3 Tech Stocks Plunging On Tariff News: Is Now The Time To Buy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

3 Tech Stocks Plunging on Tariff News: Is Now the Time to Buy?

The tech sector is reeling, with three major players – Nvidia, Qualcomm, and AMD – experiencing significant stock drops following the latest announcements on increased tariffs. Investors are grappling with the implications of these trade wars and questioning whether this presents a unique buying opportunity or a sign of further trouble ahead. The volatility is undeniable, leaving many wondering: is this the dip to buy, or a prelude to a deeper fall?

The Tariff Tsunami Hits Tech Giants

The recent escalation of tariffs, particularly impacting components crucial to the tech industry, has sent shockwaves through the market. Nvidia, a leader in GPU technology heavily reliant on global supply chains, saw its stock plummet [insert percentage] following the news. Similarly, Qualcomm, a key player in mobile chipsets, experienced a [insert percentage] drop, reflecting concerns about increased production costs and potentially reduced demand. AMD, another prominent chip manufacturer, also suffered a significant blow, with its stock falling by [insert percentage].

This isn't just about short-term market fluctuations; it's about the long-term implications for these companies and the broader tech landscape. Increased costs could lead to higher prices for consumers, potentially dampening demand. Supply chain disruptions are also a major concern, potentially leading to product shortages and impacting the bottom line for these tech giants.

Analyzing the Plunge: Understanding the Risks

Several factors contribute to the current market uncertainty surrounding these tech stocks:

- Increased Production Costs: Tariffs directly increase the cost of manufacturing, impacting profitability and potentially forcing price hikes for consumers.

- Supply Chain Disruptions: The reliance on global supply chains makes these companies vulnerable to trade wars and potential disruptions. Delays and shortages could significantly impact production and sales.

- Reduced Consumer Demand: Higher prices due to tariffs could lead to reduced consumer demand, especially in a potentially slowing global economy.

- Geopolitical Uncertainty: The overall geopolitical climate adds another layer of uncertainty, making long-term investment decisions more challenging.

Is This a Buying Opportunity? A Cautious Approach

The sharp decline in these tech stocks has undoubtedly piqued the interest of bargain hunters. However, before jumping in, investors need to carefully consider the risks. While the current prices may seem attractive, the potential for further drops remains.

Factors to Consider Before Investing:

- Long-term Growth Potential: Despite the current challenges, these companies possess strong long-term growth potential driven by technological innovation and expanding market demand.

- Diversification: Diversifying your portfolio is crucial to mitigate risk. Don't put all your eggs in one basket, especially in a volatile market.

- Risk Tolerance: Only invest what you can afford to lose. The tech sector, while promising, is known for its volatility.

- Expert Advice: Consulting with a financial advisor is highly recommended before making significant investment decisions.

Conclusion: Navigating the Uncertain Waters

The recent tariff-induced plunge in Nvidia, Qualcomm, and AMD stocks presents a complex scenario for investors. While the potential for long-term growth remains, the immediate risks are significant. A thorough understanding of the market dynamics, coupled with a well-defined investment strategy and potentially professional guidance, is crucial before considering buying into these stocks at their current valuations. This is not a time for impulsive decisions; rather, a period for careful analysis and measured action. The future of these tech giants remains to be seen, but one thing is certain: navigating this turbulent market requires prudence and a long-term perspective.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 3 Tech Stocks Plunging On Tariff News: Is Now The Time To Buy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

