$774M Crypto Token Unlock Wave: Bullish Market Momentum Or Impending Correction?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$774M Crypto Token Unlock Wave: Bullish Market Momentum or Impending Correction?

The cryptocurrency market is bracing for a significant event: a massive $774 million unlock of various tokens scheduled for the coming weeks. This impending wave of token releases has ignited a heated debate amongst analysts and investors: will it fuel further bullish momentum, or trigger a much-anticipated market correction? The sheer scale of the unlock presents a unique challenge to market stability, demanding a closer examination.

Understanding Token Unlocks

Before diving into the potential impact, it's crucial to understand what token unlocks entail. These events occur when previously locked tokens – often held by project founders, investors, or team members – become available for sale or transfer on the open market. This influx of newly available tokens can significantly impact supply and demand, potentially leading to price fluctuations.

The $774 Million Question: Which Tokens are Unlocking?

While the exact breakdown remains fluid, significant unlocks are anticipated across several prominent projects. Data from various on-chain analytics platforms reveals a diverse range of tokens involved, including but not limited to:

-

Layer-1 Blockchain Tokens: Several Layer-1 blockchain projects are experiencing major unlocks, potentially impacting their respective ecosystems. The increased supply could exert downward pressure on prices if not met by corresponding demand.

-

DeFi Tokens: The decentralized finance (DeFi) sector is also feeling the pressure, with a substantial volume of DeFi tokens slated for release. These unlocks could influence liquidity within DeFi protocols and potentially affect the overall DeFi market sentiment.

-

NFT-Related Tokens: The NFT space is not immune, with some projects facing substantial token unlocks. This adds another layer of complexity to the already volatile NFT market.

Bullish Arguments: Why the Unlock Could Be Positive

Despite the potential for negative price action, some analysts hold a bullish outlook. Their arguments often center on:

-

Anticipated Demand: They argue that pre-existing demand for these tokens will absorb the newly unlocked supply, preventing a significant price drop. This is particularly true if the projects involved have strong fundamentals and continued development.

-

Strategic Tokenomics: Some projects have implemented sophisticated tokenomics models designed to mitigate the negative impact of large unlocks. These models could involve gradual releases or buy-back mechanisms to stabilize the market.

-

Overall Market Sentiment: The broader cryptocurrency market's overall health plays a pivotal role. If overall sentiment remains bullish, the impact of the unlocks might be less pronounced.

Bearish Arguments: The Case for a Correction

Conversely, the bearish perspective points to the potential for a market correction triggered by the sheer volume of tokens entering circulation. Key arguments include:

-

Increased Selling Pressure: A massive influx of tokens onto exchanges could overwhelm buying pressure, leading to significant price drops. This scenario is particularly worrisome if projects lack the robust fundamentals to support their token value.

-

Lack of Demand: If demand does not keep pace with the increased supply, prices are likely to decline. This is especially true if the market is already experiencing bearish sentiment.

-

Market Uncertainty: The uncertainty surrounding the specific timing and volume of unlocks adds to market volatility. This uncertainty can lead to investors taking a risk-averse approach and potentially selling their holdings.

Conclusion: Navigating the Uncertain Waters

The $774 million token unlock wave presents a complex scenario with both bullish and bearish possibilities. Investors should proceed with caution, conducting thorough due diligence on individual projects and understanding the potential risks involved. Diversification and risk management strategies are crucial during periods of heightened market uncertainty. Closely monitoring on-chain activity, market sentiment, and the performance of specific tokens will be essential to navigate this period successfully. The coming weeks will be crucial in determining whether this event fuels further bullish momentum or precipitates a significant market correction.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $774M Crypto Token Unlock Wave: Bullish Market Momentum Or Impending Correction?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exotic Dancer Alleges Sex Urination And Masturbation Incident Involving Cassie And Diddy

May 14, 2025

Exotic Dancer Alleges Sex Urination And Masturbation Incident Involving Cassie And Diddy

