3% Oil Price Jump: Rising Global Demand Outweighs US Production Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

3% Oil Price Jump: Soaring Global Demand Outpaces US Production Dip

Oil prices surged by 3% today, reaching their highest point in several weeks, driven by a significant increase in global demand that's outstripping the recent decline in US oil production. This unexpected jump has sent ripples through the energy markets and sparked concerns about potential inflationary pressures. Analysts are closely watching this development, predicting further volatility in the coming months.

What Fueled the Surge?

The primary catalyst behind this significant price increase is the robust growth in global oil demand. Several factors are contributing to this surge:

- Strong Economic Recovery in Asia: China's post-pandemic economic rebound is a major driver, with increased industrial activity and transportation fueling a significant rise in oil consumption. Similar growth patterns are observed across other Asian economies.

- Increased Travel Demand: Global travel is experiencing a significant resurgence, particularly air travel, boosting jet fuel demand and further contributing to the overall increase in oil consumption.

- Geopolitical Uncertainty: Ongoing geopolitical instability in several oil-producing regions continues to create uncertainty and supply concerns, pushing prices higher. Market participants are factoring in potential supply disruptions.

US Production Decline: A Contributing Factor

While global demand is the primary driver, the recent decline in US oil production has exacerbated the situation. Several factors are contributing to this decrease:

- Reduced Investment: Lower profitability in recent years has led to reduced investment in new oil exploration and production in the US.

- Operational Challenges: Some producers are facing challenges in maintaining production levels due to labor shortages and logistical issues.

- Regulatory Hurdles: Environmental regulations and permitting processes continue to pose challenges for some US oil producers.

Market Implications and Future Outlook

This 3% jump in oil prices has significant implications for various sectors, including transportation, manufacturing, and inflation. Higher energy costs could lead to increased prices for goods and services, potentially impacting consumers.

Experts predict continued price volatility in the short term. The interplay between global demand and US production will continue to be a key factor determining future oil prices. Any unforeseen geopolitical events or further disruptions to supply chains could also lead to further price increases. Investors are advised to closely monitor the situation and adjust their portfolios accordingly.

Key Takeaways:

- Global oil demand is surging, driven primarily by strong economic growth in Asia and increased travel.

- The recent decline in US oil production has amplified the impact of rising global demand.

- This price jump has significant implications for inflation and various sectors of the economy.

- Market volatility is expected to continue in the near future.

Related Keywords: oil price, crude oil, energy prices, global demand, US oil production, inflation, geopolitical risk, energy market, commodity prices, oil supply, economic recovery, China economy, travel demand, jet fuel.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 3% Oil Price Jump: Rising Global Demand Outweighs US Production Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

