AI Stock Down 25%: Smart Investment Opportunity Before April 17?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AI Stock Down 25%: Smart Investment Opportunity Before April 17?

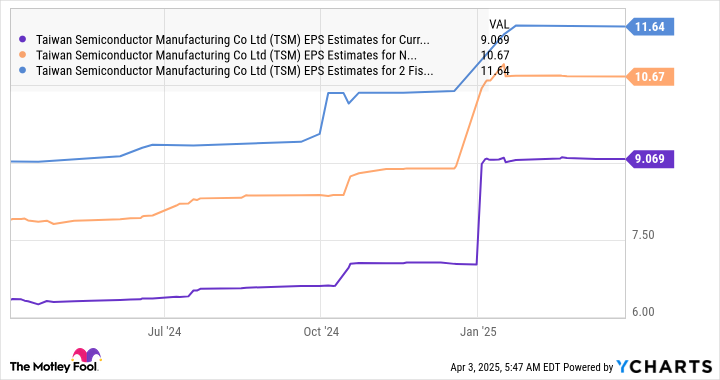

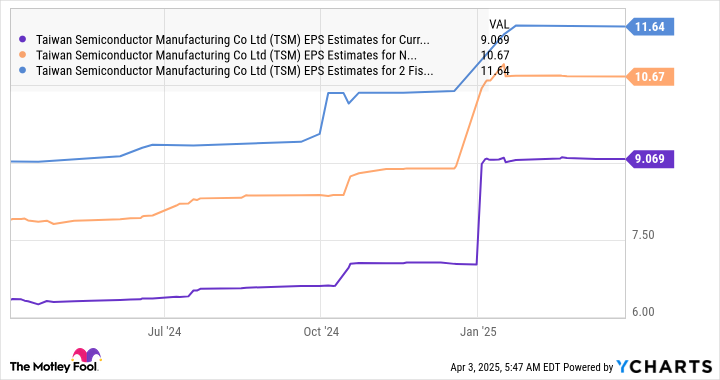

Artificial intelligence (AI) stocks have taken a significant hit recently, with some experiencing a dramatic 25% drop. This sharp decline has left many investors wondering: is this a buying opportunity, or a sign of further trouble ahead? While predicting the market is always risky, understanding the current landscape and potential catalysts could help you make informed decisions before April 17th.

The AI Market Correction: What's Driving the Dip?

Several factors contribute to the recent downturn in the AI sector. Firstly, the overall market volatility has impacted even high-growth sectors like AI. Concerns about inflation, rising interest rates, and a potential recession have led to investors seeking safer, more conservative investments.

Secondly, the rapid growth of the AI sector over the past few years has led to some overvaluation. Many AI companies are still in their early stages, and their valuations haven't always reflected their current profitability. This makes them more susceptible to corrections when investor sentiment shifts.

Thirdly, increased regulatory scrutiny is a looming concern. Governments worldwide are starting to examine the ethical and societal implications of AI, leading to potential future regulations that could impact the profitability of AI companies. This uncertainty contributes to investor hesitation.

Is This a Buying Opportunity? Analyzing the Potential Before April 17th

The 25% drop presents a compelling argument for some investors. For those with a long-term perspective and a high-risk tolerance, this could represent a significant discount on potentially game-changing technologies. However, caution is warranted.

Here are some key factors to consider before investing:

- Company Fundamentals: Thoroughly research the financial health of any AI company you're considering. Look beyond the hype and examine revenue growth, profitability, and debt levels. A strong balance sheet can help a company weather market downturns.

- Technology Differentiation: Not all AI companies are created equal. Identify companies with truly innovative technologies and a clear path to market dominance. A unique selling proposition can provide a competitive edge.

- Market Timing: Predicting market bottoms is impossible. While the current dip might be attractive, further corrections are possible. Consider a phased investment approach to mitigate risk.

- Regulatory Landscape: Stay informed about evolving regulations impacting the AI sector. Changes in policy can significantly affect a company's profitability and growth potential.

Potential Catalysts Before April 17th:

Several events before April 17th could influence AI stock prices:

- Earnings Reports: Keep an eye on upcoming earnings reports from key AI companies. Strong results could boost investor confidence and drive prices higher.

- Technological Breakthroughs: Announcements of significant technological advancements could reignite investor enthusiasm and drive up stock prices.

- Positive Regulatory News: Favorable regulatory developments or clarifications could reduce uncertainty and attract new investment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Keywords: AI stock, AI investment, artificial intelligence, stock market, investment opportunity, market correction, April 17, tech stocks, AI technology, investment strategy, risk management, stock market analysis, market volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AI Stock Down 25%: Smart Investment Opportunity Before April 17?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bhim Kohli Case 13 Year Old Girl And 15 Year Old Boy Convicted Of Manslaughter

Apr 08, 2025

Bhim Kohli Case 13 Year Old Girl And 15 Year Old Boy Convicted Of Manslaughter

Apr 08, 2025 -

Serial Bidaah Sosok Walid Dan Dampaknya Terhadap Jumlah Penonton

Apr 08, 2025

Serial Bidaah Sosok Walid Dan Dampaknya Terhadap Jumlah Penonton

Apr 08, 2025 -

Hong Kong Stocks Suffer Worst Day Since Asian Financial Crisis

Apr 08, 2025

Hong Kong Stocks Suffer Worst Day Since Asian Financial Crisis

Apr 08, 2025 -

Joint Mas Csa Statement Toppan Next Tech Suffers Ransomware Attack

Apr 08, 2025

Joint Mas Csa Statement Toppan Next Tech Suffers Ransomware Attack

Apr 08, 2025 -

Power Rankings A Deep Dive Into The 2024 Masters Tournament Field

Apr 08, 2025

Power Rankings A Deep Dive Into The 2024 Masters Tournament Field

Apr 08, 2025