Africa's Payment Landscape Transformed: USDC Adoption Streamlines International Transfers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Africa's Payment Landscape Transformed: USDC Adoption Streamlines International Transfers

Africa's financial landscape is undergoing a dramatic shift, driven by the increasing adoption of stablecoins like USDC. For years, international money transfers to and from the continent have been plagued by high fees, slow processing times, and unreliable services. However, the integration of USDC is proving to be a game-changer, offering a faster, cheaper, and more transparent alternative to traditional methods. This transformative shift is impacting businesses, individuals, and the overall economic growth of the continent.

The Challenges of Traditional Cross-Border Payments in Africa

Traditional methods of sending money across borders in Africa have long presented significant hurdles. These include:

- High transaction fees: Banks and money transfer operators often charge exorbitant fees, eating into the funds being sent and disproportionately affecting those sending smaller amounts.

- Slow processing times: Transfers can take days, even weeks, to complete, creating significant delays and uncertainty.

- Lack of transparency: Tracking the progress of a transfer can be difficult, leaving senders and recipients in the dark about its status.

- Limited access: Many individuals, particularly in rural areas, lack access to formal banking services, limiting their ability to participate in the global financial system.

USDC: A Promising Solution for African Remittances

The emergence of USDC, a stablecoin pegged to the US dollar, offers a compelling solution to these challenges. Its advantages include:

- Lower transaction fees: Compared to traditional methods, transferring USDC often involves significantly lower fees, making it a more affordable option for individuals and businesses.

- Faster processing times: Transactions are typically processed much faster, sometimes within minutes or hours, enhancing efficiency and convenience.

- Increased transparency: Blockchain technology provides a transparent and auditable record of each transaction, allowing both senders and recipients to track its progress easily.

- Enhanced accessibility: USDC can be accessed through various platforms and mobile money applications, expanding financial inclusion to a wider population.

Impact on Businesses and Economic Growth

The adoption of USDC is not just benefiting individuals; it’s also having a significant impact on businesses operating in Africa. Businesses can:

- Reduce operational costs: Lower transaction fees translate to significant savings for businesses involved in international trade and payments.

- Improve cash flow management: Faster processing times allow businesses to manage their cash flow more efficiently.

- Expand their reach: Easier access to international payments facilitates growth and expansion into new markets.

This improved efficiency and cost-effectiveness are contributing to broader economic growth within Africa, empowering entrepreneurs and fostering innovation.

Challenges and Considerations

While the adoption of USDC presents numerous benefits, it's crucial to acknowledge potential challenges:

- Regulatory uncertainty: The regulatory landscape surrounding stablecoins is still evolving in many African countries, creating uncertainty for users and businesses.

- Internet access and digital literacy: Widespread adoption requires reliable internet access and sufficient digital literacy among the population.

- Volatility risk: Although pegged to the US dollar, the value of USDC could theoretically fluctuate, though this risk is generally considered low.

The Future of Payments in Africa

The integration of USDC and other stablecoins into Africa's payment ecosystem is still in its early stages, but the potential is undeniable. As regulatory clarity improves and digital infrastructure develops, the adoption of USDC is likely to accelerate, fundamentally reshaping the continent's financial landscape and fostering inclusive economic growth. This shift towards a more efficient, transparent, and accessible payment system represents a significant step forward for Africa’s financial future, potentially unlocking new opportunities for individuals and businesses alike. The ongoing evolution will be crucial to watch for those interested in the future of African finance and the global adoption of digital currencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Africa's Payment Landscape Transformed: USDC Adoption Streamlines International Transfers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sporting Cp Team News Update Athletic Bilbao Vs Manchester United May 1

May 02, 2025

Sporting Cp Team News Update Athletic Bilbao Vs Manchester United May 1

May 02, 2025 -

Berkshire Hathaway 2024 Assista Ao Vivo A Reuniao Anual Com O Info Money Noticias E Analises

May 02, 2025

Berkshire Hathaway 2024 Assista Ao Vivo A Reuniao Anual Com O Info Money Noticias E Analises