David Fifita Shopping Around Which Nrl Team Will Secure The Titans Star

May 07, 2025

David Fifita Shopping Around Which Nrl Team Will Secure The Titans Star

May 07, 2025 -

David Beckham On Lamine Yamal A Rising Star At Barcelona

May 07, 2025

David Beckham On Lamine Yamal A Rising Star At Barcelona

May 07, 2025 -

Xrp Price Slump In May 2025 Five Potential Causes And Market Analysis

May 07, 2025

Xrp Price Slump In May 2025 Five Potential Causes And Market Analysis

May 07, 2025 -

Flying Without A Real Id Updated Tsa Rules And Requirements For Air Travel

May 07, 2025

Flying Without A Real Id Updated Tsa Rules And Requirements For Air Travel

May 07, 2025 -

Tuesday May 6th Nyt Mini Crossword Clues And Answers

May 07, 2025

Tuesday May 6th Nyt Mini Crossword Clues And Answers

May 07, 2025

Latest Posts

-

Stars Clinch Game 7 Plus Round 1 Review Join Our Hockey Playoff Chat

May 08, 2025

Stars Clinch Game 7 Plus Round 1 Review Join Our Hockey Playoff Chat

May 08, 2025 -

Record Breaking Stunt 71 Year Old In Final Destination Bloodlines

May 08, 2025

Record Breaking Stunt 71 Year Old In Final Destination Bloodlines

May 08, 2025 -

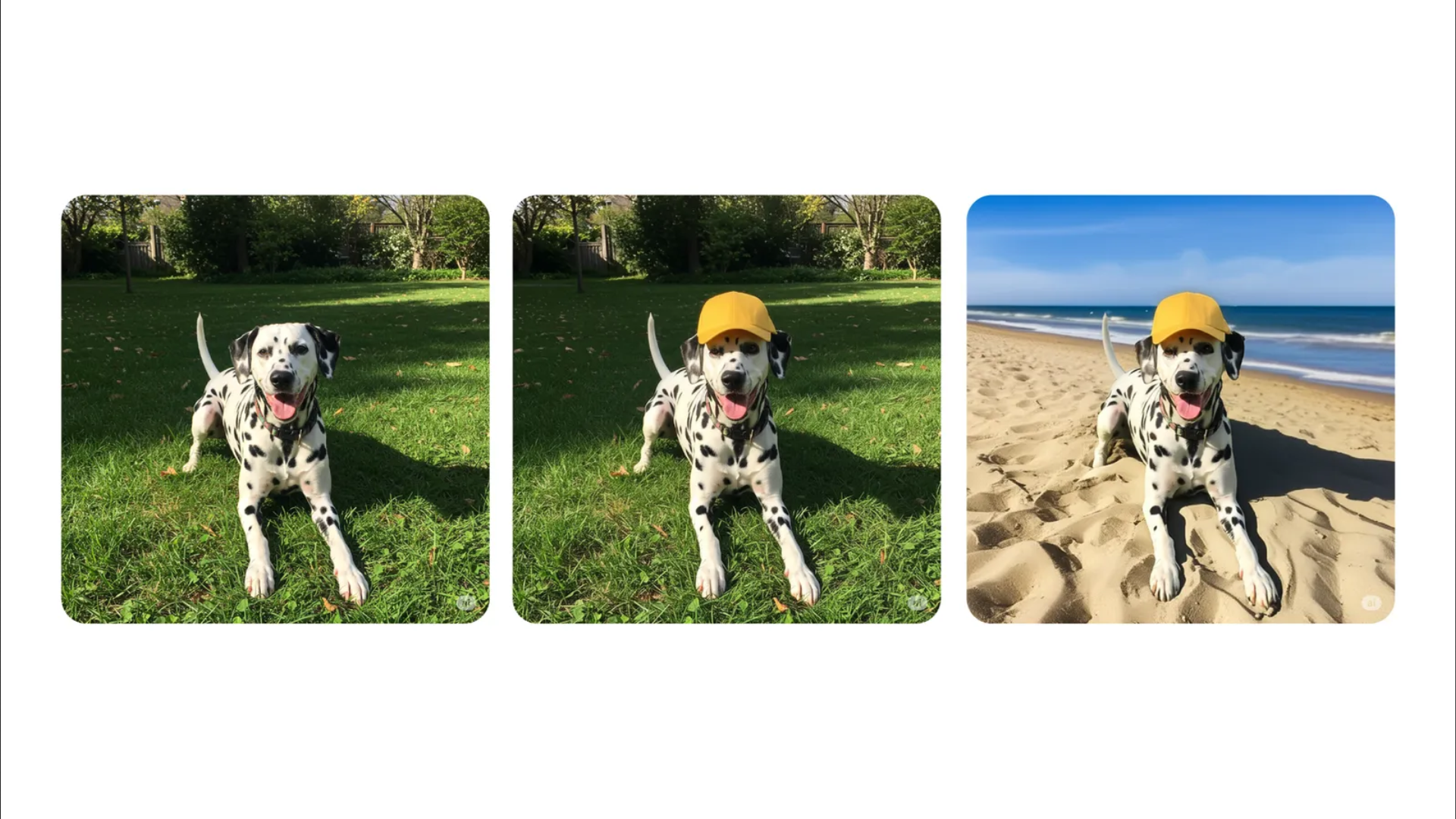

Enhanced Image Editing Capabilities Now Available In Gemini

May 08, 2025

Enhanced Image Editing Capabilities Now Available In Gemini

May 08, 2025 -

Five Victims Of Revenge Tattle Aali Gripped By Violence

May 08, 2025

Five Victims Of Revenge Tattle Aali Gripped By Violence

May 08, 2025 -

Laos Monsoon Season Urgent Travel Warnings And Safety Advice

May 08, 2025

Laos Monsoon Season Urgent Travel Warnings And Safety Advice

May 08, 2025