$530 Million Pours Into BlackRock's Bitcoin ETF; Ethereum Funds Show No Change

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$530 Million Floodgates Open: BlackRock's Bitcoin ETF Dominates, While Ethereum Funds Remain Stagnant

The cryptocurrency world is buzzing after BlackRock's highly anticipated Bitcoin ETF saw a monumental influx of $530 million in its first day of trading. This massive investment dwarfs initial expectations and signals a significant shift in institutional confidence in Bitcoin as a viable asset class. Conversely, Ethereum-focused funds experienced no comparable surge, highlighting the distinct market dynamics at play.

BlackRock's Bitcoin ETF: A Watershed Moment for Crypto Adoption?

The launch of BlackRock's iShares Bitcoin Trust ETF (iShares BTC) has been hailed as a pivotal moment for Bitcoin's legitimacy. The sheer scale of investment demonstrates a powerful vote of confidence from one of the world's largest asset managers. This influx of capital represents a significant leap forward for Bitcoin's integration into mainstream finance, potentially paving the way for broader institutional adoption. The $530 million figure eclipses many predictions, solidifying BlackRock's position as a key player in the evolving cryptocurrency landscape.

This unprecedented level of investment suggests several key factors are converging:

- Increased Regulatory Clarity: Growing regulatory clarity in the US, albeit still evolving, is likely contributing to increased institutional comfort with Bitcoin investments.

- BlackRock's Brand Recognition: BlackRock's reputation for financial stability and expertise inspires confidence among investors, attracting both seasoned and new participants to the Bitcoin market.

- Diversification Strategies: Institutional investors are increasingly seeking diversification beyond traditional assets, and Bitcoin is proving to be an attractive addition to their portfolios.

Ethereum Funds: A Tale of Two Cryptocurrencies

While the Bitcoin ETF experienced explosive growth, Ethereum-based funds remained relatively unchanged. This disparity underscores the differing market perceptions of the two leading cryptocurrencies. While both are significant players in the blockchain space, Bitcoin continues to be viewed as a more established store of value, while Ethereum’s focus on decentralized applications and smart contracts fosters a different investor profile and risk assessment.

What Lies Ahead for Bitcoin and Ethereum?

The significant investment in BlackRock's Bitcoin ETF presents a bullish signal for the cryptocurrency market. However, the long-term implications remain to be seen. The success of this ETF could potentially trigger a domino effect, encouraging other institutional investors to enter the market, driving further price appreciation.

The contrasting performance of Bitcoin and Ethereum funds highlights the inherent volatility and specific market dynamics within the cryptocurrency sector. While Bitcoin currently benefits from increased institutional interest and regulatory clarity, the future performance of both cryptocurrencies will depend on a multitude of factors including technological advancements, regulatory developments, and overall market sentiment.

Keywords: BlackRock, Bitcoin ETF, iShares Bitcoin Trust, Ethereum, Cryptocurrency, Institutional Investment, Crypto Market, Bitcoin Price, Regulatory Clarity, Financial Markets, Asset Management, Portfolio Diversification.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $530 Million Pours Into BlackRock's Bitcoin ETF; Ethereum Funds Show No Change. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

