A Once-in-a-Lifetime Shift: Dalio's View On US Decline And China's Power

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

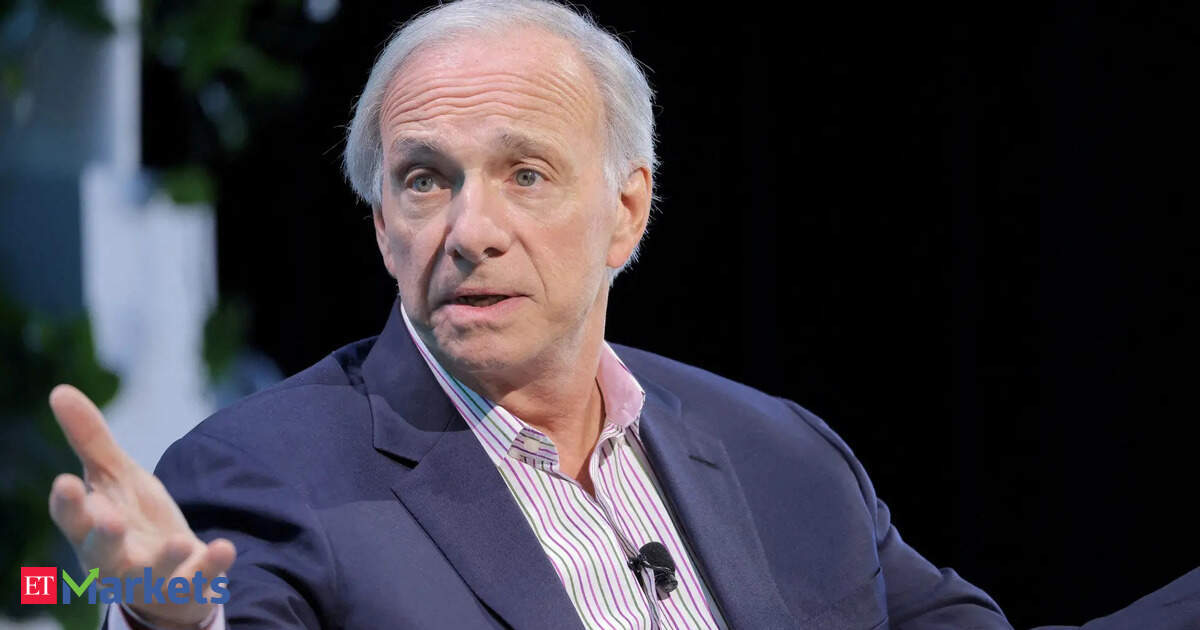

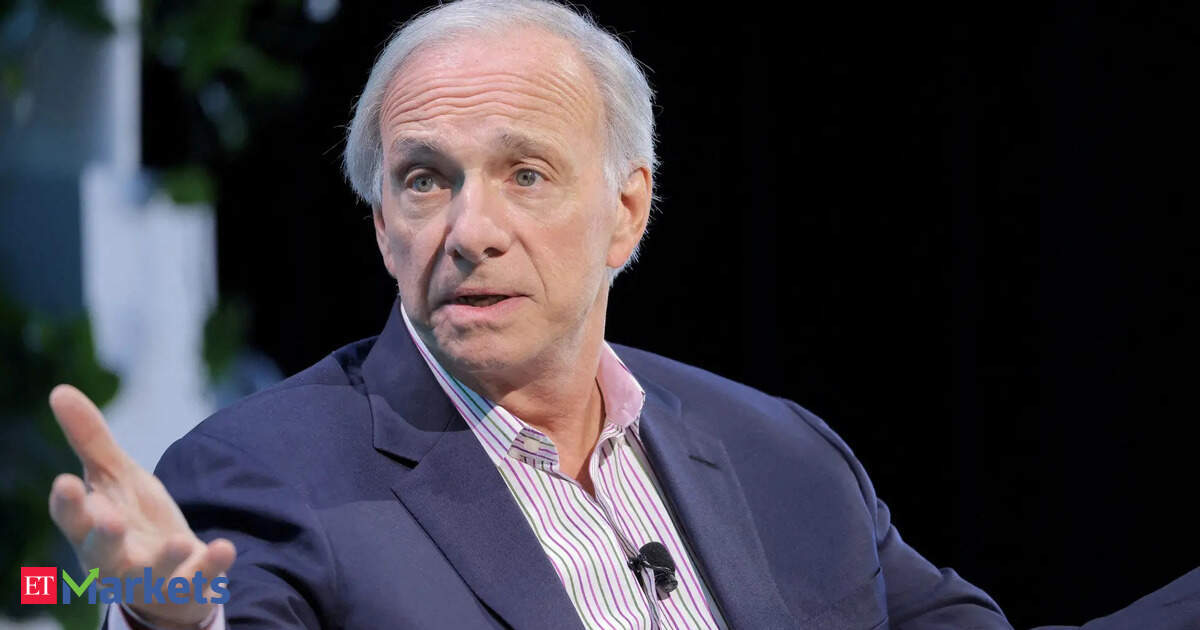

<h1>A Once-in-a-Lifetime Shift: Dalio's View on US Decline and China's Power</h1>

