AI Stock Plunge: Is This 25% Drop A Buying Opportunity Before April 17?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AI Stock Plunge: Is This 25% Drop a Buying Opportunity Before April 17?

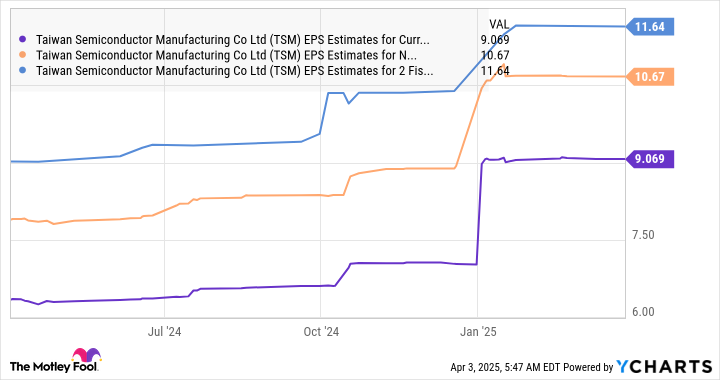

The artificial intelligence (AI) sector has experienced a dramatic shake-up, with several prominent AI stocks plummeting by as much as 25% in recent weeks. This significant drop has left investors questioning whether this represents a temporary setback or a more serious market correction. The question on everyone's mind: is this a buying opportunity before April 17th, or a sign of trouble to come?

This volatility follows a period of intense growth and hype surrounding AI, fueled by advancements in large language models and generative AI. However, recent profit warnings and concerns about the long-term viability of some AI projects have led to a significant market reassessment. Let's delve into the factors contributing to this AI stock plunge and explore whether this presents a compelling investment opportunity.

What Triggered the AI Stock Market Correction?

Several key factors have contributed to the recent downturn in the AI market:

- Profit Warnings: Several leading AI companies have issued profit warnings, indicating slower-than-expected growth and increased operating costs. This has shaken investor confidence and triggered sell-offs.

- Valuation Concerns: The rapid rise in AI stock prices in the preceding months led to concerns about overvaluation. Some analysts believe that current market valuations don't accurately reflect the underlying financial performance of these companies.

- Regulatory Uncertainty: The increasing scrutiny of AI technologies by regulatory bodies globally adds another layer of uncertainty. Potential regulations could impact the future profitability and growth prospects of AI companies.

- Increased Competition: The AI sector is becoming increasingly competitive, with new players emerging and established companies investing heavily in R&D. This intense competition could squeeze profit margins.

- Economic Headwinds: The broader macroeconomic environment, characterized by inflation and potential recessionary pressures, is also impacting investor sentiment and risk appetite.

Is This a Buying Opportunity Before April 17th?

The 25% drop in some AI stocks has undoubtedly created a tempting entry point for some investors. However, the decision to buy should not be taken lightly. Before April 17th (a date often cited as a potential catalyst for further market movement, though this is purely speculative), consider these factors:

- Fundamental Analysis: Thoroughly research the financial health and long-term prospects of any AI company you are considering investing in. Look beyond the hype and focus on concrete metrics like revenue growth, profitability, and debt levels.

- Risk Tolerance: Investing in AI stocks inherently involves a degree of risk. Only invest money you can afford to lose, and diversify your portfolio to mitigate potential losses.

- Long-Term Perspective: The AI industry is still in its early stages of development. A long-term investment strategy is crucial, as short-term volatility is to be expected.

- Market Sentiment: Pay close attention to market sentiment and news surrounding the AI sector. Sudden shifts in investor sentiment can significantly impact stock prices.

- Expert Opinion: Consult with a qualified financial advisor before making any investment decisions. They can help you assess your risk tolerance and create a diversified investment strategy.

Looking Ahead: Navigating the AI Market

The recent AI stock plunge underscores the inherent volatility of this rapidly evolving sector. While the 25% drop might present a buying opportunity for some, it's crucial to approach this with caution and conduct thorough due diligence. The period leading up to April 17th will likely see continued market fluctuation, making informed decision-making even more critical. Remember, successful investing requires a balanced approach that combines careful analysis with a long-term perspective and a realistic assessment of risk. Don't let the hype cloud your judgment; rely on facts and sound financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AI Stock Plunge: Is This 25% Drop A Buying Opportunity Before April 17?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

