25% HMRC Penalty For Cash Withdrawals: Are UK Households At Risk?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

25% HMRC Penalty for Cash Withdrawals: Are UK Households at Risk?

The UK's tax authority, HMRC, is cracking down on undeclared cash withdrawals, leaving many households wondering if they're at risk of a hefty 25% penalty. This significant increase in enforcement action has sparked widespread concern and confusion, particularly amongst those who regularly use cash for personal transactions. But who is actually targeted, and what steps can you take to protect yourself?

Understanding the HMRC's Focus on Cash Transactions

HMRC's increased scrutiny on cash withdrawals is part of a broader strategy to combat tax evasion and money laundering. Large cash transactions, particularly those exceeding £10,000, are already subject to strict reporting requirements. However, the tax authority is now focusing on smaller, seemingly insignificant withdrawals, especially when these transactions consistently fail to align with declared income. This means even regular cash withdrawals for everyday expenses could fall under suspicion if they appear disproportionate to your reported earnings.

Who is Most at Risk?

While anyone using cash could technically be affected, certain groups are considered more vulnerable:

- Self-employed individuals: Those working in cash-based industries, such as tradespeople or market vendors, often handle large amounts of cash. Accurate record-keeping is crucial for avoiding penalties.

- Individuals with undeclared income: This includes those receiving cash-in-hand payments, or engaging in unreported 'gig' work.

- Those with inconsistent banking activity: Frequent large cash withdrawals with minimal corresponding bank deposits can raise red flags.

- Businesses failing to comply with reporting thresholds: Even businesses that diligently record their income can find themselves facing penalties if they haven't properly accounted for all cash transactions.

The 25% Penalty: What it Means

The 25% penalty isn't simply a fine; it's levied on the total amount of the undeclared income inferred from the suspicious cash withdrawals. This means a seemingly small oversight can quickly escalate into a substantial financial burden. This significant penalty aims to deter tax evasion and ensure fairness within the tax system.

Protecting Yourself: Key Steps to Take

Fortunately, there are proactive measures you can take to safeguard yourself:

- Maintain meticulous records: Keep detailed records of all income and expenses, including cash transactions. Digital accounting software can significantly simplify this process.

- Declare all income accurately: Ensure your self-assessment tax returns are completely accurate and reflect all your income sources.

- Use banking facilities: Whenever possible, opt for electronic payments to provide a clear audit trail of your transactions.

- Seek professional advice: If you're unsure about your tax obligations or are concerned about your cash transactions, consult a qualified accountant or tax advisor. They can guide you on best practices and help you avoid potential penalties.

Looking Ahead: The Future of Cash Transactions in the UK

The HMRC's intensified focus on cash transactions underscores a wider shift towards a more digitalized economy. While cash remains a legal tender, its use for significant transactions is becoming increasingly scrutinized. Understanding the implications of these changes and adhering to the necessary regulations is vital for avoiding costly penalties. Ignoring the risks could prove financially devastating. Staying informed and proactive is the best defense against the 25% HMRC penalty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 25% HMRC Penalty For Cash Withdrawals: Are UK Households At Risk?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing The Celtics Knicks Matchup A Film Study Approach

