300K Chainlink (LINK) Inflows Fuel Concerns Of Price Drop Below $10

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

300K Chainlink (LINK) Inflows Fuel Concerns of Price Drop Below $10

A significant influx of Chainlink (LINK) tokens into centralized exchanges has sparked anxieties among investors, raising concerns about a potential price drop below the crucial $10 support level. The cryptocurrency market, known for its volatility, is once again under scrutiny as this substantial movement fuels speculation about the future of LINK.

Over the past week, approximately 300,000 LINK tokens have flowed into major exchanges, according to data from multiple on-chain analytics platforms. This significant increase in exchange reserves suggests that a considerable number of holders are either preparing to sell their LINK holdings or are responding to broader market trends. The implications for the LINK price are significant, especially considering its recent price action.

What's Driving the LINK Inflow?

Several factors could be contributing to this substantial influx of LINK tokens onto exchanges:

- Profit-Taking: After a period of relative stability, some investors might be looking to secure profits, capitalizing on any recent price increases before a potential correction.

- Market Sentiment: The overall bearish sentiment in the broader cryptocurrency market might be influencing LINK holders to move their tokens to exchanges, anticipating further price declines.

- Upcoming Events: Any upcoming events, such as major announcements or network upgrades, could be causing some investors to adjust their positions before uncertainty settles.

- Liquidity Needs: Some holders may need immediate liquidity for various reasons, forcing them to sell their LINK on exchanges.

Could LINK Dip Below $10?

The $10 price point represents a significant psychological support level for LINK. A breach below this level could trigger further selling pressure, potentially leading to a more substantial price drop. However, it's crucial to remember that market sentiment is fickle and many factors influence price.

Technical Analysis: Technical indicators provide mixed signals. While some suggest a potential downside, others point to potential support levels that could prevent a sharp decline. It's vital for investors to conduct their own thorough technical analysis before making any trading decisions.

Fundamental Analysis: The fundamental strength of the Chainlink network, its widespread adoption in the decentralized finance (DeFi) space, and its partnerships remain strong. This suggests that despite short-term price fluctuations, the long-term prospects for LINK could still be positive.

What Should Investors Do?

The situation calls for a cautious approach. Investors should:

- Conduct thorough research: Before making any decisions, carefully consider the factors contributing to the LINK inflow and assess your own risk tolerance.

- Diversify your portfolio: Diversification is crucial to mitigate risk. Don't put all your eggs in one basket.

- Monitor market trends: Keep a close eye on market developments and be prepared to adjust your strategy accordingly.

- Avoid emotional decision-making: Panic selling or impulsive buying can lead to significant losses. Make informed decisions based on sound analysis.

The influx of 300,000 LINK tokens onto exchanges is undoubtedly a cause for concern. While a price drop below $10 is a possibility, it's not a certainty. The situation warrants close monitoring, a level-headed approach, and a thorough understanding of the market dynamics before any investment decisions are made regarding Chainlink. This situation highlights the inherent volatility of the cryptocurrency market and underscores the importance of informed and careful trading.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 300K Chainlink (LINK) Inflows Fuel Concerns Of Price Drop Below $10. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wnba Draft Chicago Sky Coachs Opinion On Caitlin Clark