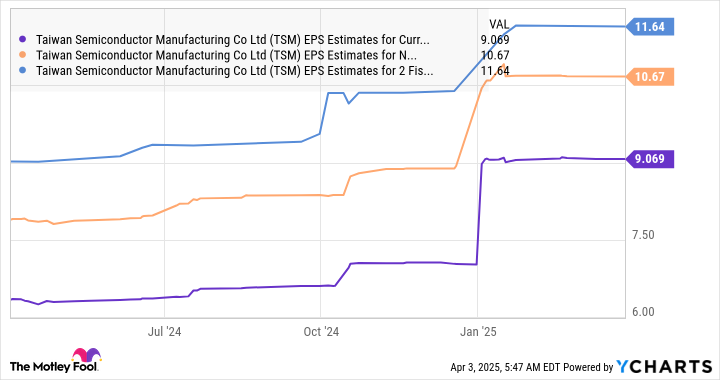

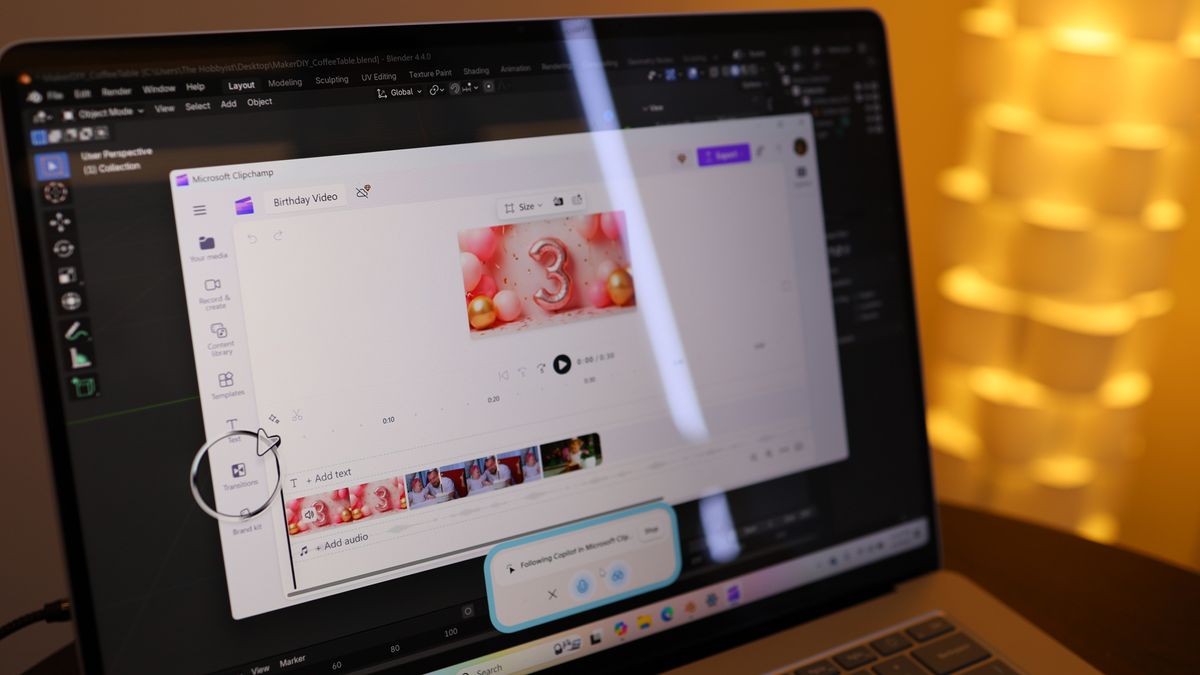

I Tested Copilot Vision For Windows Heres What I Found

Apr 07, 2025

I Tested Copilot Vision For Windows Heres What I Found

Apr 07, 2025 -

Semiconductor Industry Ajinomoto Scales Up Production

Apr 07, 2025

Semiconductor Industry Ajinomoto Scales Up Production

Apr 07, 2025 -

Urgent Irs Announces Changes Impacting Your 2023 Tax Return

Apr 07, 2025

Urgent Irs Announces Changes Impacting Your 2023 Tax Return

Apr 07, 2025 -

Champions League Semi Final Race Heats Up Quarter Final Showdowns Begin

Apr 07, 2025

Champions League Semi Final Race Heats Up Quarter Final Showdowns Begin

Apr 07, 2025 -

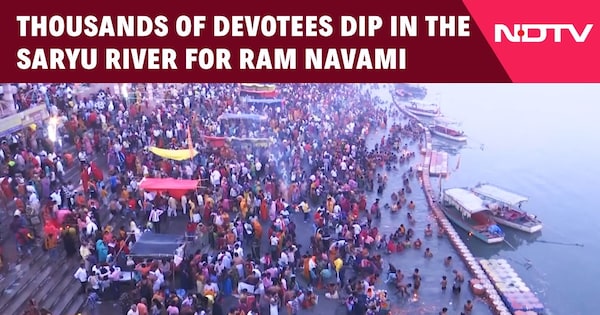

Video Devotees Faith On Display At Saryu River On Ram Navami

Apr 07, 2025

Video Devotees Faith On Display At Saryu River On Ram Navami

Apr 07, 2025