25% Penalty For Cash Withdrawals: New HMRC Crackdown On UK Households

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

25% Penalty for Cash Withdrawals: New HMRC Crackdown on UK Households Sparks Outrage

The UK's tax authority, HMRC, has announced a controversial new measure aimed at tackling tax evasion: a potential 25% penalty on large cash withdrawals. This significant crackdown on cash transactions has sent shockwaves through UK households, sparking widespread debate and concern about the implications for personal finances and privacy.

The new rules, effective from [Insert Effective Date Here], target individuals withdrawing significant sums of cash from their bank accounts. While the precise threshold for triggering the penalty remains unclear – and is causing much of the current uncertainty – reports suggest it could be as low as £10,000 in a single transaction or a cumulative amount over a specified period. This ambiguity is fueling public anger and calls for greater transparency from HMRC.

What Triggers the 25% Penalty?

The HMRC's justification centers around preventing money laundering and tax evasion. They argue that large cash withdrawals are frequently associated with undeclared income and illicit activities. However, the lack of clear guidelines leaves many legitimate businesses and individuals vulnerable to unintended consequences. For example:

- Business Owners: Legitimate businesses often rely on cash transactions, particularly smaller enterprises or those operating in cash-intensive sectors like hospitality. The new rules could severely impact their cash flow and operational efficiency.

- Property Transactions: Cash transactions are still common in property dealings, even if decreasing. The new rules could complicate property purchases and sales for those choosing to utilize cash.

- Everyday Expenses: Although unlikely to trigger the penalty, individuals making several large cash withdrawals for legitimate purposes, such as home renovations or significant purchases, could face unnecessary scrutiny.

HMRC's Response and Public Reaction

The HMRC has stated that the 25% penalty is a deterrent aimed at discouraging illegal activity, and that only those suspected of tax evasion will be targeted. However, the vague nature of the announcement has led to widespread criticism. Many are concerned about:

- Erosion of Privacy: Critics argue that the new rules represent an unwarranted intrusion into personal finances and a significant erosion of privacy rights.

- Disproportionate Impact: Concerns exist that the new regulations will disproportionately affect vulnerable individuals and small businesses already struggling with the cost of living crisis.

- Lack of Clarity: The absence of detailed guidance on what constitutes a "large" cash withdrawal is causing significant anxiety and uncertainty.

What Should UK Households Do?

Given the current uncertainty, it is advisable to:

- Keep Detailed Records: Maintain meticulous records of all financial transactions, especially large cash withdrawals, to demonstrate the legitimacy of your activities if questioned.

- Seek Professional Advice: If you are concerned about the implications of the new rules for your business or personal finances, consult with a financial advisor or accountant.

- Stay Informed: Keep abreast of any further announcements or guidance from HMRC regarding the new regulations.

The new HMRC crackdown on cash withdrawals represents a significant shift in the UK's approach to tax enforcement. While the aim of tackling tax evasion is understandable, the lack of clarity and potential for disproportionate impact have understandably fueled public anger and uncertainty. Only time will tell the true consequences of these new regulations and whether they achieve their intended objectives without causing undue hardship for law-abiding citizens.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 25% Penalty For Cash Withdrawals: New HMRC Crackdown On UK Households. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mothers Day 2025 Best Fast Food Brunch And Dining Deals

