Affordable Payment Plans For TVs & AirPods: Klarna Financing Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Affordable Payment Plans for TVs & AirPods: Klarna Financing Explained

Want that stunning new OLED TV or the latest AirPods Pro, but worried about the upfront cost? Don't let budget constraints hold you back! Klarna financing offers a convenient solution, allowing you to spread the cost of your electronics over time with manageable monthly payments. This guide breaks down how Klarna financing works, its benefits, and what you need to know before you apply.

What is Klarna?

Klarna is a global financial technology company that provides a range of payment options, including "buy now, pay later" (BNPL) services. They've become a popular choice for online shoppers looking for flexible payment plans, especially for larger purchases like electronics. Klarna partners with numerous retailers, allowing you to use their financing options at checkout.

How Klarna Financing Works for TVs & AirPods:

The process is generally straightforward:

- Shop: Find your desired TV or AirPods at a participating retailer that offers Klarna as a payment option. Many major electronics stores and online retailers integrate Klarna into their checkout process.

- Select Klarna at Checkout: During the checkout process, choose Klarna as your payment method.

- Apply & Get Approved: You'll be redirected to Klarna's secure application page. You'll need to provide some basic personal and financial information. Approval is typically instant or very quick.

- Make Payments: Once approved, your purchase will be processed, and you'll begin making scheduled monthly payments according to your chosen plan. Klarna usually provides clear payment schedules and reminders.

Benefits of Using Klarna for Electronics Purchases:

- Budget-Friendly Payments: Spread the cost of expensive electronics over several months, making large purchases more affordable.

- No Interest (Often): Many Klarna plans offer 0% interest if you pay on time, allowing you to avoid extra fees. Always check the terms and conditions to confirm.

- Easy Application Process: The online application is quick and easy, typically requiring minimal paperwork.

- Wide Acceptance: Klarna is accepted by a growing number of online and in-store retailers, giving you flexibility in where you shop.

- Improved Cash Flow: Avoid depleting your savings account with a single large purchase.

Things to Consider Before Using Klarna:

- On-Time Payments are Crucial: Missing payments can result in late fees and negatively impact your credit score.

- Interest Charges: While many plans offer 0% interest, be aware that some may charge interest if you don't pay on time or choose a longer repayment period. Read the fine print carefully.

- Credit Check: Klarna will typically perform a soft credit check, which won't affect your credit score significantly. However, some plans may involve a harder credit check.

- Total Cost: Remember, even with 0% interest, you'll pay the full price of the item plus any applicable taxes and fees.

Klarna vs. Other Financing Options:

Klarna competes with other BNPL services and traditional store credit cards. The best option depends on your individual needs and creditworthiness. Compare interest rates, fees, and repayment terms before deciding.

Conclusion:

Klarna financing can be a valuable tool for purchasing high-ticket items like TVs and AirPods, offering a convenient and often affordable way to spread payments. However, responsible use is key. Always carefully review the terms and conditions and ensure you can comfortably make your monthly payments on time to avoid extra charges and protect your credit score. By understanding how Klarna works and weighing the pros and cons, you can make an informed decision about whether it's the right financing option for you.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Affordable Payment Plans For TVs & AirPods: Klarna Financing Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tom Cruise Responds To Viral Video Of His Popcorn Eating Method

May 24, 2025

Tom Cruise Responds To Viral Video Of His Popcorn Eating Method

May 24, 2025 -

Navigating The Maze A Guide To Googles Confusing Ai Products

May 24, 2025

Navigating The Maze A Guide To Googles Confusing Ai Products

May 24, 2025 -

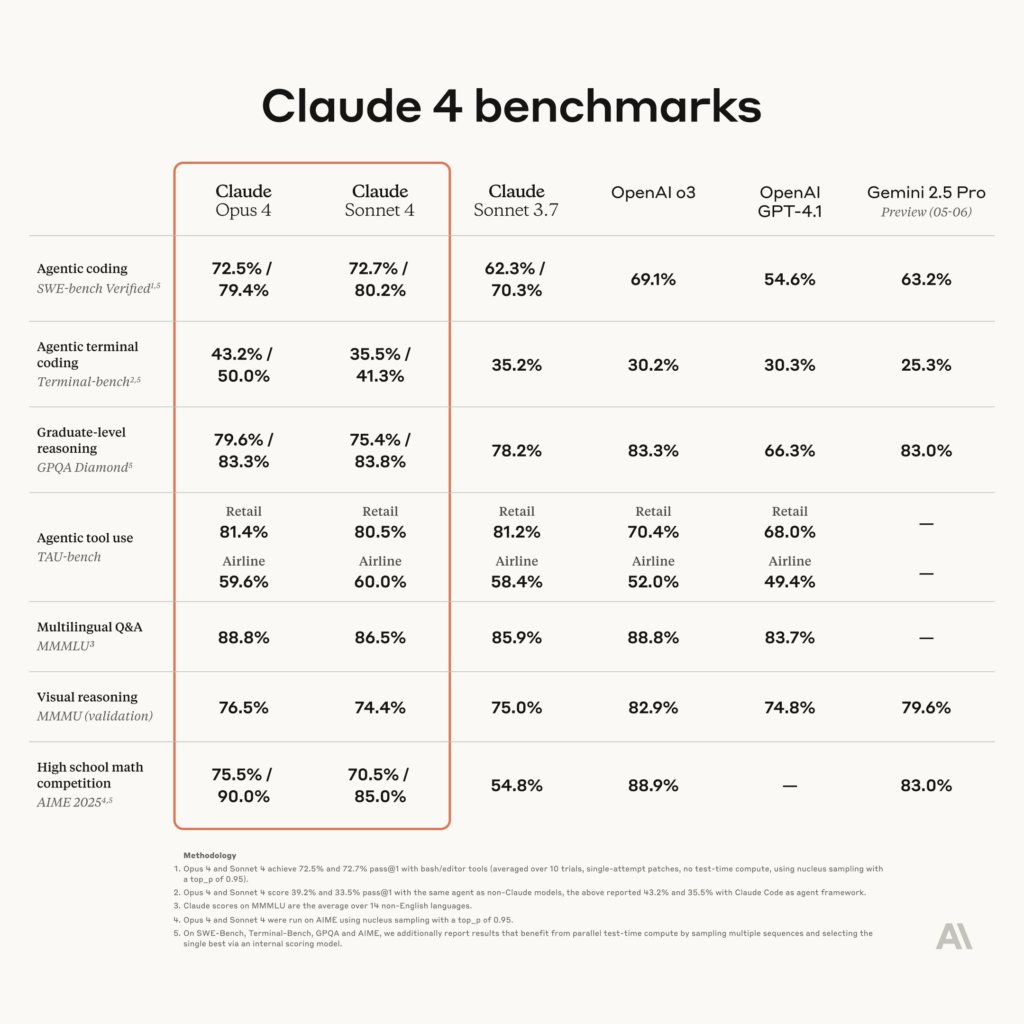

Anthropic Claude 4 Sonnet Opus And Next Level Agentic Coding Capabilities

May 24, 2025

Anthropic Claude 4 Sonnet Opus And Next Level Agentic Coding Capabilities

May 24, 2025 -

Can Auckland Achieve A 30 000 Person Attendance Record Coricas Prediction

May 24, 2025

Can Auckland Achieve A 30 000 Person Attendance Record Coricas Prediction

May 24, 2025 -

Friday May 23rd Lottery Results Check Euro Millions And Thunderball Winning Numbers

May 24, 2025

Friday May 23rd Lottery Results Check Euro Millions And Thunderball Winning Numbers

May 24, 2025