Ray Dalio, the billionaire founder of Bridgewater Associates, has once again ignited global debate with his stark assessment of the shifting global power dynamic. His recent pronouncements paint a picture of a declining United States and a rapidly rising China, a paradigm shift he describes as a "once-in-a-lifetime" event with profound implications for the world economy and geopolitical landscape. This isn't just another market prediction; it's a comprehensive analysis touching upon economic cycles, technological advancements, and the very nature of global leadership.

<h2>Dalio's Thesis: A Multifaceted Decline and Ascent</h2>

Dalio's perspective isn't simply a pessimistic view of American decline. Instead, he presents a nuanced argument focusing on several key factors contributing to this significant power shift:

-

Internal Political Polarization: Dalio highlights the increasing political polarization within the US as a major impediment to effective governance and economic progress. This internal strife, he argues, hinders the nation's ability to address crucial challenges and implement necessary reforms.

-

Economic Debt and Inequality: The growing national debt and widening income inequality are cited as significant threats to long-term economic stability. These factors, he suggests, create systemic vulnerabilities that could hamper future growth and global competitiveness.

-

China's Economic Rise and Technological Prowess: Conversely, Dalio emphasizes China's remarkable economic growth and its rapid advancements in technology, particularly in areas like artificial intelligence and renewable energy. He sees China's growing influence in global trade and its increasing technological capabilities as key drivers of its ascent.

-

The Changing Global Order: The shift isn't solely about the US and China; it’s about a broader realignment of global power. Dalio suggests a multipolar world order is emerging, with several nations vying for influence, challenging the established post-World War II order.

<h2>Beyond Economics: Geopolitical Implications</h2>

The implications of Dalio's assessment extend far beyond economic forecasts. The potential for increased geopolitical tension, trade wars, and even military conflict are all points of concern. The shift in global power could lead to:

-

Increased Competition for Resources: As China's economic power grows, competition for natural resources and strategic assets will likely intensify, potentially leading to conflicts and instability.

-

Realignment of Alliances: Nations may reassess their alliances and partnerships in response to the changing global landscape, potentially creating new blocs and power dynamics.

-

Technological Arms Race: The competition between the US and China in technological innovation could spark a new technological arms race, with potentially unpredictable consequences.

<h2>Navigating the Shifting Sands: What Does It Mean for Investors?</h2>

For investors, Dalio's analysis underscores the need for diversification and a long-term perspective. He suggests that investors should consider:

-

Diversifying Investments: Reducing reliance on solely US-centric investments and exploring opportunities in emerging markets, particularly in Asia, is crucial.

-

Understanding Geopolitical Risks: Investors need to incorporate geopolitical risks into their investment strategies, anticipating potential disruptions and volatility.

-

Focusing on Long-Term Growth: Given the long-term nature of this power shift, investors should prioritize investments with strong long-term growth potential, regardless of short-term market fluctuations.

<h2>Conclusion: A Call for Adaptation and Strategic Thinking</h2>

Ray Dalio's analysis of the US decline and China's rise presents a compelling, albeit challenging, view of the future. While the specifics of the transition remain uncertain, the overall trend toward a multipolar world order seems undeniable. This necessitates a reassessment of strategies across all sectors – economic, political, and technological – requiring adaptation and strategic thinking to navigate this once-in-a-lifetime shift effectively. The key takeaway is not simply to predict the future but to prepare for its inevitable uncertainties.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on A Once-in-a-Lifetime Shift: Dalio's View On US Decline And China's Power. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

A Coastal Cake Connoisseurs Verdict One Tearooms Standout Bakery

Apr 08, 2025

A Coastal Cake Connoisseurs Verdict One Tearooms Standout Bakery

Apr 08, 2025 -

Roof Collapse In Dominican Republic Death Toll Rises To 13 Mass Casualties Reported

Apr 08, 2025

Roof Collapse In Dominican Republic Death Toll Rises To 13 Mass Casualties Reported

Apr 08, 2025 -

Bitcoin Price Warning Is This Key Metric About To Fail

Apr 08, 2025

Bitcoin Price Warning Is This Key Metric About To Fail

Apr 08, 2025 -

Teslas Optimus Robot Improved Gait And Actuator Performance

Apr 08, 2025

Teslas Optimus Robot Improved Gait And Actuator Performance

Apr 08, 2025 -

United Health Group Unh Investment A Decades Growth

Apr 08, 2025

United Health Group Unh Investment A Decades Growth

Apr 08, 2025