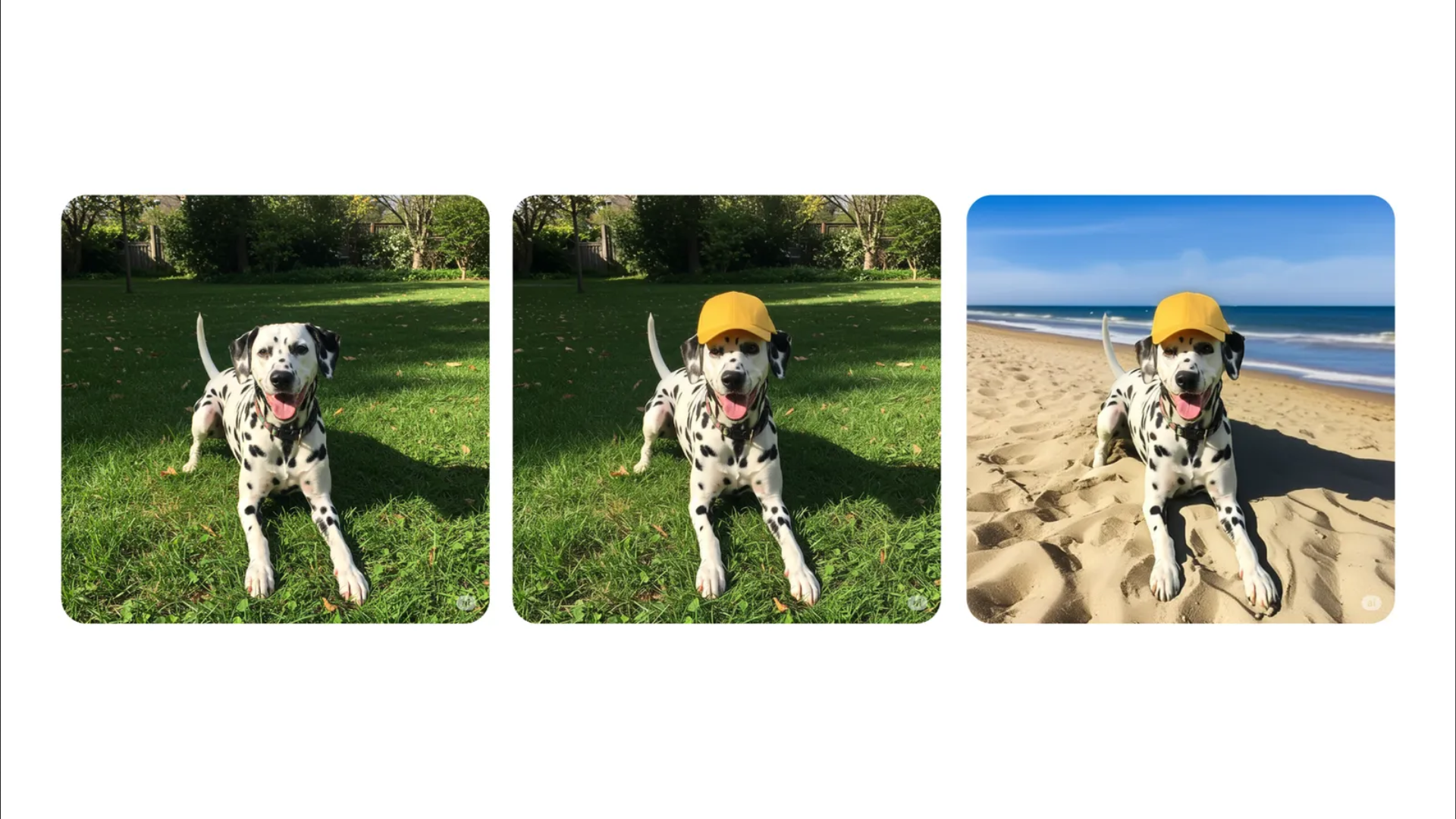

Gemini Update Introducing Integrated Image Editing Capabilities

May 08, 2025

Gemini Update Introducing Integrated Image Editing Capabilities

May 08, 2025 -

Market Reaction Dbs Shares Climb Following Positive Earnings Report

May 08, 2025

Market Reaction Dbs Shares Climb Following Positive Earnings Report

May 08, 2025 -

Thunder Fans Honor Russell Westbrook A Classy Tribute Years In The Making

May 08, 2025

Thunder Fans Honor Russell Westbrook A Classy Tribute Years In The Making

May 08, 2025 -

Teslas Robotaxi Service Gets Green Light Across Texas A Regulatory Milestone

May 08, 2025

Teslas Robotaxi Service Gets Green Light Across Texas A Regulatory Milestone

May 08, 2025 -

Detained Georgetown Scholar A Political Prisoner Us Advocates Speak Out

May 08, 2025

Detained Georgetown Scholar A Political Prisoner Us Advocates Speak Out

May 08, 2025

Latest Posts

-

Get To Know Jaylin Williams Arkansas Razorback Now With The Okc Thunder

May 08, 2025

Get To Know Jaylin Williams Arkansas Razorback Now With The Okc Thunder

May 08, 2025 -

Nhl Playoffs Game 7 Results Round 1 Wrap Up And The Hockey News Live Discussion

May 08, 2025

Nhl Playoffs Game 7 Results Round 1 Wrap Up And The Hockey News Live Discussion

May 08, 2025 -

Dbs Beats Earnings Estimates Sending Shares Up Over 2

May 08, 2025

Dbs Beats Earnings Estimates Sending Shares Up Over 2

May 08, 2025 -

The Masked Singer A Mad Scientists Journey To Liberation

May 08, 2025

The Masked Singer A Mad Scientists Journey To Liberation

May 08, 2025 -

Shai Gilgeous Alexanders Motivation 2019 Trade And The Clippers Playoffs Matchup

May 08, 2025

Shai Gilgeous Alexanders Motivation 2019 Trade And The Clippers Playoffs Matchup

May 08, 2025