$357 Million In Crypto Losses: Analyzing April's 18 Hacks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>$357 Million in Crypto Losses: Analyzing April's 18 Hacks</h1>

The month of April 2024 witnessed a staggering $357 million in cryptocurrency losses due to 18 separate hacking incidents. This alarming figure highlights the persistent vulnerabilities within the crypto ecosystem and underscores the urgent need for enhanced security measures. The sheer scale of these breaches demands a closer look at the contributing factors and potential solutions.

<h2>A Month of Breaches: Examining the Attacks</h2>

April's crypto hacks weren't a single, catastrophic event; instead, they represented a series of smaller-scale attacks targeting various platforms and protocols. This distributed nature of the attacks makes identifying a single root cause challenging, suggesting a broader issue with overall security practices. The targets ranged from centralized exchanges to decentralized finance (DeFi) protocols, demonstrating the pervasiveness of the problem.

<h3>Types of Exploits:</h3>

- Smart Contract Vulnerabilities: A significant number of hacks exploited weaknesses in the smart contracts governing DeFi protocols. These vulnerabilities allowed attackers to drain funds, manipulate prices, or gain unauthorized access to user assets. This highlights the critical need for rigorous audits and security testing before deploying smart contracts.

- Phishing and Social Engineering: Several incidents involved phishing scams and social engineering attacks, exploiting human error to gain access to private keys or sensitive information. User education and awareness remain crucial defenses against these types of attacks.

- Exchange Breaches: Centralized exchanges, despite employing robust security measures, continue to be attractive targets. These breaches often involve sophisticated attacks exploiting weaknesses in the exchange's infrastructure or security protocols.

<h2>The Human Factor: A Critical Vulnerability</h2>

While technological vulnerabilities play a significant role, the human element remains a crucial factor in many crypto hacks. Phishing scams, social engineering attacks, and insider threats consistently demonstrate the vulnerability of human oversight. Improving user education, implementing robust security protocols, and fostering a culture of security awareness are crucial steps in mitigating these risks.

<h2>The Impact on the Crypto Market</h2>

The cumulative $357 million loss significantly impacts investor confidence and the overall perception of the crypto market's stability. Such incidents can trigger price drops and increase market volatility. Addressing these security concerns is not just a technological challenge but also a critical factor in building long-term trust and sustainability within the cryptocurrency ecosystem.

<h2>Looking Ahead: Strengthening Crypto Security</h2>

To mitigate future attacks, the industry needs a multi-pronged approach:

- Enhanced Smart Contract Audits: Thorough audits by reputable security firms are essential to identify and rectify vulnerabilities before deployment.

- Improved User Education: Continual education and awareness campaigns can significantly reduce the success rate of phishing and social engineering attacks.

- Robust Security Protocols: Exchanges and DeFi platforms need to invest in robust security measures, including multi-factor authentication, advanced threat detection systems, and regular security assessments.

- Regulatory Oversight: Increased regulatory oversight and standardized security protocols can help raise the bar for security within the crypto industry.

The $357 million loss from April's crypto hacks serves as a stark reminder of the ongoing security challenges within the cryptocurrency space. Addressing these vulnerabilities through technological advancements, improved user education, and increased regulatory scrutiny is paramount to building a more secure and trustworthy crypto ecosystem. The future of cryptocurrency hinges on the industry's ability to learn from past mistakes and proactively prevent future breaches.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $357 Million In Crypto Losses: Analyzing April's 18 Hacks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Confirmed Ukrainian Drone Takes Down Russian Su 30 In Black Sea Conflict

May 10, 2025

Confirmed Ukrainian Drone Takes Down Russian Su 30 In Black Sea Conflict

May 10, 2025 -

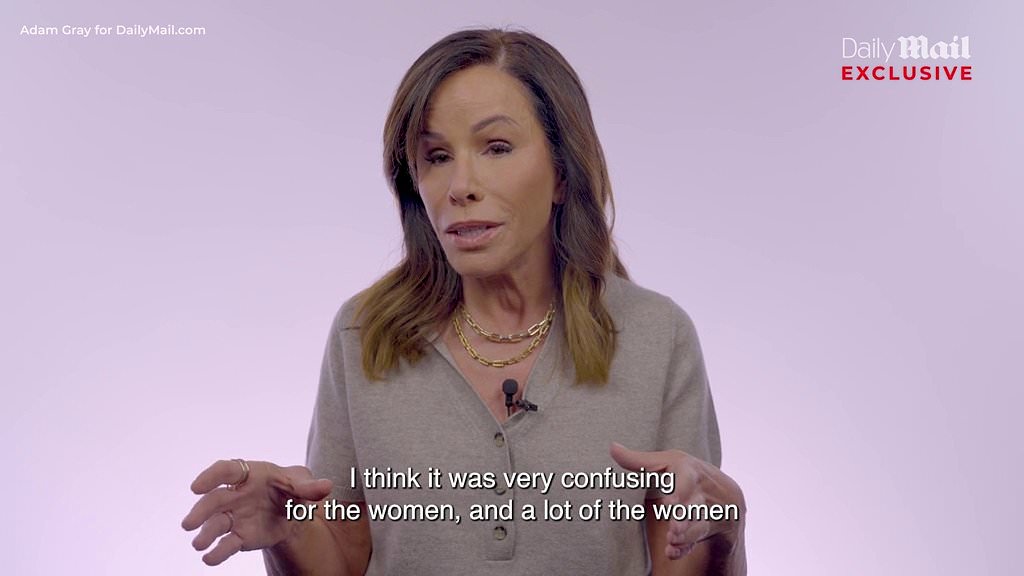

Joan Rivers Remembered A Comics Ashes Based Tribute Before Show Premiere

May 10, 2025

Joan Rivers Remembered A Comics Ashes Based Tribute Before Show Premiere

May 10, 2025 -

Check Your Packets Major Uk Crisp Brand Issues Urgent Recall

May 10, 2025

Check Your Packets Major Uk Crisp Brand Issues Urgent Recall

May 10, 2025 -

Public Health Warning Thousands Of Crisp Packets Recalled In The Uk Over Safety Concerns

May 10, 2025

Public Health Warning Thousands Of Crisp Packets Recalled In The Uk Over Safety Concerns

May 10, 2025 -

Melissa Rivers Questions Met Gala Invite For Unlikely Guest

May 10, 2025

Melissa Rivers Questions Met Gala Invite For Unlikely Guest

May 10, 2025

Latest Posts

-

Nez Balelo Defends Ohtanis 700 M Deal Wouldnt Do Anything Different

May 10, 2025

Nez Balelo Defends Ohtanis 700 M Deal Wouldnt Do Anything Different

May 10, 2025 -

The Oilers Comeback Kings A Winning Formula

May 10, 2025

The Oilers Comeback Kings A Winning Formula

May 10, 2025 -

Unexpected Victory Coasters Stunning Performance At World Surf Tour

May 10, 2025

Unexpected Victory Coasters Stunning Performance At World Surf Tour

May 10, 2025 -

Nba News Steph Currys Hamstring Issue Sidelines Him For At Least 3 Games

May 10, 2025

Nba News Steph Currys Hamstring Issue Sidelines Him For At Least 3 Games

May 10, 2025 -

Met Galas Fashion Future Melissa Rivers On The Importance Of Critics

May 10, 2025

Met Galas Fashion Future Melissa Rivers On The Importance Of Critics

May 10, 2025