25% Drop In AI Stock: Should You Invest Before April 17?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

25% Drop in AI Stock: Should You Invest Before April 17?

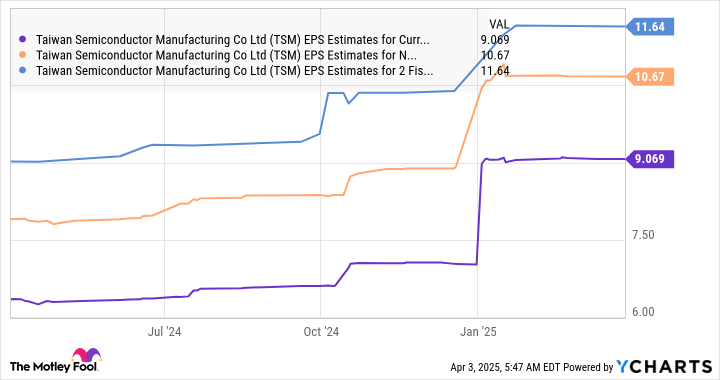

Artificial intelligence (AI) stocks have taken a significant hit recently, with some experiencing a dramatic 25% drop. This sudden downturn has left many investors wondering: is this a buying opportunity, or a sign of further trouble ahead? The crucial question on everyone's mind is whether to invest before April 17th, a date that seems to be looming large in the minds of market analysts. This article delves into the reasons behind this decline and explores whether now is the right time to jump in.

The AI Stock Market Crash: Understanding the Plunge

The recent 25% drop in certain AI stocks isn't an isolated incident. Several factors have contributed to this market correction, creating a climate of uncertainty for investors.

-

Overvalued Expectations: The initial hype surrounding AI led to inflated valuations for many companies. As the market matures and investors become more discerning, some companies are struggling to meet the initially projected growth rates. This reality check has resulted in a significant price correction.

-

Increased Competition: The AI sector is becoming increasingly crowded, with both established tech giants and nimble startups vying for market share. This intense competition can put downward pressure on profit margins and stock prices.

-

Regulatory Uncertainty: Governments worldwide are grappling with the implications of rapidly advancing AI technology. The potential for future regulations, impacting data usage and algorithmic transparency, creates uncertainty for investors.

-

Economic Slowdown Fears: The broader economic climate also plays a role. Concerns about a potential recession or slowdown are impacting investor sentiment across various sectors, including AI.

Should You Buy the Dip Before April 17th?

The question of whether to invest before April 17th is a complex one. There's no easy answer, and any investment decision should be based on your individual risk tolerance and financial goals. However, here are some factors to consider:

-

Long-Term Potential: Despite the recent downturn, the long-term potential of AI remains substantial. The technology is transforming numerous industries, and the market is expected to experience significant growth in the coming years.

-

Fundamental Analysis: Before making any investment, conduct thorough due diligence. Analyze the company's financials, competitive landscape, and management team. Look beyond short-term market fluctuations and focus on the company's underlying value.

-

Diversification: Don't put all your eggs in one basket. Diversify your portfolio to mitigate risk. Investing in a variety of AI companies or spreading your investments across different sectors can help protect against significant losses.

-

Expert Opinion: Consult with a qualified financial advisor before making any investment decisions. They can help you assess your risk tolerance and develop a personalized investment strategy.

April 17th: A Catalyst for Change?

While April 17th itself doesn't hold any specific significance in the AI market calendar, it serves as a deadline for many investors to reassess their portfolios and make decisions based on the recent market performance. This date acts as a symbolic marker, prompting action and potentially influencing market trends.

Conclusion: Navigating the AI Investment Landscape

The 25% drop in AI stock prices presents both challenges and opportunities. While the recent downturn is concerning, the long-term potential of AI remains strong. However, careful consideration, thorough research, and a well-defined investment strategy are crucial. Remember, before investing, conduct thorough due diligence, diversify your portfolio, and consider seeking professional financial advice. The decision to invest before April 17th, or at any time, is ultimately a personal one based on your individual circumstances and risk appetite. Don't let the short-term volatility distract you from the long-term potential of this transformative technology.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 25% Drop In AI Stock: Should You Invest Before April 17?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Australia South Korea Womens Friendly Live Match Updates And Highlights

Apr 07, 2025

Australia South Korea Womens Friendly Live Match Updates And Highlights

Apr 07, 2025 -

Australia To Avoid Global Recession Chalmers Highlights Growth Threats

Apr 07, 2025

Australia To Avoid Global Recession Chalmers Highlights Growth Threats

Apr 07, 2025 -

Nintendos Switch 2 Preorder Delays Due To Unexpected Tariffs

Apr 07, 2025

Nintendos Switch 2 Preorder Delays Due To Unexpected Tariffs

Apr 07, 2025 -

New Echo Show Amazons Compact And Affordable Smart Display Challenges Googles Dominance

Apr 07, 2025

New Echo Show Amazons Compact And Affordable Smart Display Challenges Googles Dominance

Apr 07, 2025 -

From Tongue To Tech The Science Behind Reproducing Taste

Apr 07, 2025

From Tongue To Tech The Science Behind Reproducing Taste

Apr 07, 2025