After Record High, Tesla Stock: Key Price Levels And Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

After Record High, Tesla Stock: Key Price Levels and Predictions

Tesla's stock recently hit record highs, leaving investors buzzing with questions about the future. After such a dramatic surge, where does the electric vehicle giant go from here? This analysis delves into key price levels, potential catalysts, and expert predictions for Tesla's stock price.

Tesla's Record-Breaking Run: A Recap

Tesla's meteoric rise isn't just a matter of hype; it's fueled by strong fundamentals. The company's consistent delivery growth, expansion into new markets (including China), and innovative technological advancements have all contributed to its impressive performance. The recent record high reflects investor confidence in Elon Musk's vision and Tesla's position as a leader in the burgeoning electric vehicle (EV) sector. However, this success also raises questions about sustainability and potential corrections.

Key Price Levels to Watch:

Several key price levels will be crucial in determining Tesla's short-term and long-term trajectory. These include:

- Support Levels: Previous highs and lows often act as support levels. Analysts will be closely watching for a potential pullback to around [insert recent significant support level, e.g., $700] before any further upward momentum. Breaking below this level could signal a more significant correction.

- Resistance Levels: Similarly, previous resistance levels, such as [insert recent significant resistance level, e.g., $850], could act as barriers to further price increases. A successful break above this level would signal strong bullish sentiment.

- Moving Averages: Technical analysts frequently use moving averages (e.g., 50-day, 200-day) to gauge momentum and identify potential trend reversals. A sustained break above the 200-day moving average, for instance, is often considered a bullish signal.

Catalysts for Future Growth:

Several factors could drive Tesla's stock price higher in the coming months and years:

- Cybertruck Launch: The highly anticipated launch of the Cybertruck could significantly boost demand and production volumes.

- Expansion of Supercharger Network: Continued expansion of Tesla's Supercharger network globally will further enhance the appeal of its vehicles.

- Battery Technology Advancements: Breakthroughs in battery technology could lead to improved range, faster charging times, and reduced costs, enhancing Tesla's competitive advantage.

- Energy Business Growth: Tesla's energy business, encompassing solar panels and energy storage solutions, is poised for significant growth, contributing to overall revenue.

- Autonomous Driving Progress: Advancements in Tesla's Full Self-Driving (FSD) technology could significantly increase the value proposition of its vehicles.

Expert Predictions and Market Sentiment:

While predicting the future of any stock is inherently speculative, several analysts offer insights into Tesla's potential. Some predict further growth, citing the factors mentioned above, while others caution about potential overvaluation and the risks associated with a highly volatile stock. [Insert quotes from reputable financial analysts, linking to their sources where possible]. Overall market sentiment towards Tesla remains largely positive, but investors should always exercise caution and diversify their portfolios.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and you should conduct your own thorough research before making any investment decisions.

Conclusion:

Tesla's stock price journey is far from over. While the recent record high is a testament to its success, navigating future price movements requires careful consideration of various factors, including key price levels, potential catalysts, and expert predictions. Keeping a close eye on these elements will be crucial for investors seeking to make informed decisions in this dynamic market. Remember to consult with a financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on After Record High, Tesla Stock: Key Price Levels And Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Figmas Ceo Unveils Innovative Ai Approach For Design