May 10, 2025

Analyzing The Celtics Knicks Matchup A Film Study Approach

May 10, 2025 -

Sgas Respectful Words Shai Gilgeous Alexander Comments On Russell Westbrook

May 10, 2025

Sgas Respectful Words Shai Gilgeous Alexander Comments On Russell Westbrook

May 10, 2025 -

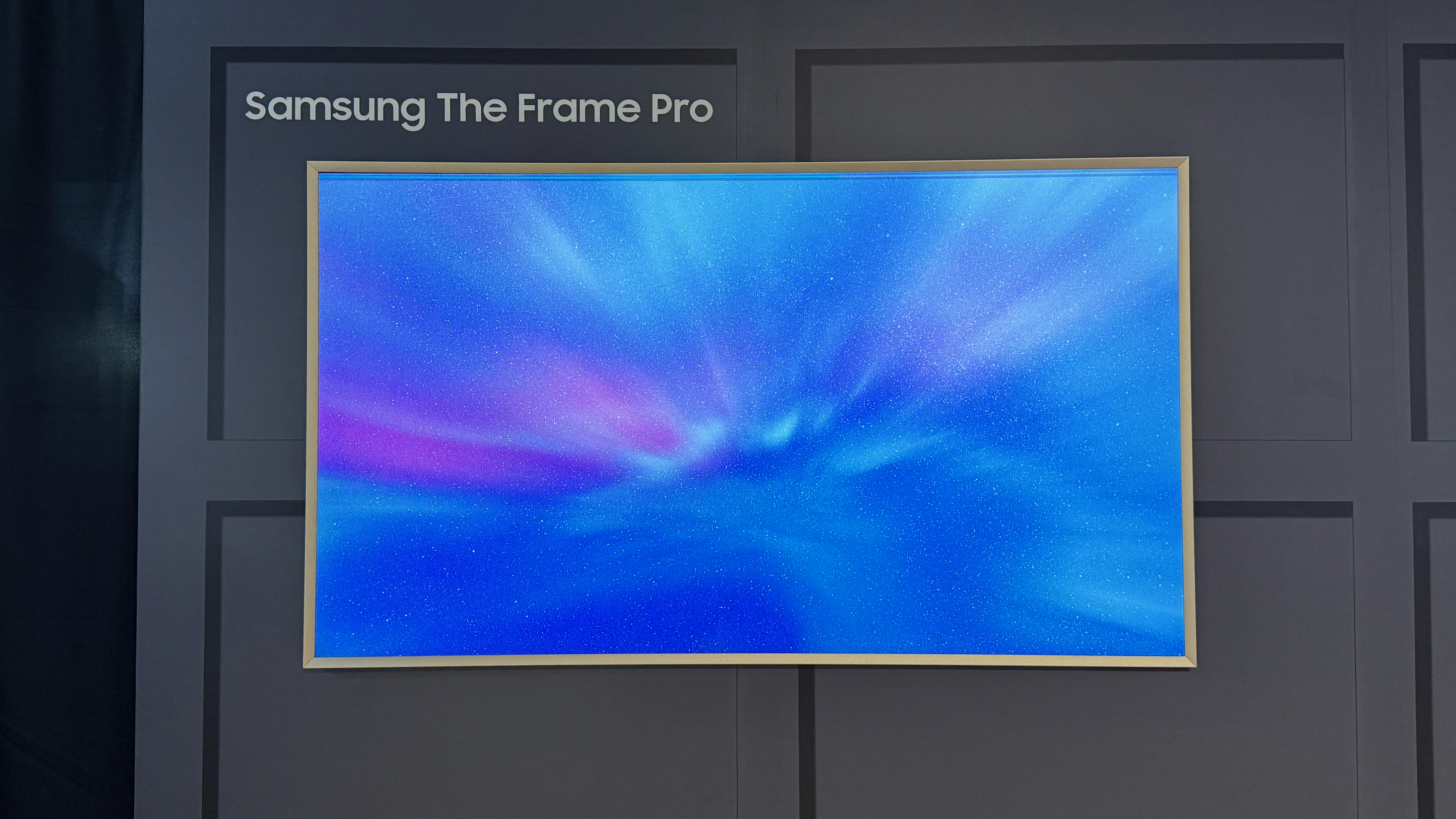

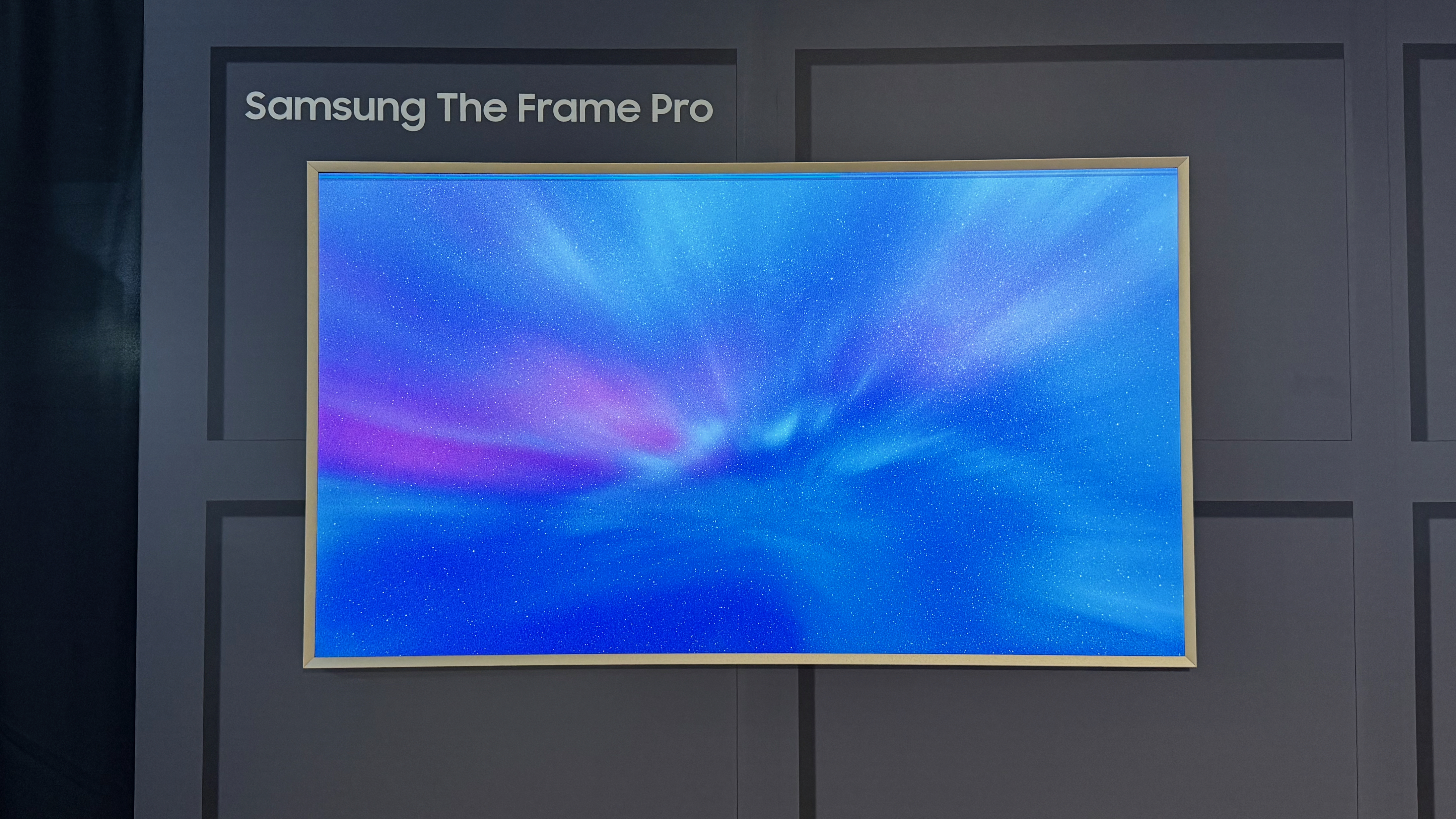

Samsung The Frame Pro Is The Upgrade Worth It After Years With The Frame

May 10, 2025

Samsung The Frame Pro Is The Upgrade Worth It After Years With The Frame

May 10, 2025 -

Los Angeles Dodgers Is This All Star Already An Mvp Candidate

May 10, 2025

Los Angeles Dodgers Is This All Star Already An Mvp Candidate

May 10, 2025 -

As Greves E Seus Custos Bilionarios Prejuizos Para Empresas E A Nacao

May 10, 2025

As Greves E Seus Custos Bilionarios Prejuizos Para Empresas E A Nacao

May 10, 2025

Latest Posts

-

Two Weeks To Google I O Gemini 3 And Gemini Ultra Predictions

May 10, 2025

Two Weeks To Google I O Gemini 3 And Gemini Ultra Predictions

May 10, 2025 -

Post Bologna Win Conceicao Keeps Milan Grounded Ahead Of Final

May 10, 2025

Post Bologna Win Conceicao Keeps Milan Grounded Ahead Of Final

May 10, 2025 -

From The Frame To The Frame Pro A Detailed Comparison And Review

May 10, 2025

From The Frame To The Frame Pro A Detailed Comparison And Review

May 10, 2025 -

Nuggets Take 2 1 Series Lead After Thrilling Overtime Win Against Thunder

May 10, 2025

Nuggets Take 2 1 Series Lead After Thrilling Overtime Win Against Thunder

May 10, 2025 -

Setback For Pakistan Cricket Uae Denies Psl 2025 Hosting Request

May 10, 2025

Setback For Pakistan Cricket Uae Denies Psl 2025 Hosting Request

May 10, 2025