3% Oil Price Jump: Stronger Demand From Europe And China Outweighs US Output Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

3% Oil Price Jump: Stronger Demand from Europe and China Outweighs US Output Decline

Oil prices surged by 3% on Tuesday, reaching their highest point in several months, fueled by unexpectedly strong demand from Europe and China. This significant jump comes despite a reported decline in US oil production, highlighting a complex interplay of global economic forces shaping the energy market. The price increase signals a potentially bullish outlook for the oil industry, prompting speculation about future price trends and the impact on global economies.

Stronger-Than-Expected Demand in Key Markets

The primary driver behind the oil price surge is the robust demand from two of the world's largest oil consumers: Europe and China. Europe's energy needs have intensified following the ongoing conflict in Ukraine and subsequent sanctions on Russian energy supplies. This has forced European nations to seek alternative energy sources, leading to increased demand for oil from other global producers.

Simultaneously, China's post-pandemic economic recovery has fueled a significant increase in oil consumption. As the Chinese economy rebounds, industrial activity and transportation sectors are consuming more oil, contributing substantially to the global demand surge. This unexpected boost in demand from both regions has significantly outweighed the impact of lower US oil output.

US Output Decline: A Balancing Factor

While the increase in demand from Europe and China fueled the price jump, a decline in US oil production acted as a counterbalancing factor. Although this decline contributed to the overall tightness in the global oil supply, its impact was dwarfed by the surge in demand from other regions. This suggests that current global oil supply may not be sufficient to meet the ever-growing demand, particularly if the economic recovery in China continues at its current pace.

Impact on Global Economies and Future Outlook

The 3% jump in oil prices will have a significant impact on global economies. Higher oil prices can lead to increased inflation, affecting consumer spending and overall economic growth. Industries heavily reliant on oil, such as transportation and manufacturing, will face increased production costs, potentially leading to higher prices for goods and services.

However, the oil price increase also presents an opportunity for oil-producing countries and companies. Higher prices translate to increased revenues, potentially stimulating further investment in the oil and gas sector. The long-term outlook for oil prices remains uncertain, dependent on several factors, including the ongoing geopolitical situation, the pace of economic recovery in major economies, and future investment decisions in the energy sector.

Key Takeaways:

- Demand surge: Increased oil demand from Europe and China is the primary driver of the 3% price jump.

- US production decline: A reduction in US oil output contributed to tighter supply, but its impact was overshadowed by increased demand.

- Global economic impact: Higher oil prices will likely lead to increased inflation and affect global economic growth.

- Investment implications: The price increase presents an opportunity for oil-producing nations and companies to increase investments.

- Uncertainty remains: Future oil prices will depend on various factors, including geopolitical stability and global economic conditions.

This significant price increase underscores the complex and interconnected nature of the global energy market. Experts will closely monitor the situation, analyzing the interplay between supply, demand, and geopolitical factors to predict future price trends and their broader economic consequences. The coming weeks and months will be crucial in determining the long-term impact of this sudden oil price surge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 3% Oil Price Jump: Stronger Demand From Europe And China Outweighs US Output Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Follow The 2025 Ncaa Womens Lacrosse Championship Bracket Schedule And Updated Results

May 07, 2025

Follow The 2025 Ncaa Womens Lacrosse Championship Bracket Schedule And Updated Results

