$209 Million Loss: Investigation Into WLFI-Linked Wallet And ETH Dump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$209 Million Loss: Investigation into WLFI-Linked Wallet and ETH Dump Rocks DeFi World

The decentralized finance (DeFi) world is reeling after a staggering $209 million loss linked to a wallet associated with Wrapped Lido Finance (WLFI) and a subsequent massive Ethereum (ETH) dump. The incident, which unfolded rapidly, has sparked a widespread investigation and raised serious concerns about the security and stability of DeFi protocols. This unexpected event highlights the inherent risks within the volatile cryptocurrency market and the importance of robust security measures.

The Timeline of the Catastrophe:

The drama began with the unusual activity detected in a wallet reportedly linked to WLFI. This wallet, holding a substantial amount of ETH, suddenly began offloading its holdings, causing a significant price drop in ETH and sending shockwaves through the cryptocurrency community. Within hours, the $209 million loss was confirmed, leaving investors scrambling to understand the cause and potential ramifications.

What is Wrapped Lido Finance (WLFI)?

Wrapped Lido Finance (WLFI) is a wrapped version of Lido staked ETH (stETH), designed to enhance liquidity and usability. It essentially represents a claim on staked ETH, allowing users to participate in staking rewards without directly locking up their ETH. The incident raises questions about the security mechanisms within the WLFI protocol and its potential vulnerabilities.

Possible Explanations Under Investigation:

Several theories are circulating regarding the cause of the $209 million loss and the subsequent ETH dump. These include:

- A security breach: This is a primary suspect, with investigators examining the possibility of a hack or exploit within the WLFI protocol itself or a related service. Experts are meticulously scrutinizing the transaction history to identify any irregularities.

- Insider trading: Another theory suggests the possibility of insider trading, where someone with privileged information about an impending vulnerability or event dumped their ETH holdings before the news became public. Authorities will likely be investigating this possibility.

- Accidental transaction: While less likely given the scale of the loss, the possibility of a large, accidental transaction cannot be entirely ruled out. This scenario would involve a significant error in a smart contract or a major oversight in the handling of the funds.

The Impact on the DeFi Ecosystem:

The $209 million loss has understandably shaken confidence in the DeFi ecosystem. Investors are questioning the security of their investments and the overall robustness of DeFi protocols. This incident serves as a stark reminder that despite the innovative potential of DeFi, significant risks remain.

Regulatory Scrutiny Heightened:

The event is likely to intensify regulatory scrutiny of the DeFi space. Regulators are already grappling with how to oversee the rapidly evolving DeFi landscape, and incidents like this underscore the need for clear guidelines and oversight mechanisms to protect investors.

Moving Forward: Lessons Learned and Future Precautions:

This significant loss offers valuable lessons for both investors and developers within the DeFi space:

- Due diligence is crucial: Thoroughly researching and understanding the risks associated with any DeFi protocol is paramount.

- Security audits are essential: Regularly auditing smart contracts and protocols for vulnerabilities is vital to prevent similar incidents.

- Diversification is key: Spreading investments across various assets and protocols can help mitigate risk.

The investigation into the $209 million loss associated with WLFI and the ETH dump is ongoing. As more information emerges, the cryptocurrency community will be watching closely to understand the full extent of the damage and to learn from this costly event. The future of DeFi hinges on the ability to address these security challenges effectively and build a more resilient and trustworthy ecosystem.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $209 Million Loss: Investigation Into WLFI-Linked Wallet And ETH Dump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Small Plane Catches Fire Crashes On Busy Boca Raton Road

Apr 11, 2025

Small Plane Catches Fire Crashes On Busy Boca Raton Road

Apr 11, 2025 -

Gempi Di Korea Selatan Potret Liburan Yang Menawan Tunjukkan Kecantikan Anak Gadis

Apr 11, 2025

Gempi Di Korea Selatan Potret Liburan Yang Menawan Tunjukkan Kecantikan Anak Gadis

Apr 11, 2025 -

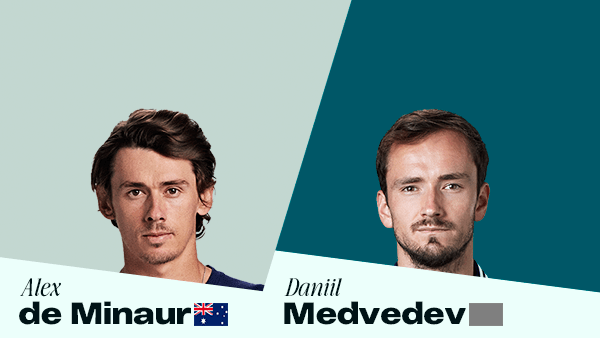

Watch Medvedev Vs De Minaur Monte Carlo Showdown Tv Listings And Betting Odds

Apr 11, 2025

Watch Medvedev Vs De Minaur Monte Carlo Showdown Tv Listings And Betting Odds

Apr 11, 2025 -

Collaboration Boost Auroville Foundation And Cdac Sign Mo U

Apr 11, 2025

Collaboration Boost Auroville Foundation And Cdac Sign Mo U

Apr 11, 2025 -

Morgan Oey Perankan Edwin Sebuah Studi Karakter Generasi Sekarang

Apr 11, 2025

Morgan Oey Perankan Edwin Sebuah Studi Karakter Generasi Sekarang

Apr 11, 2025