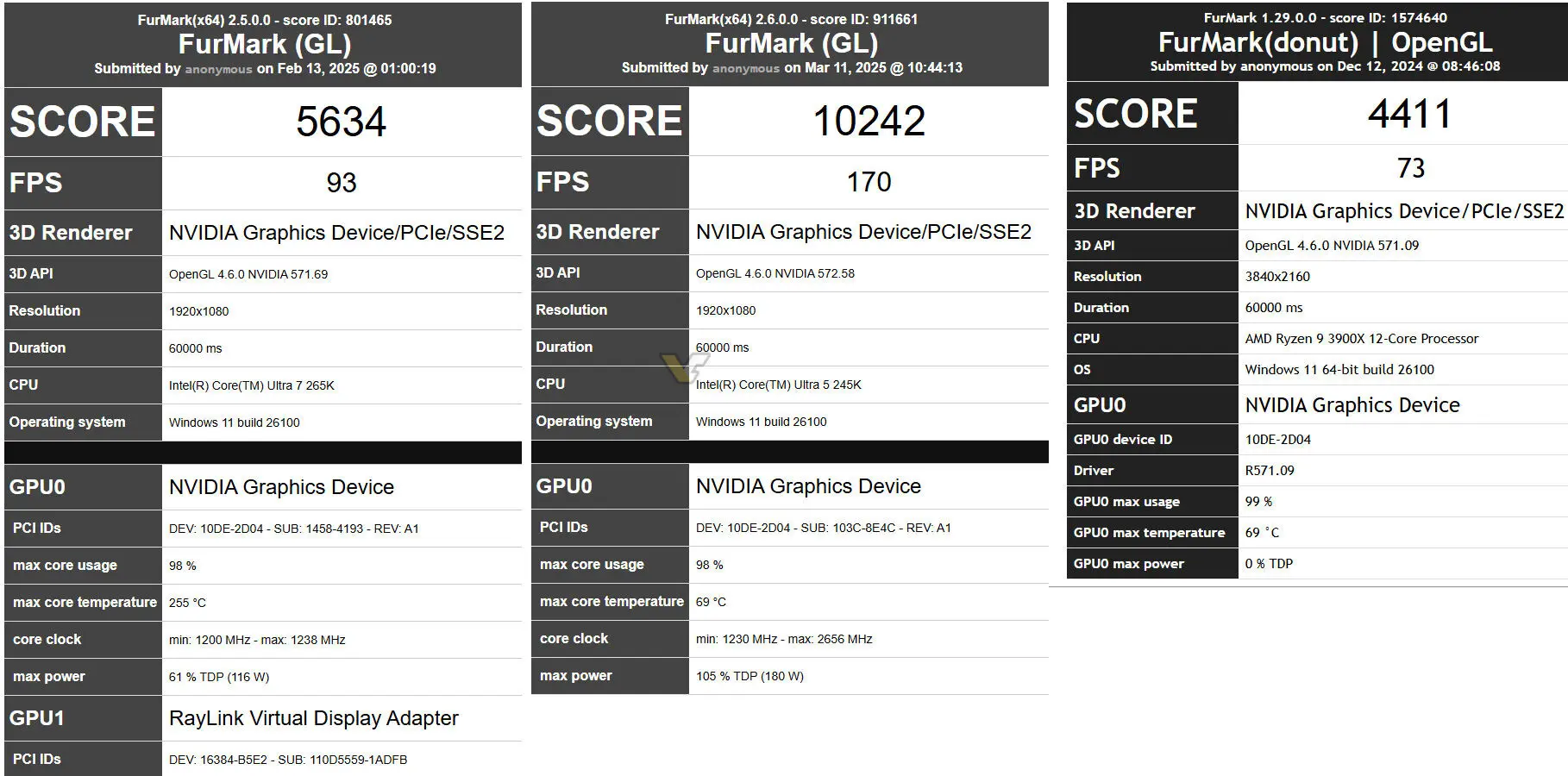

Nvidia Rtx 5060 Ti Fur Mark Benchmarks Reveal 180 W Tdp Performance

Apr 07, 2025

Nvidia Rtx 5060 Ti Fur Mark Benchmarks Reveal 180 W Tdp Performance

Apr 07, 2025 -

Myanmar Earthquake 3 471 Dead Rains Hinder Relief Efforts

Apr 07, 2025

Myanmar Earthquake 3 471 Dead Rains Hinder Relief Efforts

Apr 07, 2025 -

Indian Stock Market Downturn Deep Dive Into Todays Sensex And Nifty Fall

Apr 07, 2025

Indian Stock Market Downturn Deep Dive Into Todays Sensex And Nifty Fall

Apr 07, 2025 -

Knights Coach Sounds Alarm Over Offensive Woes

Apr 07, 2025

Knights Coach Sounds Alarm Over Offensive Woes

Apr 07, 2025 -

2025 Ram Mandir Surya Tilak Ceremony Date Time And Viewing Options

Apr 07, 2025

2025 Ram Mandir Surya Tilak Ceremony Date Time And Viewing Options

Apr 07, 2025