3 Tech Stocks To Buy Before The Next Bull Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

3 Tech Stocks to Buy Before the Next Bull Market

The tech sector has taken a beating lately, but seasoned investors know that market downturns often precede periods of explosive growth. While nobody can predict the market with certainty, several tech companies are showing signs of resilience and long-term potential, making them compelling buys before the next bull market. Are you ready to position yourself for substantial returns? Let's dive into three tech stocks poised for a comeback.

Identifying Promising Tech Stocks:

Predicting the next bull market is impossible, but identifying undervalued, growth-oriented companies is key to maximizing your investment potential. Our selection criteria focus on companies with:

- Strong fundamentals: Solid financial performance, robust revenue streams, and a clear path to future growth.

- Innovative technology: Companies at the forefront of technological advancements, offering solutions to significant market needs.

- Resilience to market fluctuations: Demonstrated ability to weather economic storms and maintain profitability.

1. Nvidia (NVDA): The Undisputed Leader in AI

Nvidia's dominance in the GPU market is undeniable, but its recent expansion into the burgeoning field of artificial intelligence (AI) has solidified its position as a long-term investment powerhouse. The demand for high-performance computing for AI applications, from data centers to autonomous vehicles, is skyrocketing, fueling Nvidia's impressive growth trajectory.

- Key Strengths: Market leadership in AI hardware, strong partnerships with major tech companies, and a robust pipeline of innovative products.

- Potential Risks: High valuation, dependence on the semiconductor industry, and competition from emerging players.

- Why Buy Now?: The AI revolution is only just beginning, and Nvidia is uniquely positioned to benefit significantly from this transformative technology. The current market correction presents a strategic opportunity to acquire shares at a potentially discounted price.

2. Microsoft (MSFT): A Tech Titan with a Cloud-First Strategy

Microsoft's transformation into a cloud-centric company, spearheaded by its Azure platform, has been nothing short of spectacular. Azure's growth continues to outpace competitors, demonstrating the strength of Microsoft's cloud infrastructure and its ability to adapt to the changing technological landscape. Furthermore, Microsoft's diverse portfolio, including Windows, Office 365, and gaming (Xbox), provides a safety net against sector-specific downturns.

- Key Strengths: Strong brand recognition, diversified revenue streams, dominant position in enterprise software, and a robust cloud platform.

- Potential Risks: Intense competition in the cloud computing market, regulatory scrutiny, and potential economic slowdown impacting enterprise spending.

- Why Buy Now?: Microsoft’s consistent performance and strategic focus on cloud computing make it a reliable investment, particularly as businesses increasingly rely on cloud-based solutions. The current market downturn offers a chance to buy into a proven winner at a potentially attractive price point.

3. Alphabet (GOOGL): The King of Search and Beyond

Alphabet, the parent company of Google, remains a dominant force in the digital advertising market and continues to innovate in areas such as AI, autonomous vehicles (Waymo), and life sciences (Verily). While facing challenges from increasing competition and regulatory pressures, Alphabet's vast resources and innovative spirit make it a compelling long-term investment.

- Key Strengths: Market leadership in search and digital advertising, extensive data resources, significant investments in cutting-edge technologies, and a highly skilled workforce.

- Potential Risks: Antitrust concerns, increasing competition, and dependence on digital advertising revenue.

- Why Buy Now?: Alphabet's diversification into various promising sectors and its continued dominance in the search market provide a buffer against potential risks. The current market climate provides an opportunity to acquire shares at a potentially lower valuation, allowing for higher future returns.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in the stock market involves risk, and you could lose money. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 3 Tech Stocks To Buy Before The Next Bull Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

