AIRO IPO Pricing: Aerospace & Defense Company Targets $75 Million

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AIRO IPO Pricing: Aerospace & Defense Company Targets $75 Million

AIRO, a leading innovator in aerospace and defense technology, is set to launch its highly anticipated Initial Public Offering (IPO), aiming to raise $75 million in fresh capital. This move marks a significant milestone for the company, paving the way for further expansion and groundbreaking advancements in its sector. The IPO pricing and details have been eagerly awaited by investors, reflecting the growing interest in the future of aerospace and defense technology.

The company's prospectus, filed with the Securities and Exchange Commission (SEC), reveals a planned offering of [Number] shares at a price range of $[Price per share] to $[Price per share]. This valuation positions AIRO competitively within the burgeoning aerospace and defense market, attracting significant attention from both individual and institutional investors.

H2: What Makes AIRO's IPO so Attractive?

AIRO's success stems from its commitment to cutting-edge research and development, specifically in [mention key technological areas, e.g., drone technology, AI-powered surveillance systems, advanced materials]. Several factors contribute to the attractiveness of this IPO:

- Strong Growth Trajectory: AIRO has demonstrated consistent revenue growth and profitability in recent years, showcasing its strong market position and potential for future expansion. Their recent contracts with [mention key clients or government agencies if possible] further solidify their position.

- Disruptive Technology: The company’s innovative technologies are disrupting traditional methods in the aerospace and defense sector, offering significant advantages in terms of efficiency, cost-effectiveness, and performance. This makes AIRO a compelling investment for those seeking exposure to disruptive innovation.

- Experienced Management Team: AIRO boasts a highly experienced leadership team with a proven track record in the aerospace and defense industry. This expertise instills confidence in investors regarding the company’s future strategic direction and operational capabilities.

- Growing Market Demand: The global aerospace and defense market is experiencing significant growth, driven by increasing government spending on defense modernization and the rising adoption of advanced technologies. AIRO is well-positioned to capitalize on this market expansion.

H2: Potential Risks and Considerations for Investors

While the IPO presents a promising investment opportunity, potential investors should be aware of certain risks:

- Market Volatility: The stock market is inherently volatile, and the price of AIRO's shares could fluctuate significantly after the IPO.

- Competition: The aerospace and defense industry is competitive, and AIRO faces competition from established players and emerging startups.

- Regulatory Compliance: The aerospace and defense sector is heavily regulated, and AIRO must comply with various regulations and standards.

H2: IPO Timeline and Next Steps

The AIRO IPO is expected to [mention the expected date or timeframe]. Investors interested in participating should consult with their financial advisors to determine if investing in AIRO aligns with their investment objectives and risk tolerance. Further details regarding the offering will be made available through the company's website and official SEC filings.

H2: Conclusion:

AIRO's IPO presents a significant opportunity for investors seeking exposure to the dynamic aerospace and defense technology sector. The company's innovative technology, strong growth trajectory, and experienced management team make it a compelling investment proposition. However, potential investors should carefully consider the associated risks before making any investment decisions. The $75 million funding goal highlights the ambitious plans AIRO has for the future, making this IPO a key event to watch in the coming weeks. Stay tuned for further updates as the IPO progresses.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AIRO IPO Pricing: Aerospace & Defense Company Targets $75 Million. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uk Court Ruling Home Office Fails In Secret Legal Battle Against Apple Over I Phone Security

Apr 10, 2025

Uk Court Ruling Home Office Fails In Secret Legal Battle Against Apple Over I Phone Security

Apr 10, 2025 -

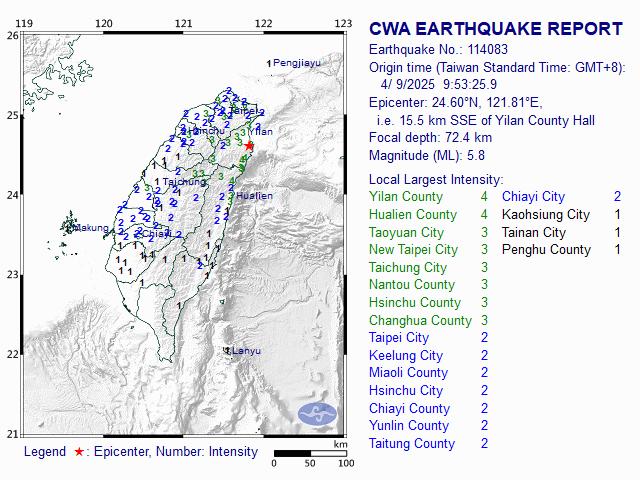

Strong Quake Strikes Northern Taiwan But Reports Indicate No Damage Or Casualties

Apr 10, 2025

Strong Quake Strikes Northern Taiwan But Reports Indicate No Damage Or Casualties

Apr 10, 2025 -

Mickelsons Classy Gesture To Keegan Bradley A Show Of True Sportsmanship

Apr 10, 2025

Mickelsons Classy Gesture To Keegan Bradley A Show Of True Sportsmanship

Apr 10, 2025 -

9 Kutipan Film Jumbo Yang Akan Mengubah Perspektif Anda

Apr 10, 2025

9 Kutipan Film Jumbo Yang Akan Mengubah Perspektif Anda

Apr 10, 2025 -

Masters 2025 Your Complete Guide To Watching The Tournament

Apr 10, 2025

Masters 2025 Your Complete Guide To Watching The Tournament

Apr 10, 2025