After 31% Surge, Worldcoin (WLD) Price Consolidation: Analyzing Key Resistance Levels

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

After 31% Surge, Worldcoin (WLD) Price Consolidation: Analyzing Key Resistance Levels

Worldcoin (WLD), the cryptocurrency associated with the ambitious World ID project, has experienced a dramatic 31% price surge, leaving investors wondering what's next. After such a significant rally, a period of consolidation is expected, and understanding key resistance levels is crucial for navigating the potential market volatility. This analysis delves into the current market situation for WLD, exploring the factors driving its recent growth and identifying critical price points to watch.

The 31% Surge: A Closer Look

The recent price jump in WLD wasn't a spontaneous event. Several factors contributed to this impressive gain, including:

- Increased adoption of World ID: The underlying technology, World ID, continues to gain traction, with more users and organizations adopting the platform for its unique digital identity verification capabilities. This growing adoption fuels confidence in the long-term potential of WLD.

- Positive market sentiment: The broader cryptocurrency market has shown signs of recovery, and this positive sentiment has spilled over into altcoins like WLD, boosting investor confidence and driving demand.

- Speculative trading: Increased media coverage and social media buzz surrounding Worldcoin have attracted speculative traders, leading to a surge in trading volume and price appreciation. This highlights the importance of fundamental analysis alongside technical indicators.

Key Resistance Levels to Watch

While the 31% surge is exciting, it's vital to understand that significant price increases often lead to consolidation phases. Traders and investors should pay close attention to the following key resistance levels:

- $0.25: This level represents a significant psychological barrier and a previous resistance point. A sustained break above $0.25 could signal further upward momentum.

- $0.30: This is a more robust resistance level based on previous price action. A decisive break above $0.30 would confirm a stronger bullish trend.

- $0.35: This level represents a long-term resistance level and would indicate a strong bullish breakout. Breaking above this level could trigger significant price appreciation.

Potential Support Levels

It's equally important to identify potential support levels, indicating where buying pressure might outweigh selling pressure:

- $0.18: This level acted as support during previous price dips. A breach below this level could signal a potential bearish trend reversal.

- $0.15: A drop below this level would be a significant concern, potentially indicating a more substantial correction.

Technical Indicators and Trading Strategies

Analyzing technical indicators like the Relative Strength Index (RSI), Moving Averages (MA), and trading volume is crucial for informed decision-making. High RSI values may indicate overbought conditions, suggesting a potential price correction. Conversely, low RSI values could signal oversold conditions and potential buying opportunities. Monitoring trading volume is also essential for confirming price movements and identifying potential breakouts or breakdowns.

Conclusion: Navigating the Consolidation Phase

The 31% surge in Worldcoin's price presents a compelling case study in cryptocurrency market dynamics. While the project shows considerable promise, understanding key resistance and support levels is crucial for navigating the expected consolidation phase. By carefully monitoring price action, technical indicators, and fundamental factors like World ID adoption, investors can make more informed decisions and potentially capitalize on future price movements. Remember to always conduct thorough research and manage risk effectively before making any investment decisions in the volatile cryptocurrency market. The information provided here is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on After 31% Surge, Worldcoin (WLD) Price Consolidation: Analyzing Key Resistance Levels. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

After 31 Surge Worldcoin Wld Faces Crucial Resistance Whats Next For Investors

Apr 26, 2025

After 31 Surge Worldcoin Wld Faces Crucial Resistance Whats Next For Investors

Apr 26, 2025 -

Understanding Li Dar Costs And Supply Chains Impact On Byd And Chinese Automakers

Apr 26, 2025

Understanding Li Dar Costs And Supply Chains Impact On Byd And Chinese Automakers

Apr 26, 2025 -

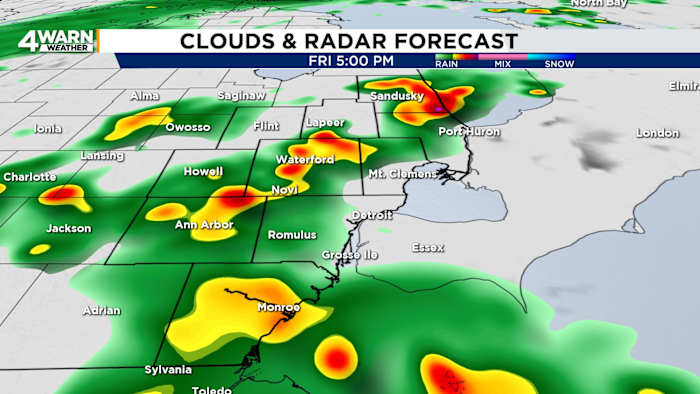

Summer Heat Arrives Early Se Michigan Weekend Weather Update

Apr 26, 2025

Summer Heat Arrives Early Se Michigan Weekend Weather Update

Apr 26, 2025 -

Prince Louis Channels Young Prince William In New Birthday Video

Apr 26, 2025

Prince Louis Channels Young Prince William In New Birthday Video

Apr 26, 2025 -

Benji Ball And The Galvin Saga A Deeper Look At The Wests Tigers Drama

Apr 26, 2025

Benji Ball And The Galvin Saga A Deeper Look At The Wests Tigers Drama

Apr 26, 2025