May 02, 2025 -

Is This The Beginning Of The End For Xrp Etf Setback And Bearish Pattern Emerge

May 02, 2025

Is This The Beginning Of The End For Xrp Etf Setback And Bearish Pattern Emerge

May 02, 2025 -

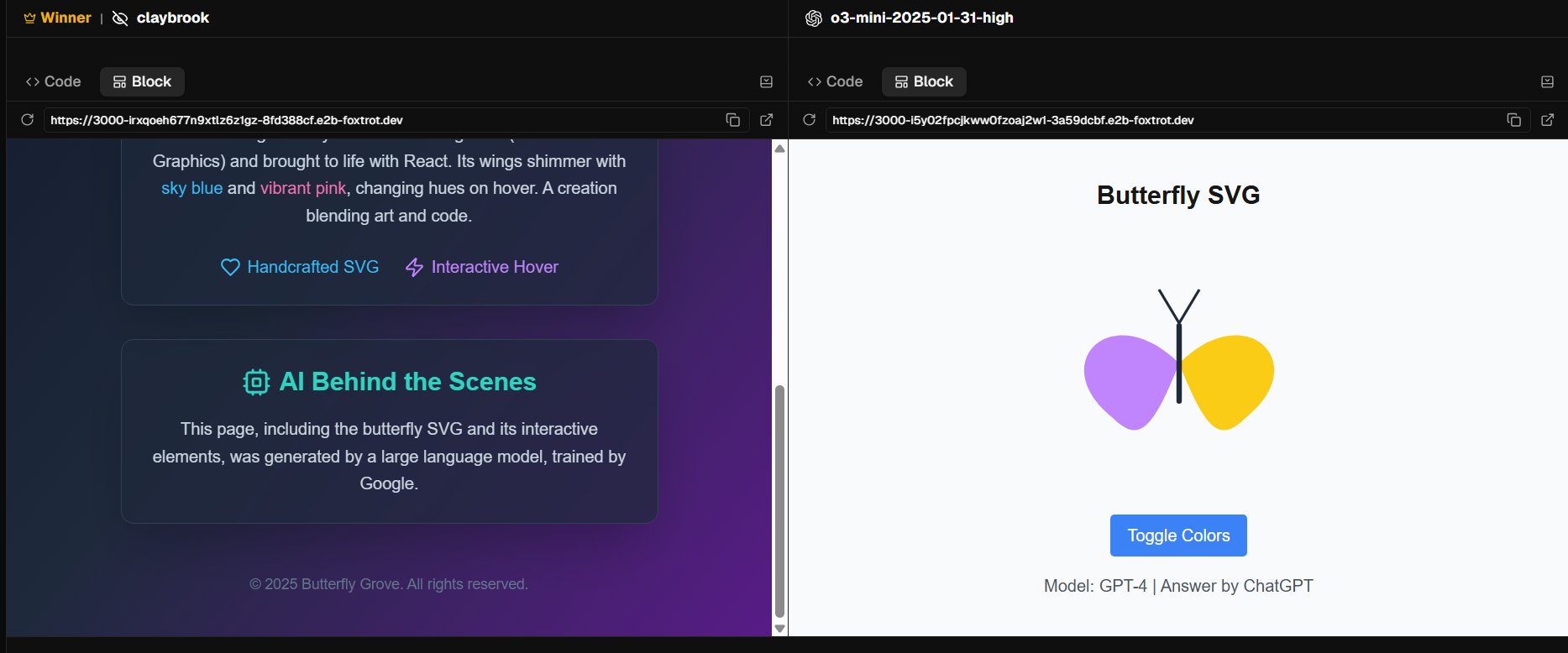

Enhance Ui Ux And Web Development With Googles Claybrook Ai

May 02, 2025

Enhance Ui Ux And Web Development With Googles Claybrook Ai

May 02, 2025 -

Navigating The Ge 2025 Cooling Off Period Dos And Don Ts

May 02, 2025

Navigating The Ge 2025 Cooling Off Period Dos And Don Ts

May 02, 2025