Alibaba Shares Tumble After Earnings Disappointment: A 5% Pre-Market Drop

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alibaba Shares Tumble After Earnings Disappointment: A 5% Pre-Market Drop

Alibaba Group Holding Limited (BABA), the Chinese e-commerce giant, experienced a significant pre-market slump on Thursday, with shares dropping approximately 5% following the release of its latest quarterly earnings report. The disappointing results sent shockwaves through the market, raising concerns about the company's future growth prospects in a challenging economic climate. This substantial drop underscores the pressure Alibaba faces amidst increasing competition and a slowing Chinese economy.

What Triggered the Alibaba Stock Plunge?

The primary catalyst for the Alibaba stock tumble was the company's Q4 2023 earnings report, which fell short of analysts' expectations. Revenue growth remained sluggish, highlighting the difficulties Alibaba is facing in maintaining its dominance in the increasingly competitive Chinese e-commerce market. Key factors contributing to the underwhelming performance include:

-

Increased Competition: Alibaba is facing intensifying competition from rivals such as Pinduoduo and JD.com, which are aggressively expanding their market share. This competitive landscape is forcing Alibaba to invest heavily in marketing and promotions, impacting profitability.

-

Slowing Chinese Economy: The broader economic slowdown in China has also weighed heavily on consumer spending, directly affecting Alibaba's revenue growth. Reduced consumer confidence and discretionary spending have impacted sales across various sectors, including e-commerce.

-

Regulatory Scrutiny: The lingering impact of past regulatory crackdowns on Chinese tech companies continues to cast a shadow over Alibaba's operations and investor sentiment. While some regulatory uncertainties have eased, the ongoing regulatory environment remains a key factor influencing investor confidence.

Analyzing the Impact on Investors and the Future of Alibaba

The 5% pre-market drop represents a significant loss of investor confidence. Many analysts are now reassessing their projections for Alibaba's future performance, prompting a downward revision of price targets. This downturn highlights the inherent risks associated with investing in Chinese tech companies, particularly in light of ongoing geopolitical and economic uncertainties.

However, it's important to note that Alibaba remains a dominant player in the Chinese e-commerce market, boasting a massive user base and a diversified portfolio of businesses beyond its core e-commerce platform. The company is actively exploring new growth avenues, including cloud computing and digital entertainment, to diversify its revenue streams and mitigate risks.

Looking Ahead: What to Expect from Alibaba

The coming months will be crucial for Alibaba. The company will need to demonstrate a clear strategy to navigate the challenges it faces, including:

-

Strengthening its competitive edge: Alibaba needs to innovate and differentiate its offerings to better compete with rivals and attract new users.

-

Capitalizing on growth opportunities: Effectively leveraging its strengths in cloud computing and other emerging sectors will be essential for sustained growth.

-

Improving investor confidence: Transparent communication and a clear roadmap for future growth are critical to regaining investor trust and boosting the stock price.

The Alibaba stock tumble serves as a stark reminder of the inherent volatility in the tech sector, especially in a rapidly evolving global economic landscape. While the short-term outlook remains uncertain, Alibaba's long-term prospects will largely depend on its ability to adapt to the changing market dynamics and effectively execute its strategic initiatives. The coming quarters will be crucial in determining whether this recent setback represents a temporary blip or a more significant shift in the company's trajectory.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alibaba Shares Tumble After Earnings Disappointment: A 5% Pre-Market Drop. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

No Karen Read Trial On Tuesday Court Delays Due To Unavoidable Circumstances

May 15, 2025

No Karen Read Trial On Tuesday Court Delays Due To Unavoidable Circumstances

May 15, 2025 -

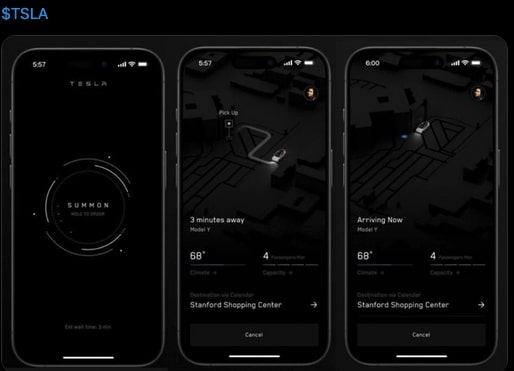

Will Tesla Launch Ridesharing In Austin This June Supervised And Unsupervised Models Under Scrutiny

May 15, 2025

Will Tesla Launch Ridesharing In Austin This June Supervised And Unsupervised Models Under Scrutiny

May 15, 2025 -

Music Producer Injured Chris Brown Arrested For Assault At Nightclub

May 15, 2025

Music Producer Injured Chris Brown Arrested For Assault At Nightclub

May 15, 2025 -

Tennis In Rome Gauff Andreeva Alcaraz And Draper Headline Matchups

May 15, 2025

Tennis In Rome Gauff Andreeva Alcaraz And Draper Headline Matchups

May 15, 2025 -

Balanco Da Tragedia No Rs 75 Vitimas Fatais E Quase 1 3 Milhao De Imoveis Sem Servicos Essenciais

May 15, 2025

Balanco Da Tragedia No Rs 75 Vitimas Fatais E Quase 1 3 Milhao De Imoveis Sem Servicos Essenciais

May 15, 2025

Latest Posts

-

Afl Round 10 Matchups Key Players And Betting Odds

May 15, 2025

Afl Round 10 Matchups Key Players And Betting Odds

May 15, 2025 -

Victoria Day Fireworks Toronto 2025 Best Viewing Spots And Events

May 15, 2025

Victoria Day Fireworks Toronto 2025 Best Viewing Spots And Events

May 15, 2025 -

The Highly Anticipated Reese Witherspoon Novel Cover And Title Launch

May 15, 2025

The Highly Anticipated Reese Witherspoon Novel Cover And Title Launch

May 15, 2025 -

Find Your Flow A Lofi Journaling Kit For The Digital Age

May 15, 2025

Find Your Flow A Lofi Journaling Kit For The Digital Age

May 15, 2025 -

Fbc Firebreak Remedys Departure From Traditional Game Storytelling

May 15, 2025

Fbc Firebreak Remedys Departure From Traditional Game Storytelling

May 15, 2025