameworks governing them remain stubbornly stuck in the past, creating uncertainty and hindering widespread adoption.

The Problem with 2014 Tax Codes in the Crypto World

The core issue lies in the inherent mismatch between the decentralized, borderless nature of cryptocurrencies and the geographically-bound, centralized nature of traditional tax systems. Tax codes drafted in 2014, before the widespread adoption of Bitcoin and other cryptocurrencies, simply weren't designed to handle the complexities of digital assets. This results in several key problems:

-

Ambiguous Tax Treatment: The lack of clarity surrounding the tax treatment of crypto transactions – such as staking rewards, airdrops, and DeFi yields – leads to confusion and inconsistent application of the law. This uncertainty makes it difficult for businesses to plan effectively and discourages investment.

-

High Compliance Costs: Navigating the complexities of reporting cryptocurrency transactions can be incredibly expensive, particularly for smaller businesses and individual investors. This disproportionately impacts startups and limits participation in the crypto economy.

-

Increased Regulatory Burden: The inconsistent application of existing regulations creates a regulatory burden that discourages innovation. Developers and entrepreneurs are hesitant to invest time and resources in projects when the legal landscape is so uncertain.

-

International Inconsistencies: Different countries have adopted varying approaches to regulating cryptocurrencies, creating a fragmented global market. This lack of harmonization makes it challenging for businesses operating internationally to comply with multiple sets of regulations.

Outdated Regulations and the Impact on Innovation

The outdated 2014 tax codes act as a significant barrier to entry for many potential participants in the crypto space. This chilling effect is particularly pronounced in:

-

Decentralized Finance (DeFi): The complex nature of DeFi protocols and the associated tax implications make it difficult for projects to scale and attract users.

-

Non-Fungible Tokens (NFTs): The unique characteristics of NFTs present further challenges in terms of valuation and tax reporting.

-

Cryptocurrency Mining: The energy consumption and regulatory uncertainties surrounding cryptocurrency mining often deter potential investors.

The Need for Modernized Crypto Regulations

The current situation demands urgent action. Lawmakers and regulators need to work collaboratively with the cryptocurrency industry to develop clear, consistent, and future-proof regulations. This requires:

-

Comprehensive Tax Legislation: Creating specific legislation tailored to the unique characteristics of cryptocurrencies is paramount. This legislation must address issues like staking, DeFi, and NFTs explicitly.

-

Improved Educational Resources: Clear and accessible educational resources can help individuals and businesses navigate the complexities of crypto taxation.

-

International Cooperation: International cooperation is essential to harmonize regulations and create a more unified global market.

Looking Ahead

The 2014 tax codes were clearly not designed for the dynamic world of cryptocurrencies. Failure to adapt these regulations will not only stifle innovation but will also limit the potential economic benefits of this rapidly growing technology. The time for clear, comprehensive, and forward-thinking crypto regulation is now. The future of finance depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 2014 Tax Codes: Anachronistic Regulations Stifling Crypto Innovation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Steph Currys Hamstring Impact On Warriors Playoff Run Remains Uncertain

