25% AI Stock Decline: Expert Predictions And Investment Strategies Before April 17

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

25% AI Stock Decline: Expert Predictions and Investment Strategies Before April 17

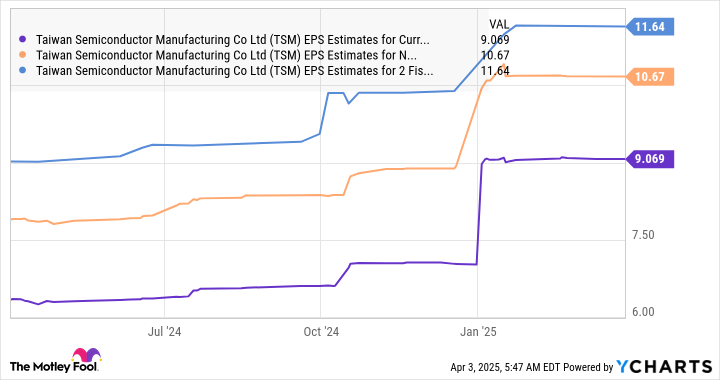

The artificial intelligence (AI) sector has experienced a dramatic downturn, with some stocks plummeting by as much as 25%. Experts are weighing in on the causes and offering crucial advice for investors navigating this volatile market before the crucial April 17th deadline.

The recent AI stock decline has sent shockwaves through the investment world, leaving many wondering what the future holds. This significant drop, impacting prominent players in the AI sector, necessitates a careful examination of the underlying factors and a strategic approach to navigating the market's uncertainty. This article explores the potential causes of this downturn, analyzes expert predictions, and provides actionable investment strategies to consider before April 17th.

Understanding the AI Stock Market Dip: Why the 25% Drop?

Several contributing factors have been identified as potential drivers behind the recent 25% decline in AI stocks. These include:

-

Overvaluation Concerns: The rapid growth of the AI sector led to concerns about overvaluation in certain companies. Investors are now reassessing the long-term potential of some AI businesses, leading to a correction in stock prices.

-

Increased Interest Rates: The ongoing impact of rising interest rates globally has made investors more cautious, shifting their focus to more stable, less risky investments. This has negatively affected growth stocks, including many AI companies.

-

Profitability Concerns: Many AI companies are still in the early stages of development and are not yet profitable. This lack of profitability makes them vulnerable during periods of economic uncertainty.

-

Geopolitical Uncertainty: The ongoing global geopolitical landscape, including the war in Ukraine and other international tensions, adds to the overall market volatility and contributes to investor apprehension.

Expert Predictions: What's Next for AI Stocks?

Financial analysts offer a range of predictions regarding the future of AI stocks. Some believe the current downturn is a temporary correction, presenting a buying opportunity for long-term investors. Others suggest the decline may continue, advising caution and a more conservative investment approach.

Key predictions to consider:

- Short-term volatility: Most experts predict continued short-term volatility until the market stabilizes and clearer trends emerge.

- Long-term growth: The long-term potential of AI remains largely unchanged. The current downturn is seen by some as a temporary setback within a larger upward trajectory.

- Sector-specific performance: Performance will vary greatly across different AI companies. Careful due diligence is crucial before making investment decisions.

Investment Strategies Before April 17th: Mitigating Risk and Maximizing Returns

Given the current market conditions, investors need a strategic approach to mitigate risks and potentially capitalize on opportunities before April 17th. Consider these strategies:

- Diversification: Diversifying your portfolio across different sectors and asset classes is crucial to minimize the impact of any single sector's downturn.

- Risk Assessment: Thoroughly assess the risk tolerance of your investment portfolio and adjust accordingly. Consider shifting towards lower-risk investments if necessary.

- Fundamental Analysis: Conduct thorough fundamental analysis of individual AI companies before investing. Focus on factors like revenue growth, profitability, and technological innovation.

- Dollar-Cost Averaging: Employ a dollar-cost averaging strategy to mitigate the risk of investing a lump sum at a potentially unfavorable time.

- Seek Professional Advice: Consult with a financial advisor for personalized guidance tailored to your specific financial situation and investment goals.

The AI sector remains a promising area for long-term investment, but navigating the current volatility requires careful planning and strategic decision-making. By understanding the contributing factors to the decline and adopting a well-informed approach, investors can potentially weather this storm and position themselves for future success. Remember, this information is for educational purposes and should not be considered financial advice. Always consult with a qualified financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 25% AI Stock Decline: Expert Predictions And Investment Strategies Before April 17. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sse Composite Index Plunges 6 06 Market Analysis And Expert Insights

Apr 07, 2025

Sse Composite Index Plunges 6 06 Market Analysis And Expert Insights

Apr 07, 2025 -

Minecraft Film Review A Faithful Adaptation Or A Missed Opportunity

Apr 07, 2025

Minecraft Film Review A Faithful Adaptation Or A Missed Opportunity

Apr 07, 2025 -

Multi Billion Indian Conglomerate Invests In 10 B Indian Semiconductor Fab

Apr 07, 2025

Multi Billion Indian Conglomerate Invests In 10 B Indian Semiconductor Fab

Apr 07, 2025 -

Powerful Ai Search For All The Sentient Initiative

Apr 07, 2025

Powerful Ai Search For All The Sentient Initiative

Apr 07, 2025 -

Clippers Vs Mavericks Witnessing A Pointed Remark Towards Nico Harrison

Apr 07, 2025

Clippers Vs Mavericks Witnessing A Pointed Remark Towards Nico Harrison

Apr 07, 2025