May 10, 2025

Mothers Day 2025 Best Fast Food Brunch And Dining Deals

May 10, 2025 -

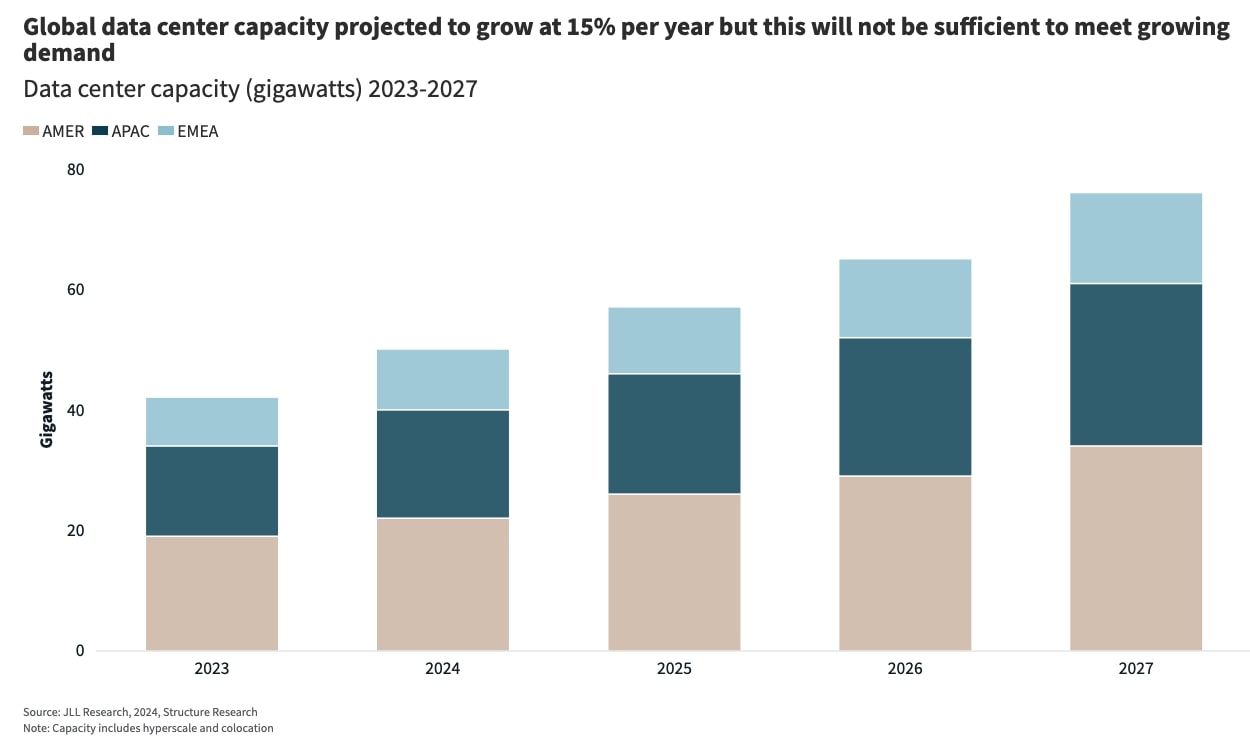

The Future Of Ai Data Centers Growth Trends Despite Amazon And Microsoft Changes

May 10, 2025

The Future Of Ai Data Centers Growth Trends Despite Amazon And Microsoft Changes

May 10, 2025 -

Automated Malware Removal Security Researchers Develop Vaccine Like Solution

May 10, 2025

Automated Malware Removal Security Researchers Develop Vaccine Like Solution

May 10, 2025 -

Nez Balelos Commentary On The Ohtani Deal A 700 Million Success Story

May 10, 2025

Nez Balelos Commentary On The Ohtani Deal A 700 Million Success Story

May 10, 2025 -

Conceicaos Focus Milans Bologna Victory And The Road To The Final

May 10, 2025

Conceicaos Focus Milans Bologna Victory And The Road To The Final

May 10, 2025

Latest Posts

-

Westbrooks Impact Renck Weighs In On His Role With The Denver Nuggets

May 11, 2025

Westbrooks Impact Renck Weighs In On His Role With The Denver Nuggets

May 11, 2025 -

Wnba Preseason Roundup Notable Performances By Plum And Griner

May 11, 2025

Wnba Preseason Roundup Notable Performances By Plum And Griner

May 11, 2025 -

Modi Meets With Indian Armed Forces Chiefs Amid Pakistan Tensions

May 11, 2025

Modi Meets With Indian Armed Forces Chiefs Amid Pakistan Tensions

May 11, 2025 -

Labour Mps Revolt Starmer Faces Backlash Over Welfare Plans

May 11, 2025

Labour Mps Revolt Starmer Faces Backlash Over Welfare Plans

May 11, 2025 -

Muncy Weighs In Dodgers Potential Arenado Acquisition

May 11, 2025

Muncy Weighs In Dodgers Potential Arenado Acquisition

May 11, 2025