May 07, 2025 -

The Karate Kid Exploring The Enduring Legacy Of A Martial Arts Classic

May 07, 2025

The Karate Kid Exploring The Enduring Legacy Of A Martial Arts Classic

May 07, 2025 -

Game 1 Thriller Knicks Erase 20 Point Deficit Defeat Celtics In Overtime

May 07, 2025

Game 1 Thriller Knicks Erase 20 Point Deficit Defeat Celtics In Overtime

May 07, 2025 -

Nyt Wordle May 5th Solution And Helpful Hints For Puzzle 1416

May 07, 2025

Nyt Wordle May 5th Solution And Helpful Hints For Puzzle 1416

May 07, 2025 -

Full News Archive Last Page 6221 Of 6221

May 07, 2025

Full News Archive Last Page 6221 Of 6221

May 07, 2025

Latest Posts

-

Leaked 35 Unit Amd Epyc 4005 Mini Pc Racks From Major Us Vendor

May 08, 2025

Leaked 35 Unit Amd Epyc 4005 Mini Pc Racks From Major Us Vendor

May 08, 2025 -

Mark Daigneaults Strategic Use Of Fouls And The Impact On 3 Point Shooting

May 08, 2025

Mark Daigneaults Strategic Use Of Fouls And The Impact On 3 Point Shooting

May 08, 2025 -

Shadow Force A Look At Kerry Washingtons New Movie Role

May 08, 2025

Shadow Force A Look At Kerry Washingtons New Movie Role

May 08, 2025 -

From Teen Idol To Cult Favorite Josh Hartnetts Risky New Film

May 08, 2025

From Teen Idol To Cult Favorite Josh Hartnetts Risky New Film

May 08, 2025 -

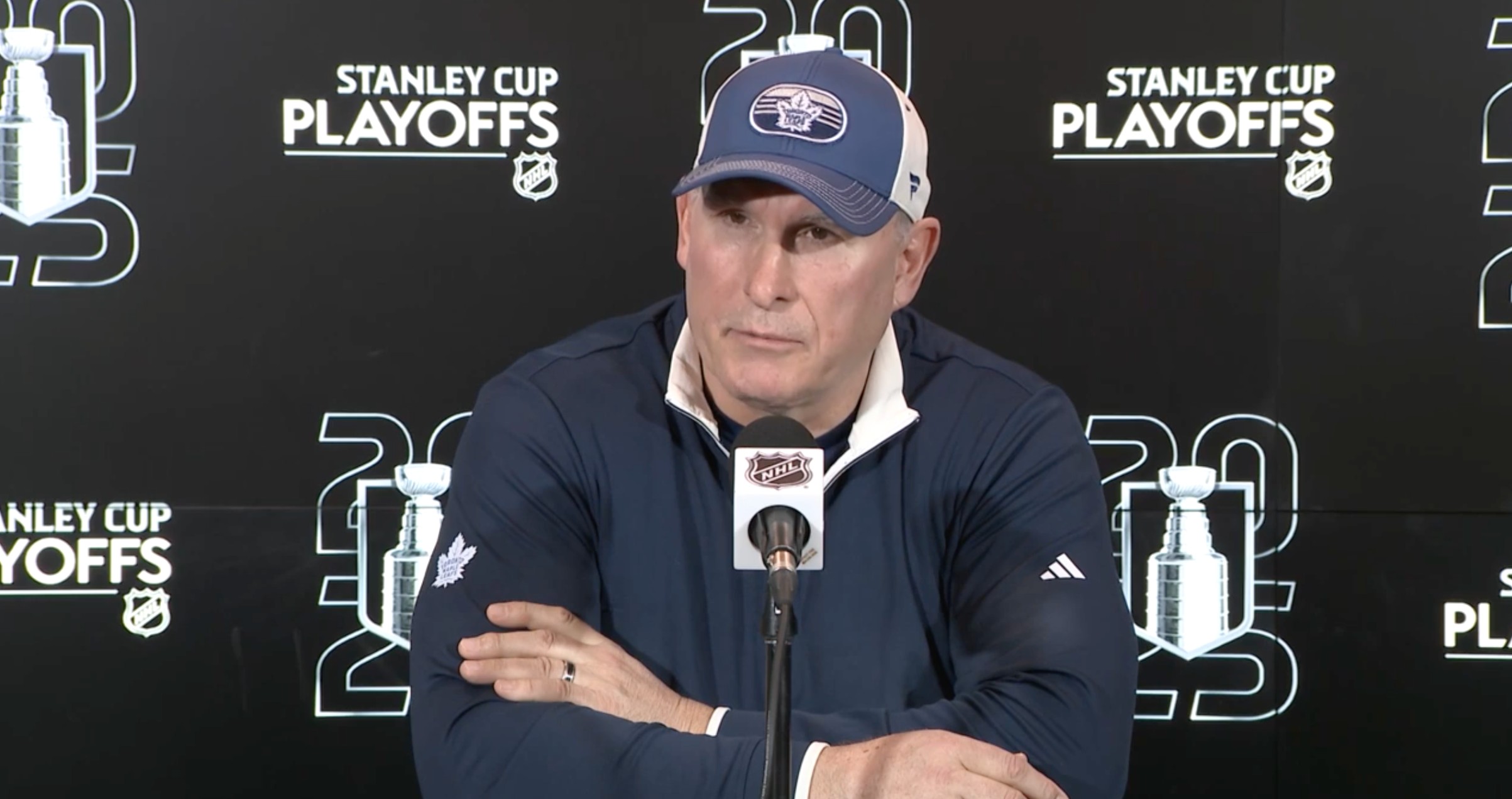

Berube Defies Panthers Favoritism We Re A Good Team Too

May 08, 2025

Berube Defies Panthers Favoritism We Re A Good Team Too

May 08, 2025