Above $100K: Bitcoin Short Squeeze Triggers Market Volatility

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Above $100K: Bitcoin Short Squeeze Triggers Market Volatility

Bitcoin's price surged past the $100,000 mark, sending shockwaves through the cryptocurrency market and highlighting the potential power of short squeezes. This dramatic price jump, fueled by a rapid unwinding of bearish bets, left many traders scrambling and sparked intense debate about the future of Bitcoin's price volatility.

What is a Short Squeeze?

Before diving into the specifics of this recent Bitcoin surge, let's understand the mechanism behind it: a short squeeze. In simple terms, a short squeeze occurs when a significant number of traders have bet against an asset (in this case, Bitcoin), expecting its price to fall. These traders, known as "shorts," borrow the asset and sell it, hoping to buy it back later at a lower price and profit from the difference. However, if the price unexpectedly rises, these shorts face mounting losses and are forced to buy back the asset to limit their damage. This rush to buy pushes the price even higher, creating a self-reinforcing upward spiral – the short squeeze.

The Bitcoin Rally: Factors Contributing to the Squeeze

Several factors converged to trigger this dramatic Bitcoin short squeeze:

- Increased Institutional Adoption: Growing institutional investment in Bitcoin continues to lend credence to its long-term viability, driving demand and pushing prices upward.

- Regulatory Clarity (or Lack Thereof): While regulatory uncertainty remains a significant factor, recent pronouncements from certain jurisdictions suggesting a more accommodating stance towards cryptocurrencies can fuel positive sentiment.

- FOMO (Fear Of Missing Out): As the price climbed, the fear of missing out on potential gains likely propelled further buying, exacerbating the squeeze.

- Technical Indicators: Several technical indicators pointed towards an impending price surge, potentially attracting more buyers and adding pressure on short positions.

- Macroeconomic Factors: Global economic uncertainty and inflation concerns can drive investors towards alternative assets like Bitcoin, increasing demand.

Market Volatility and its Implications

The rapid price increase led to significant market volatility, impacting other cryptocurrencies and potentially traditional financial markets. Many smaller altcoins experienced correlated price jumps, while some investors cashed out, taking profits and contributing to short-term price corrections.

What Does This Mean for the Future?

The recent Bitcoin short squeeze demonstrates the inherent volatility of the cryptocurrency market and the significant influence of speculative trading. While this event highlights Bitcoin's potential for rapid price appreciation, it also underscores the risks associated with its high volatility. Investors should proceed with caution, carefully managing their risk exposure and conducting thorough due diligence before making any investment decisions. The long-term trajectory of Bitcoin remains uncertain and is likely influenced by a complex interplay of technological advancements, regulatory developments, and macroeconomic trends.

The Importance of Diversification and Risk Management

This event underscores the importance of diversification within any investment portfolio and robust risk management strategies. Investors should never invest more than they can afford to lose and should consider consulting with a financial advisor before engaging in cryptocurrency trading.

Keywords: Bitcoin, Cryptocurrency, Short Squeeze, Market Volatility, Price Surge, $100,000 Bitcoin, Institutional Adoption, Cryptocurrency Investment, Crypto Regulation, FOMO, Bitcoin Price Prediction, Risk Management, Investment Strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Above $100K: Bitcoin Short Squeeze Triggers Market Volatility. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Game 2 Film Study Predicting The Knicks And Celtics Strategies In New York

May 11, 2025

Game 2 Film Study Predicting The Knicks And Celtics Strategies In New York

May 11, 2025 -

Alexander Arnold And The Right Back Key Takeaways From Arne Slots Press Conference

May 11, 2025

Alexander Arnold And The Right Back Key Takeaways From Arne Slots Press Conference

May 11, 2025 -

Inexcusable Celtics Stars Scathing Assessment Following Another Blown Lead

May 11, 2025

Inexcusable Celtics Stars Scathing Assessment Following Another Blown Lead

May 11, 2025 -

Coventry Vs Sunderland Black Cats Win 2 1 Claim Play Off Upper Hand

May 11, 2025

Coventry Vs Sunderland Black Cats Win 2 1 Claim Play Off Upper Hand

May 11, 2025 -

Della Maddalena Vs Muhammad Ufc 315 Fight Scorecards And Analysis

May 11, 2025

Della Maddalena Vs Muhammad Ufc 315 Fight Scorecards And Analysis

May 11, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

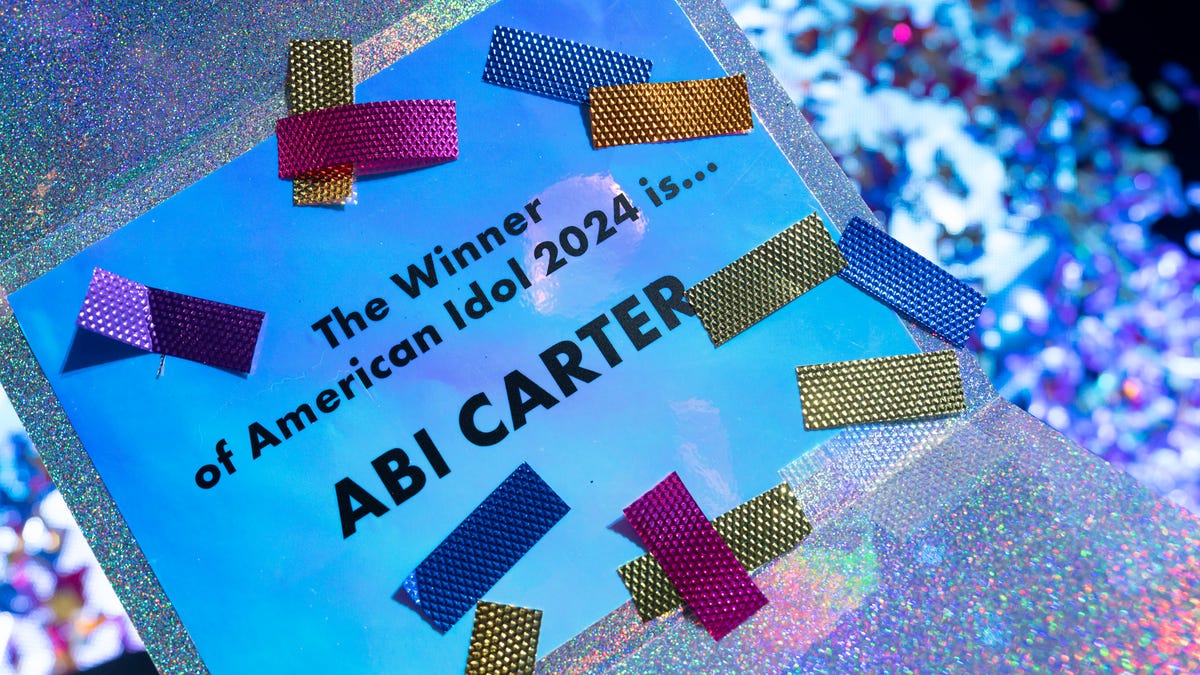

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025