May 12, 2025

Figmas Ceo Unveils Innovative Ai Approach For Design

May 12, 2025 -

Instagram Feud Beckham Calls Out Minnesota United For Goading Inter Miami

May 12, 2025

Instagram Feud Beckham Calls Out Minnesota United For Goading Inter Miami

May 12, 2025 -

Cavaliers Mitchell Injured Pacers Cruise To Easy Game 4 Win In Nba Playoffs

May 12, 2025

Cavaliers Mitchell Injured Pacers Cruise To Easy Game 4 Win In Nba Playoffs

May 12, 2025 -

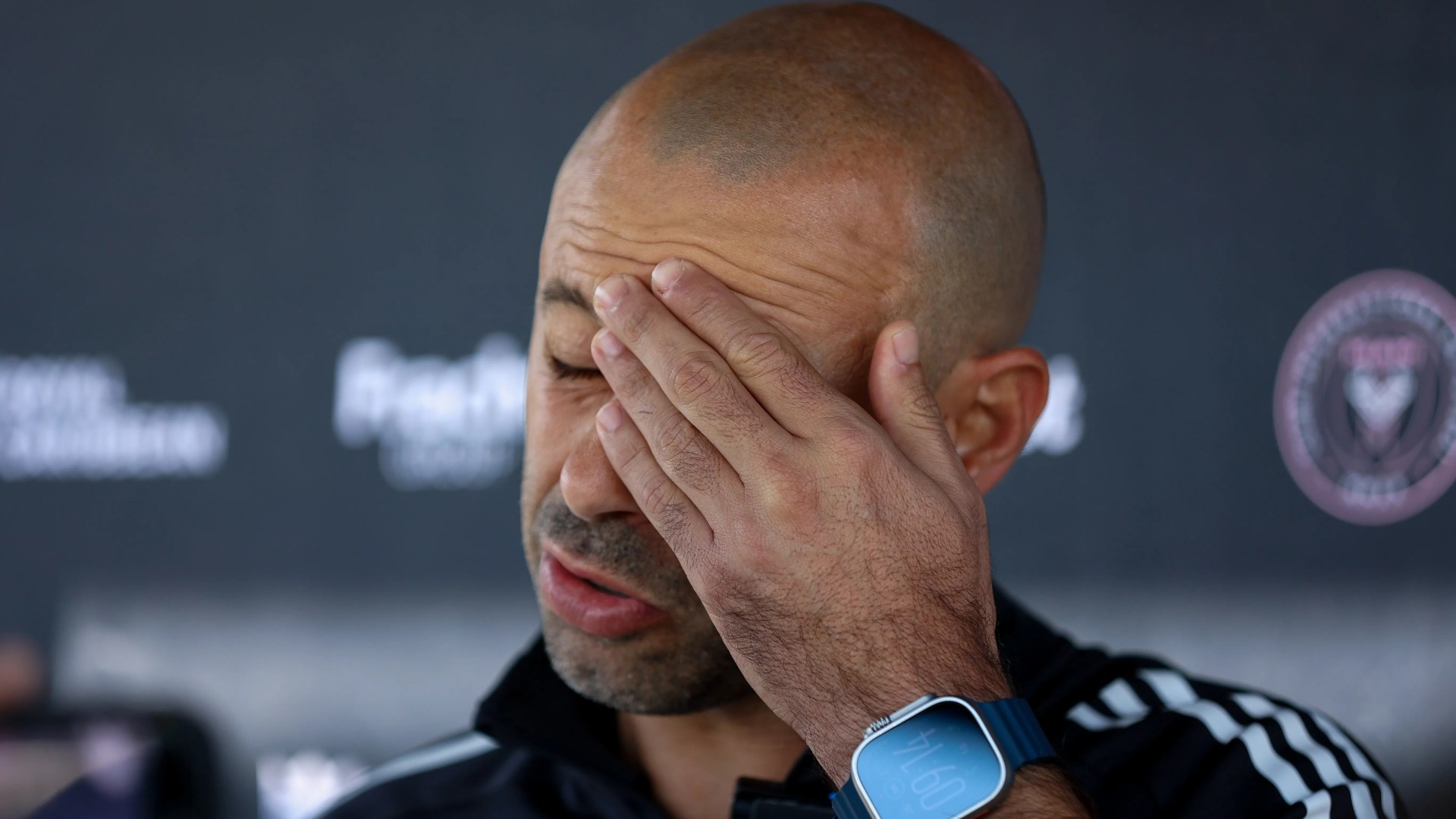

Lionel Messis Worst Mls Night Will David Beckham Axe Javier Mascherano

May 12, 2025

Lionel Messis Worst Mls Night Will David Beckham Axe Javier Mascherano

May 12, 2025 -

Rockies Crushing Defeat 21 0 Loss To Padres Highlights Teams Struggles

May 12, 2025

Rockies Crushing Defeat 21 0 Loss To Padres Highlights Teams Struggles

May 12, 2025

Latest Posts

-

The Urgent Need For Decentralized Cloud Infrastructure Avoiding Single Points Of Failure

May 12, 2025

The Urgent Need For Decentralized Cloud Infrastructure Avoiding Single Points Of Failure

May 12, 2025 -

Next Liberal Leader Key Contenders And Predictions

May 12, 2025

Next Liberal Leader Key Contenders And Predictions

May 12, 2025 -

Sony Xperia 1 Vii Significant Leak Reveals Design And Potential Release Date

May 12, 2025

Sony Xperia 1 Vii Significant Leak Reveals Design And Potential Release Date

May 12, 2025 -

23 000 Scam Fake Ai Images Of Chris Brown Target Woman

May 12, 2025

23 000 Scam Fake Ai Images Of Chris Brown Target Woman

May 12, 2025 -

Major Incident On South Essex Bypass Road Closure And Extensive Traffic Delays

May 12, 2025

Major Incident On South Essex Bypass Road Closure And Extensive Traffic Delays

May 12, 2025