May 08, 2025

Steph Currys Hamstring Impact On Warriors Playoff Run Remains Uncertain

May 08, 2025 -

A Thorough Review Of Fight Or Flight Pros And Cons

May 08, 2025

A Thorough Review Of Fight Or Flight Pros And Cons

May 08, 2025 -

Randles Mamba Mentality Shaping Edwards Future With The Timberwolves

May 08, 2025

Randles Mamba Mentality Shaping Edwards Future With The Timberwolves

May 08, 2025 -

Ncaa Di Mens Lacrosse Kirst Sets New Career Goals Record

May 08, 2025

Ncaa Di Mens Lacrosse Kirst Sets New Career Goals Record

May 08, 2025 -

New Pope Election Largest Conclave In History Underway

May 08, 2025

New Pope Election Largest Conclave In History Underway

May 08, 2025

Latest Posts

-

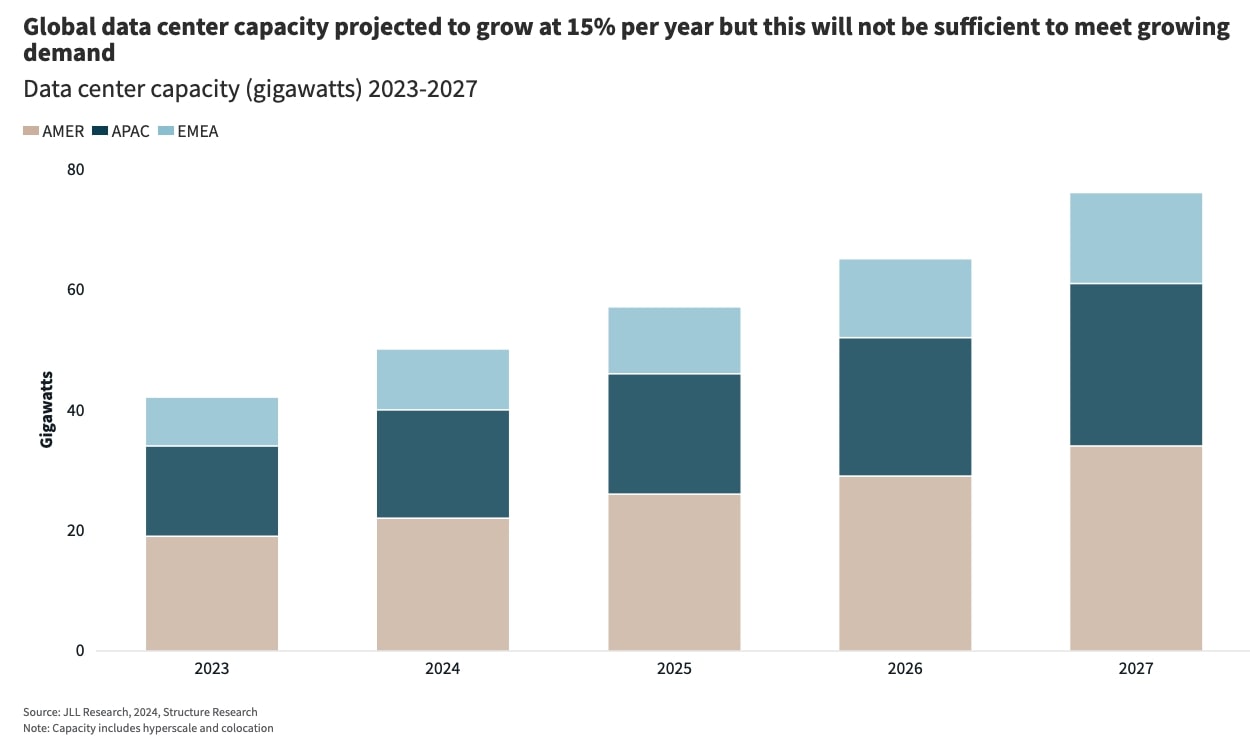

Global Ai Data Center Expansion Continues Despite Tech Giant Adjustments

May 08, 2025

Global Ai Data Center Expansion Continues Despite Tech Giant Adjustments

May 08, 2025 -

Final Destination Bloodlines Oldest Person Ever Set On Fire For A Movie Stunt

May 08, 2025

Final Destination Bloodlines Oldest Person Ever Set On Fire For A Movie Stunt

May 08, 2025 -

Badar Khan Suri From Georgetown Peace Scholar To Ice Detention Center

May 08, 2025

Badar Khan Suri From Georgetown Peace Scholar To Ice Detention Center

May 08, 2025 -

Digital Taste A New Era In Food Science And Technology

May 08, 2025

Digital Taste A New Era In Food Science And Technology

May 08, 2025 -

Boston Celtics Fall To New York Knicks In Tense Overtime Nba Game

May 08, 2025

Boston Celtics Fall To New York Knicks In Tense Overtime Nba Game

May 08, 2025