May 21, 2025

Wnba Draft Chicago Sky Coachs Opinion On Caitlin Clark

May 21, 2025 -

Nhl Playoffs Brind Amour On Floridas Undefeated Momentum

May 21, 2025

Nhl Playoffs Brind Amour On Floridas Undefeated Momentum

May 21, 2025 -

Teslas Autonomous Driving Robotics And Ai Robotaxi Optimus And Dojo 2

May 21, 2025

Teslas Autonomous Driving Robotics And Ai Robotaxi Optimus And Dojo 2

May 21, 2025 -

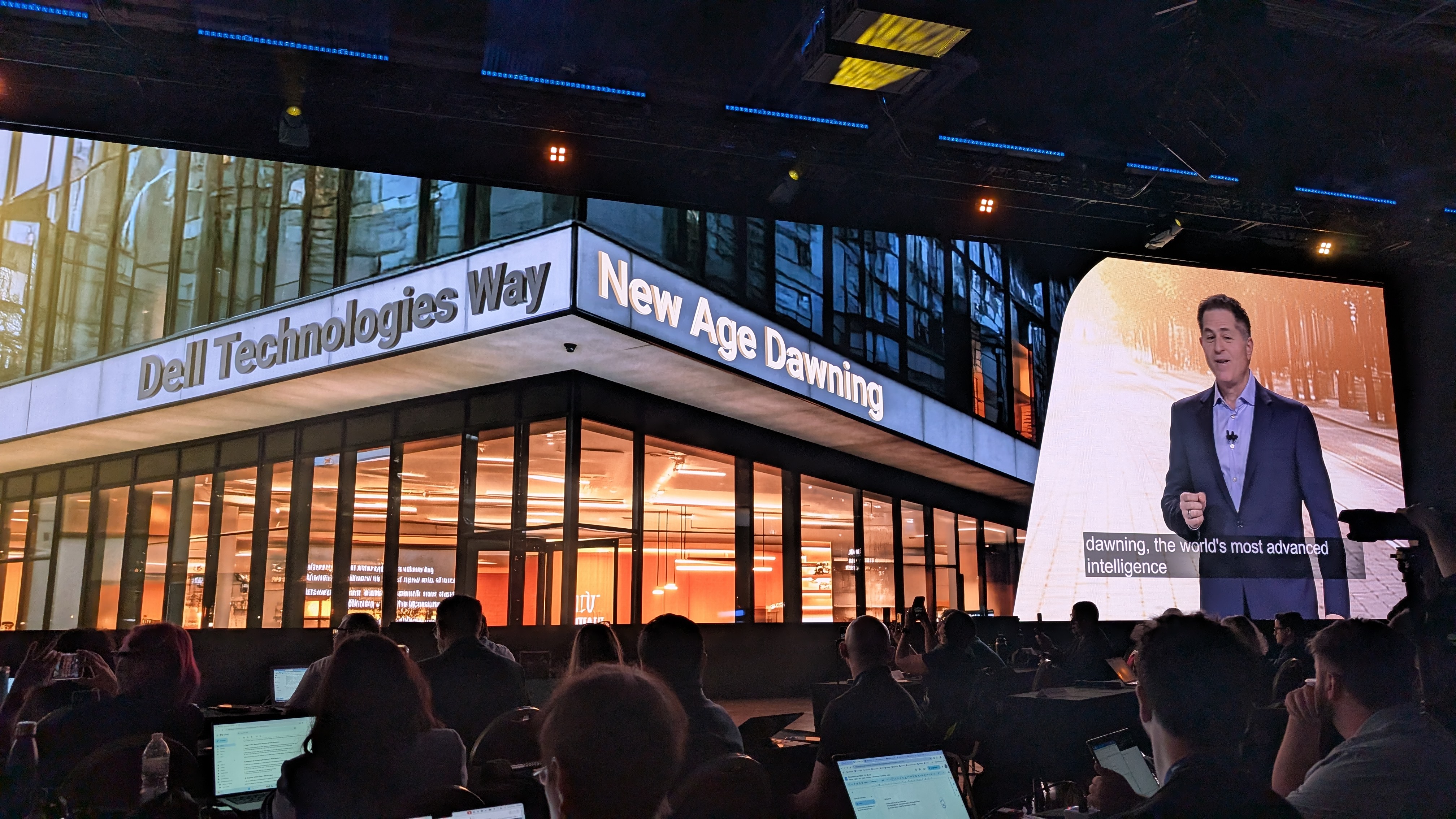

The New Electricity Michael Dells Vision For Ai And The Importance Of Innovation

May 21, 2025

The New Electricity Michael Dells Vision For Ai And The Importance Of Innovation

May 21, 2025 -

Netflix Drops Unexpected Hit A Thrilling New Competition Series

May 21, 2025

Netflix Drops Unexpected Hit A Thrilling New Competition Series

May 21, 2025