$330 Billion Crypto Rally: A US Regulatory Shift Sparks Market Recovery

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$330 Billion Crypto Rally: A US Regulatory Shift Sparks Market Recovery

The cryptocurrency market has experienced a dramatic surge, adding a staggering $330 billion to its total market capitalization in a matter of days. This significant recovery, pushing Bitcoin (BTC) above $30,000 and other major cryptos like Ethereum (ETH) experiencing substantial gains, is largely attributed to a perceived shift in the regulatory landscape in the United States. This unexpected upswing offers a glimmer of hope for investors who have weathered a turbulent period marked by regulatory uncertainty and high volatility.

Grayscale's Victory Fuels the Rally

A pivotal moment in this resurgence was the court ruling in favor of Grayscale Investments in their legal battle against the Securities and Exchange Commission (SEC). The court's decision to overturn the SEC's rejection of Grayscale's application to convert its Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF is widely seen as a major victory for the crypto industry. This landmark ruling significantly reduces regulatory hurdles for Bitcoin ETFs, potentially opening the floodgates for mainstream institutional investment. The anticipation of increased liquidity and accessibility fueled a rapid price increase across the board.

What Does This Mean for the Future of Crypto Regulation in the US?

While the Grayscale ruling is a positive development, it doesn't necessarily signal a complete regulatory overhaul. The SEC still has the option to appeal the decision, and the approval process for Bitcoin ETFs remains complex. However, the ruling sets a crucial precedent, suggesting a more favorable court interpretation of crypto assets than previously anticipated. This positive momentum has calmed investor fears and encouraged renewed confidence in the market.

Beyond Grayscale: Other Contributing Factors

The rally isn't solely reliant on the Grayscale victory. Several other factors have contributed to the positive market sentiment:

- BlackRock's ETF Application: BlackRock, the world's largest asset manager, filed its own application for a spot Bitcoin ETF shortly after the Grayscale ruling. This further strengthens the expectation that Bitcoin ETFs will soon become a reality.

- Improving Macroeconomic Conditions: A slight easing of inflation concerns and positive economic indicators have boosted investor risk appetite, leading to increased investment in riskier assets like cryptocurrencies.

- Increased Institutional Interest: The ongoing institutional adoption of cryptocurrencies, demonstrated by the continued interest from large financial institutions, contributes to the overall market stability and growth.

Navigating the Volatility: Cautious Optimism

While the recent rally is significant, investors should approach the market with cautious optimism. The cryptocurrency market remains inherently volatile, and future price movements could be influenced by a range of factors, including further regulatory developments, macroeconomic trends, and market sentiment.

The Road Ahead:

The $330 billion crypto rally signifies a potential turning point. The positive regulatory shift, combined with increased institutional interest and improving macroeconomic conditions, suggests a more positive outlook for the crypto market. However, continued vigilance and diversification remain crucial strategies for navigating the complexities and inherent volatility of this dynamic asset class. The coming months will be crucial in determining whether this rally marks the beginning of a sustained bull market or a temporary reprieve from the recent bear market. Keeping a close eye on regulatory developments and macroeconomic indicators will be essential for all investors.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $330 Billion Crypto Rally: A US Regulatory Shift Sparks Market Recovery. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Peter Diamandis And Mo Gawdat Discuss The Arrival Of Agi By 2025

Mar 04, 2025

Peter Diamandis And Mo Gawdat Discuss The Arrival Of Agi By 2025

Mar 04, 2025 -

Agora Info Money Cobre Ao Vivo A Reuniao Anual Da Berkshire Hathaway 2024

Mar 04, 2025

Agora Info Money Cobre Ao Vivo A Reuniao Anual Da Berkshire Hathaway 2024

Mar 04, 2025 -

Glasses Free 3 Ds Last Stand Lenovos Think Book 3 D Analyzed

Mar 04, 2025

Glasses Free 3 Ds Last Stand Lenovos Think Book 3 D Analyzed

Mar 04, 2025 -

Lloyds Halifax Nationwide Outage Is Antiquated Online Banking Infrastructure The Culprit

Mar 04, 2025

Lloyds Halifax Nationwide Outage Is Antiquated Online Banking Infrastructure The Culprit

Mar 04, 2025 -

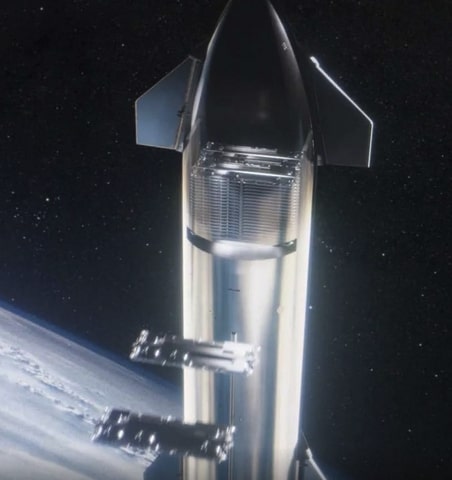

Space X Starlinks Milestone 5 Million Customers Next Gen V3 Satellites And Reusable Starship Launch

Mar 04, 2025

Space X Starlinks Milestone 5 Million Customers Next Gen V3 Satellites And Reusable Starship Launch

Mar 04, 2025