25% AI Stock Correction: Smart Investment Strategy Before April 17?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

25% AI Stock Correction: Smart Investment Strategy Before April 17?

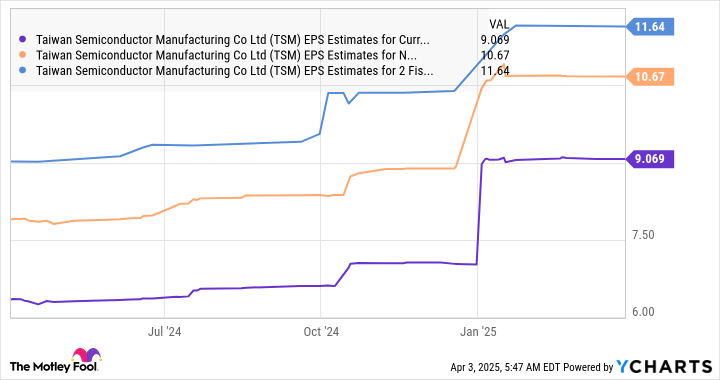

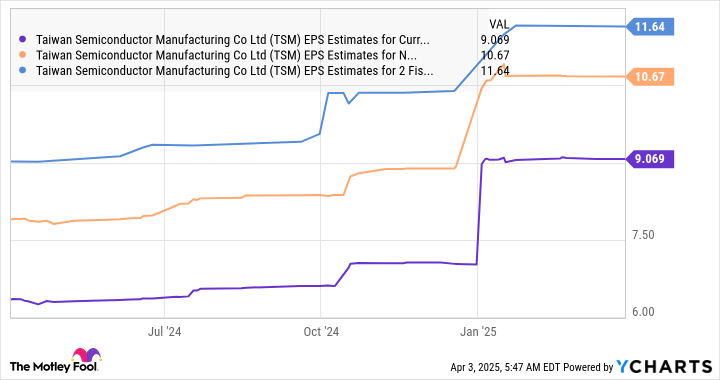

The artificial intelligence (AI) sector has experienced a meteoric rise, captivating investors with promises of transformative technology. However, recent market volatility has triggered a significant correction, with some AI stocks plummeting by as much as 25%. This dramatic downturn raises crucial questions for investors: is this a temporary setback, or the beginning of a broader market shift? And more importantly, what smart investment strategies should you consider before April 17th?

This article analyzes the current AI market landscape, explores the reasons behind the correction, and offers actionable insights to navigate this period of uncertainty.

The AI Stock Market Rollercoaster: Understanding the 25% Dip

The rapid growth of the AI sector, fueled by breakthroughs in large language models (LLMs) and generative AI, attracted massive investment. This led to inflated valuations for many AI companies, creating a bubble ripe for correction. Several factors contributed to the recent 25% drop in some AI stocks:

- Profit-Taking: After a period of substantial gains, many investors decided to secure profits, leading to a wave of selling.

- Overvaluation Concerns: Concerns remain about the long-term profitability and sustainability of some AI companies, particularly those reliant on venture capital funding.

- Economic Uncertainty: The broader economic climate, including rising interest rates and inflation, has created a risk-averse environment, impacting investor sentiment towards growth stocks like those in the AI sector.

- Regulatory Scrutiny: Increasing regulatory scrutiny surrounding AI development and data privacy is also impacting investor confidence.

Navigating the AI Market: Smart Investment Strategies Before April 17th

The potential for a continued correction before April 17th warrants a cautious approach. However, this doesn't mean abandoning the AI sector altogether. Instead, consider these strategies:

1. Diversification is Key: Don't put all your eggs in one basket. Diversify your portfolio across different AI companies and sectors to mitigate risk. Consider investing in established tech giants with strong AI initiatives alongside smaller, more innovative companies.

2. Fundamental Analysis: Focus on companies with strong fundamentals, including revenue generation, profitability, and a clear path to sustainable growth. Avoid companies solely reliant on hype and speculative investment.

3. Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy helps reduce the impact of volatility and minimizes the risk of buying high.

4. Value Investing: Look for undervalued AI companies with strong potential for future growth. This requires careful research and analysis of financial statements and market trends.

5. Long-Term Perspective: The AI revolution is still in its early stages. While short-term fluctuations are inevitable, maintaining a long-term perspective is crucial for successful investment in this sector.

April 17th and Beyond: A Look Ahead

While April 17th is an arbitrary date, it serves as a reminder that the AI market remains dynamic. Investors should continuously monitor market trends, news, and financial reports to make informed decisions. Staying informed about regulatory developments and technological advancements is paramount.

Conclusion:

The 25% AI stock correction presents both challenges and opportunities. By employing a cautious yet strategic approach, including diversification, fundamental analysis, and a long-term perspective, investors can navigate this period of uncertainty and potentially capitalize on the future growth of the AI sector. Remember to consult with a financial advisor before making any significant investment decisions. The information provided here is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 25% AI Stock Correction: Smart Investment Strategy Before April 17?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Impact Of Hud Ice Data Sharing Agreement On Nycs Immigrant Communities

Apr 08, 2025

Impact Of Hud Ice Data Sharing Agreement On Nycs Immigrant Communities

Apr 08, 2025 -

Hong Kong Stock Sell Off Fuels Asia Pacific Market Weakness Trade War Remains A Key Driver

Apr 08, 2025

Hong Kong Stock Sell Off Fuels Asia Pacific Market Weakness Trade War Remains A Key Driver

Apr 08, 2025 -

Elderly Mans Dog Attacked In Racist Incident Cctv Footage Released

Apr 08, 2025

Elderly Mans Dog Attacked In Racist Incident Cctv Footage Released

Apr 08, 2025 -

Masters Tournament Update Augusta National Delays Opening Due To Weather Conditions

Apr 08, 2025

Masters Tournament Update Augusta National Delays Opening Due To Weather Conditions

Apr 08, 2025 -

The Science Of Taste Advances In Recording And Replicating Flavor Profiles

Apr 08, 2025

The Science Of Taste Advances In Recording And Replicating Flavor Profiles

Apr 08, 2025