3% Oil Price Hike: Europe, China Demand Soars, US Output Falls

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

3% Oil Price Hike: Europe, China Demand Soars, US Output Falls

Global oil prices surged by 3% today, driven by a dramatic increase in demand from Europe and China, coupled with a concerning decline in US oil production. This significant jump marks a volatile shift in the global energy market, sending ripples through economies worldwide and sparking concerns about inflation and future energy security.

The price spike comes as a surprise to many analysts who had predicted a more stable market. Several factors are contributing to this unexpected surge:

Europe's Energy Crisis Fuels Demand:

The ongoing energy crisis in Europe, exacerbated by the ongoing conflict in Ukraine and reduced Russian gas supplies, has forced many nations to rely more heavily on oil for heating and electricity generation. This increased reliance, coupled with a colder-than-expected winter, has pushed European oil demand to record highs. This represents a significant shift in the energy landscape and underscores Europe's vulnerability to geopolitical instability. Experts predict that unless alternative energy sources are developed rapidly, Europe's dependence on oil will only increase, potentially further impacting global prices.

China's Reopening Boosts Consumption:

China's recent reopening after strict COVID-19 lockdowns has unleashed a wave of pent-up demand across various sectors, including transportation and manufacturing. This renewed economic activity is significantly impacting global oil consumption, with China's demand for crude oil rising sharply. Analysts believe that continued economic growth in China will put further upward pressure on oil prices in the coming months. The implications of this increased demand are far-reaching, impacting not only oil prices but also global supply chains and inflation.

US Production Lags Behind:

Conversely, US oil production has failed to keep pace with the soaring global demand. Several factors are contributing to this shortfall, including:

- Reduced investment: Uncertainty surrounding future energy policies and fluctuating prices have led to a decrease in investment in new oil exploration and production.

- Labor shortages: The oil and gas industry is facing a significant labor shortage, impacting production capacity.

- Pipeline constraints: Limited pipeline capacity in certain regions is hindering the transportation of oil to refineries and consumers.

This combination of factors is exacerbating the global supply-demand imbalance, directly impacting oil prices.

What Does This Mean for Consumers?

The 3% oil price hike is likely to translate into higher prices for gasoline, heating oil, and other petroleum-based products. This could further fuel inflationary pressures globally, impacting consumers' purchasing power and potentially slowing economic growth. Governments are likely to face increasing pressure to implement measures to mitigate the impact of rising oil prices on their citizens.

Looking Ahead:

The current situation highlights the interconnectedness of the global energy market and the significant impact of geopolitical events and economic policies on oil prices. While the short-term outlook remains uncertain, experts urge a focus on diversifying energy sources, investing in renewable energy technologies, and improving energy efficiency to reduce dependence on volatile oil markets. The future stability of the global energy market hinges on addressing these critical issues proactively. The coming weeks and months will be crucial in determining the long-term consequences of this recent price surge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 3% Oil Price Hike: Europe, China Demand Soars, US Output Falls. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Surprisingly Good High Quality Items On A Shoestring Budget

May 07, 2025

Surprisingly Good High Quality Items On A Shoestring Budget

May 07, 2025 -

Di Vincenzos Departure Why The Warriors Lost A Key Sharpshooter

May 07, 2025

Di Vincenzos Departure Why The Warriors Lost A Key Sharpshooter

May 07, 2025 -

Janelle Browns Daughter Speaks Out Garrisons Planned Move To North Carolina

May 07, 2025

Janelle Browns Daughter Speaks Out Garrisons Planned Move To North Carolina

May 07, 2025 -

Denver Nuggets Playoff Hopes A Thin Flawed Yet Dangerous Team

May 07, 2025

Denver Nuggets Playoff Hopes A Thin Flawed Yet Dangerous Team

May 07, 2025 -

Full Game Recap Denver Nuggets Vs Oklahoma City Thunder May 5 2025

May 07, 2025

Full Game Recap Denver Nuggets Vs Oklahoma City Thunder May 5 2025

May 07, 2025

Latest Posts

-

Cadillac Celestiq First Drive Is The 360 000 Price Tag Justified

May 08, 2025

Cadillac Celestiq First Drive Is The 360 000 Price Tag Justified

May 08, 2025 -

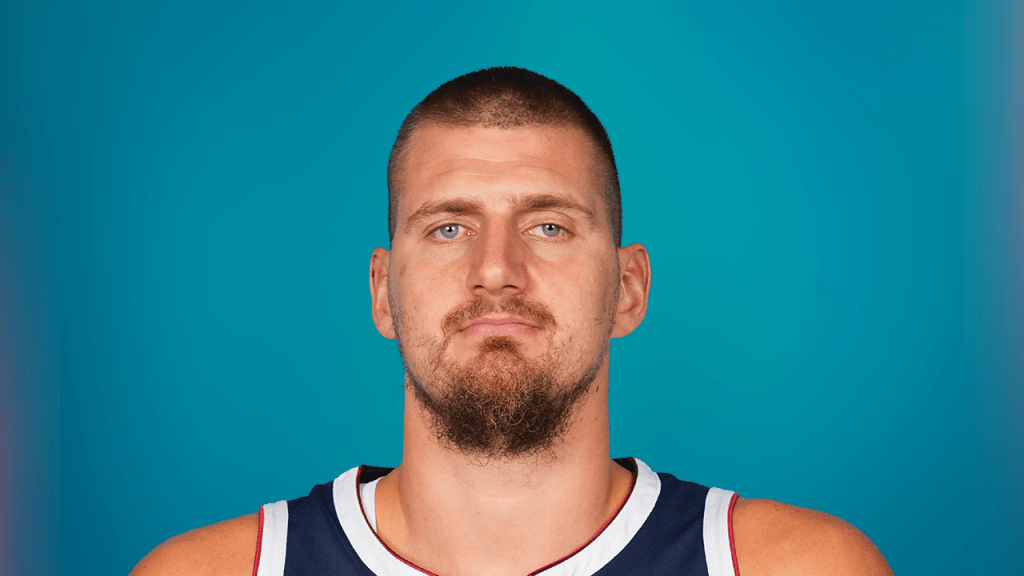

Free Throw Merchant Jokics Amusing Response To Criticisms From Fans

May 08, 2025

Free Throw Merchant Jokics Amusing Response To Criticisms From Fans

May 08, 2025 -

Modular Mini Pc Falls Short Assessing Value And Competitiveness

May 08, 2025

Modular Mini Pc Falls Short Assessing Value And Competitiveness

May 08, 2025 -

Chuwi Minibook X 10 5 Inch Convertible Laptop Under 1kg With 512 Gb Ssd

May 08, 2025

Chuwi Minibook X 10 5 Inch Convertible Laptop Under 1kg With 512 Gb Ssd

May 08, 2025 -

Dont Tax Bluey The Fight Against Us Film Tariffs Heats Up

May 08, 2025

Dont Tax Bluey The Fight Against Us Film Tariffs Heats Up

May 08, 2025