May 14, 2025 -

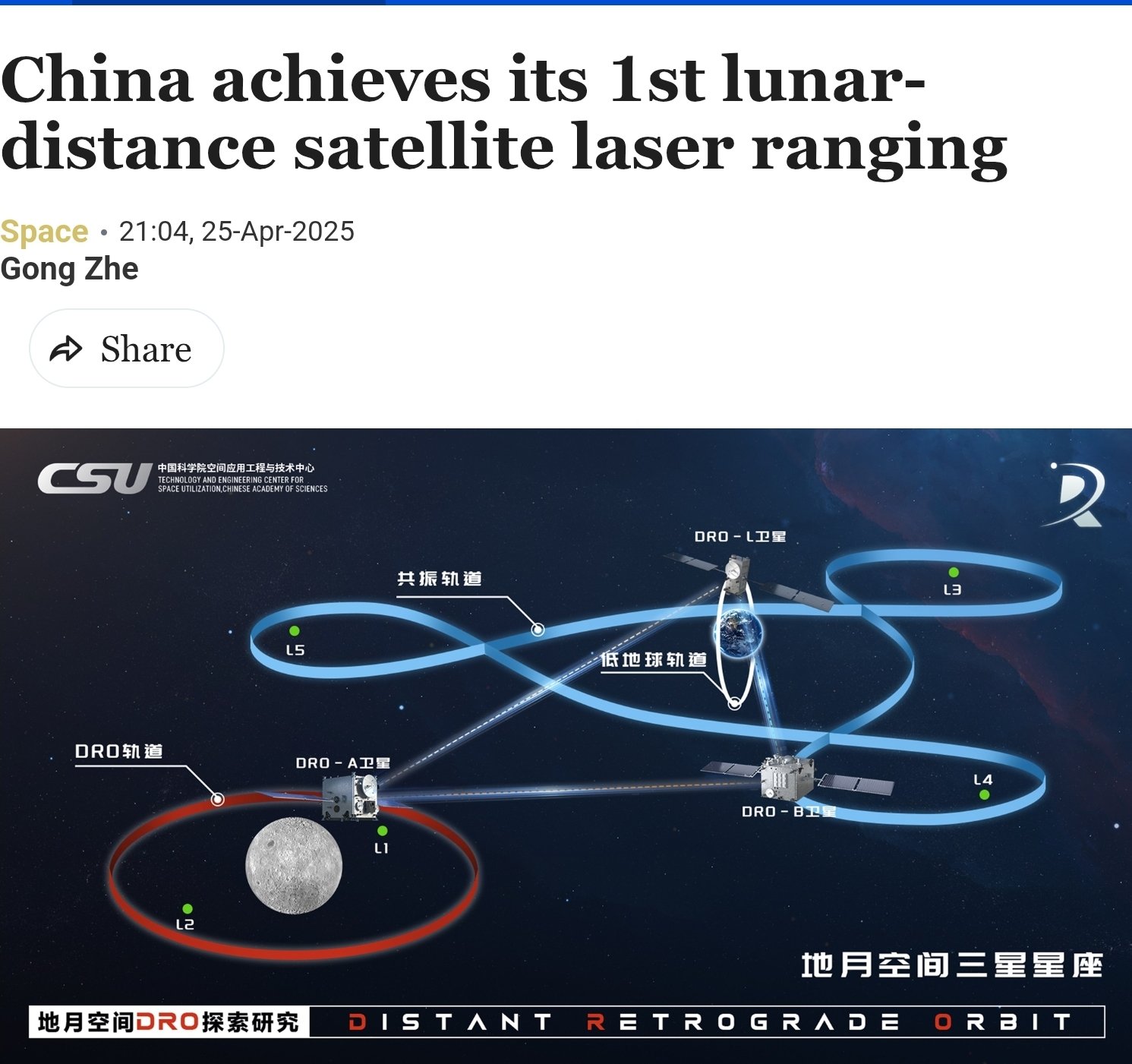

Chinas Satellite Laser Ranging Reaching The Moons Orbit

May 14, 2025

Chinas Satellite Laser Ranging Reaching The Moons Orbit

May 14, 2025 -

Targeting The Silver Tsunami Trump And Bidens Use Of Facebook Ads To Court Older Women

May 14, 2025

Targeting The Silver Tsunami Trump And Bidens Use Of Facebook Ads To Court Older Women

May 14, 2025 -

Nvidia Researcher Proposes Novel Physical Turing Test

May 14, 2025

Nvidia Researcher Proposes Novel Physical Turing Test

May 14, 2025 -

Warriors Fall To Timberwolves 102 97 Edwards And Randle Fuel Minnesotas Playoff Push

May 14, 2025

Warriors Fall To Timberwolves 102 97 Edwards And Randle Fuel Minnesotas Playoff Push

May 14, 2025

Latest Posts

-

Breakthrough Chinese Scientists Develop Fastest Most Efficient Silicon Free Transistor

May 14, 2025

Breakthrough Chinese Scientists Develop Fastest Most Efficient Silicon Free Transistor

May 14, 2025 -

Seven Factories To Close 11 000 Jobs Cut Nissans Sweeping Restructuring Plan

May 14, 2025

Seven Factories To Close 11 000 Jobs Cut Nissans Sweeping Restructuring Plan

May 14, 2025 -

Binance Listing Sends Moodeng Price Skyrocketing

May 14, 2025

Binance Listing Sends Moodeng Price Skyrocketing

May 14, 2025 -

Armstrong Aided Wiggins Recovery From Cocaine Use A Shocking Revelation

May 14, 2025

Armstrong Aided Wiggins Recovery From Cocaine Use A Shocking Revelation

May 14, 2025 -

Serena Joys Pink Decoding The Color Symbolism In The Handmaids Tale Season 6

May 14, 2025

Serena Joys Pink Decoding The Color Symbolism In The Handmaids Tale Season 6

May 14, 2025