3 Tech Stocks Plummeting Due To Tariffs: A Buying Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

3 Tech Stocks Plummeting Due to Tariffs: A Buying Opportunity?

The escalating trade war and newly implemented tariffs are sending shockwaves through the tech sector, with three prominent players – Qualcomm, Nvidia, and Micron Technology – experiencing significant stock price drops. While the immediate impact is undeniably negative, savvy investors are questioning whether this presents a unique buying opportunity. Let's delve into the specifics and assess the potential risks and rewards.

The Tariff Tempest: A Tech Sector Storm

The recent imposition of tariffs on imported goods, particularly from China, has hit the tech industry hard. These tariffs increase the cost of manufacturing and components, squeezing profit margins and impacting the bottom line for numerous companies. Qualcomm, a major supplier of mobile phone chips, Nvidia, a leader in graphics processing units (GPUs) used in everything from gaming to AI, and Micron Technology, a key player in the memory chip market, are among the hardest hit. Their reliance on global supply chains and significant manufacturing operations in tariff-affected regions makes them particularly vulnerable.

Qualcomm: Navigating the 5G Maze

Qualcomm, already facing competitive pressures in the 5G smartphone chip market, is now grappling with increased costs due to tariffs. The added expenses could hinder their ability to compete aggressively on price, potentially impacting market share. However, Qualcomm's dominance in the mobile chipset sector and its ongoing investments in 5G technology might make it a resilient long-term player. The current dip could be a chance to acquire shares at a discounted price, but investors should carefully consider the ongoing competitive landscape.

Nvidia: Headwinds in Gaming and AI

Nvidia, known for its powerful GPUs crucial for the booming gaming and artificial intelligence industries, is also feeling the pinch. Tariffs on imported components are increasing production costs, impacting profitability. The demand for GPUs remains strong, particularly in the data center and AI sectors, suggesting that Nvidia’s long-term prospects remain positive. Yet, the short-term impact of tariffs should not be underestimated. A strategic entry point for investors could be emerging, but thorough due diligence is crucial.

Micron Technology: Memory Market Volatility

Micron Technology, a significant producer of DRAM and NAND flash memory, is particularly exposed to the fluctuations in the global memory market. Tariffs add another layer of complexity, impacting profitability and potentially affecting investment decisions. While the memory market is cyclical, with periods of boom and bust, Micron's technological leadership and strategic partnerships could position it for future growth. The current decline might offer an attractive entry point for long-term investors who are comfortable with the inherent volatility of the memory chip sector.

Is This a Buying Opportunity? A Cautious Approach

The current market downturn presents a complex scenario. While the plummeting stock prices of Qualcomm, Nvidia, and Micron Technology might appear tempting to bargain hunters, investors must tread cautiously.

- Consider the long-term perspective: Are you comfortable with the potential for further short-term volatility?

- Assess fundamental strength: Evaluate each company's financials, competitive positioning, and long-term growth prospects.

- Diversify your portfolio: Don't put all your eggs in one basket. Spread your investments across different sectors to mitigate risk.

- Consult a financial advisor: Seek professional advice before making any significant investment decisions.

The impact of tariffs on these tech giants is undeniable, but the long-term consequences remain uncertain. The current situation presents both risks and opportunities. A well-informed investment strategy, based on thorough research and a clear understanding of the market dynamics, is essential for navigating this volatile landscape. Only time will tell whether this dip truly represents a compelling buying opportunity.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 3 Tech Stocks Plummeting Due To Tariffs: A Buying Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Netflixs Future Navigating The Challenges Of Trump Era Tariffs

Apr 08, 2025

Netflixs Future Navigating The Challenges Of Trump Era Tariffs

Apr 08, 2025 -

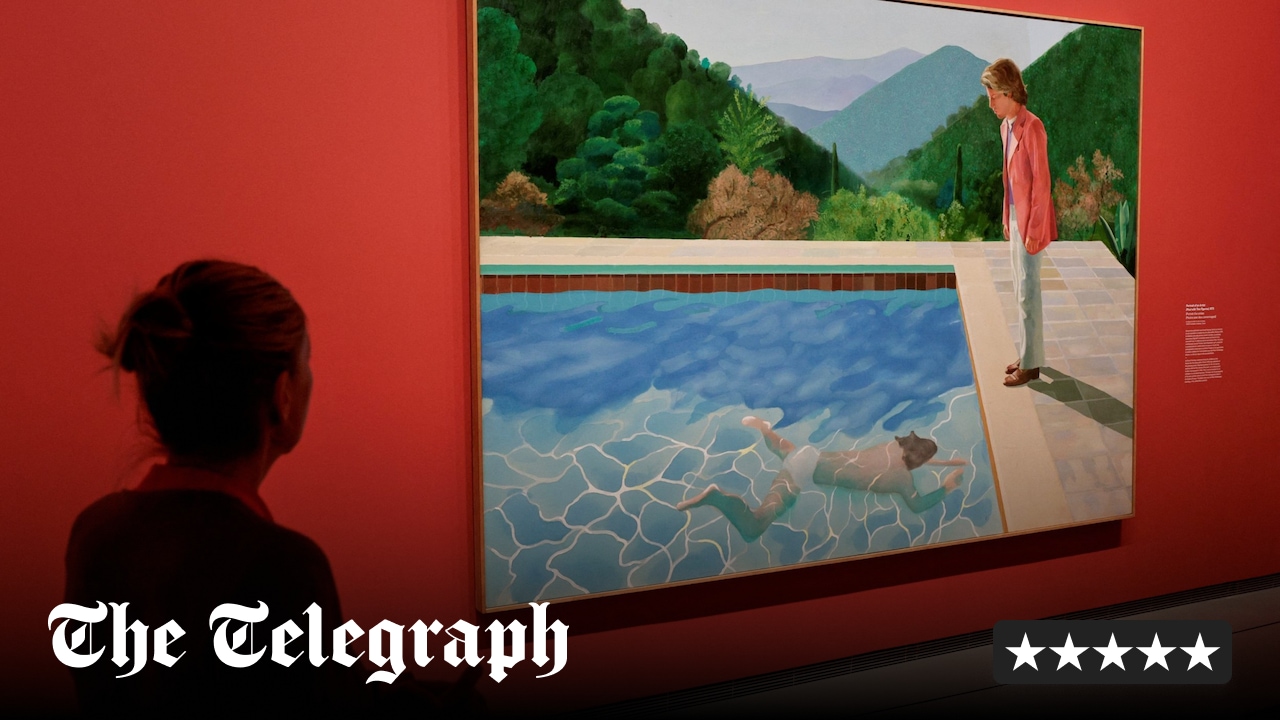

David Hockneys Legacy The Fondation Louis Vuitton Show

Apr 08, 2025

David Hockneys Legacy The Fondation Louis Vuitton Show

Apr 08, 2025 -

Global Economy At Risk Pm Wong On The Dangers Of Deteriorating Us China Relations

Apr 08, 2025

Global Economy At Risk Pm Wong On The Dangers Of Deteriorating Us China Relations

Apr 08, 2025 -

Sydney Airport Emergency Cargo Plane Makes Unexpected Landing

Apr 08, 2025

Sydney Airport Emergency Cargo Plane Makes Unexpected Landing

Apr 08, 2025 -

Tariffs Hit Amazon Hard Should Investors Buy The Dip In Amzn Stock

Apr 08, 2025

Tariffs Hit Amazon Hard Should Investors Buy The Dip In Amzn Stock

Apr 08, 2025