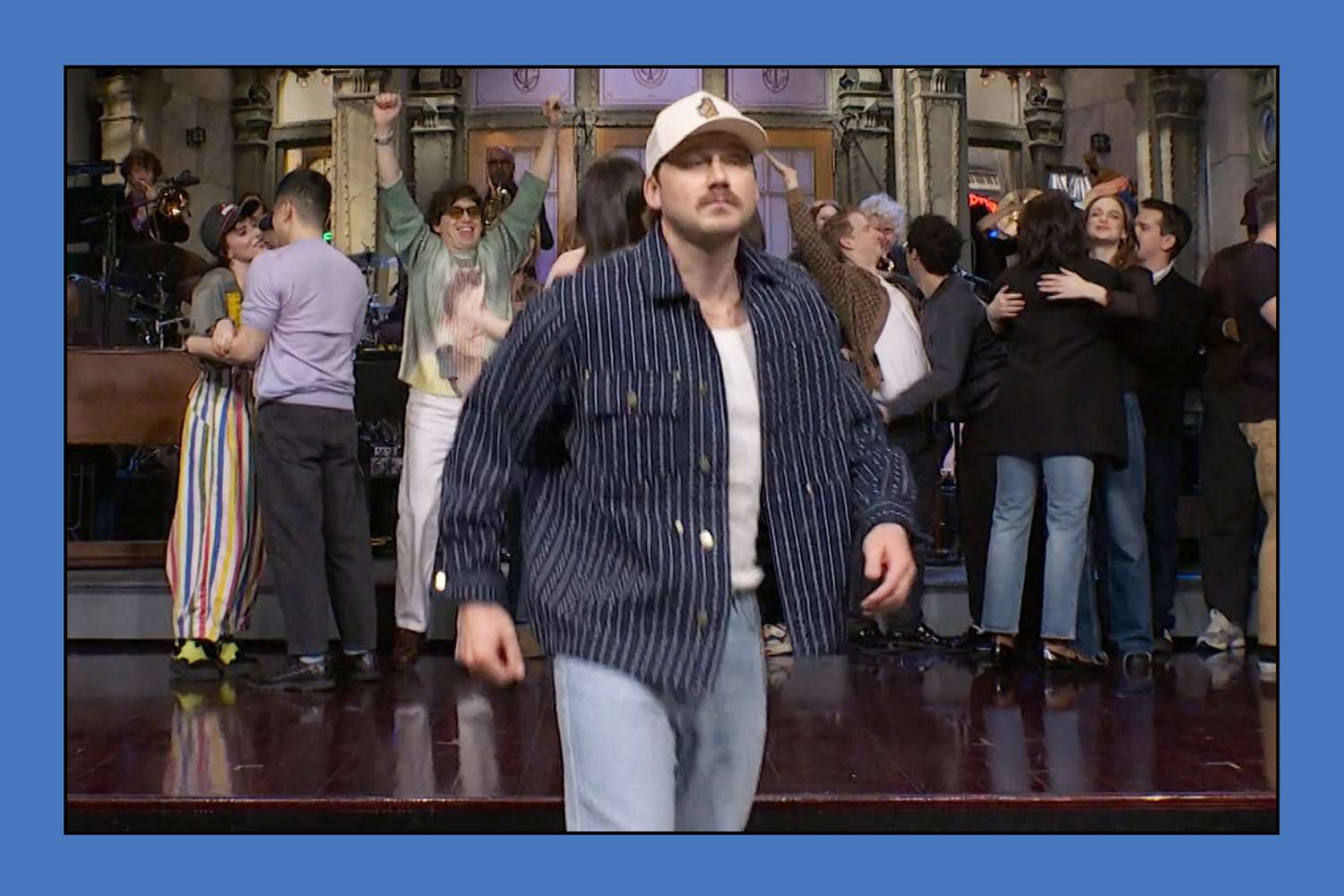

Morgan Wallen And Snl Controversy Explanation And Aftermath

Apr 07, 2025

Morgan Wallen And Snl Controversy Explanation And Aftermath

Apr 07, 2025 -

Three Promising Tech Stocks For The Next Bull Run

Apr 07, 2025

Three Promising Tech Stocks For The Next Bull Run

Apr 07, 2025 -

Dana Kaget Hari Ini Minggu 6 April 2025 Cara Dapat Saldo Gratis

Apr 07, 2025

Dana Kaget Hari Ini Minggu 6 April 2025 Cara Dapat Saldo Gratis

Apr 07, 2025 -

Major Coaching Change Announced For Bulldogs Athletic Program

Apr 07, 2025

Major Coaching Change Announced For Bulldogs Athletic Program

Apr 07, 2025 -

Boeing Starliners Risky Docking Examining The Close Call At The Iss

Apr 07, 2025

Boeing Starliners Risky Docking Examining The Close Call At The Iss

Apr 07, 2025