Amazon (AMZN) Stock: Think Investments' Top Recommendation Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon (AMZN) Stock: Think Investments' Top Recommendation Analyzed

Amazon (AMZN) stock has consistently been a subject of intense speculation and analysis within the investment community. Recently, Think Investments, a prominent financial advisory firm, named AMZN their top recommendation, sparking considerable interest and prompting a deeper dive into the rationale behind this bullish prediction. This article will dissect Think Investments' assessment, examining the factors contributing to their positive outlook and weighing the potential risks associated with investing in Amazon at this time.

Think Investments' Bullish Case for Amazon

Think Investments' recommendation isn't based on short-term market fluctuations, but rather a long-term view of Amazon's diversified and rapidly expanding business model. Their analysis highlights several key factors:

-

Dominant E-commerce Position: Amazon maintains an unparalleled position in the global e-commerce market, consistently expanding its market share and customer base. This dominance translates into significant and recurring revenue streams, providing a strong foundation for future growth.

-

AWS Cloud Computing Leadership: Amazon Web Services (AWS) remains the undisputed leader in cloud computing, boasting a robust infrastructure and a massive customer base spanning various industries. AWS’s consistent growth contributes significantly to Amazon's overall profitability and provides a critical buffer against economic downturns.

-

Expansion into New Markets: Amazon continues to aggressively expand into new and emerging markets, including advertising, healthcare, and autonomous delivery. These diversification efforts significantly reduce reliance on any single revenue stream and position Amazon for long-term growth across multiple sectors.

-

Technological Innovation: Amazon’s commitment to research and development ensures a constant stream of innovative products and services, maintaining its competitive edge and driving future growth. This includes advancements in AI, machine learning, and logistics.

-

Strong Brand Recognition and Loyalty: Amazon enjoys unparalleled brand recognition and customer loyalty, a powerful asset in the highly competitive retail landscape. This translates to repeat business and a strong foundation for future expansion.

Potential Risks and Considerations

While Think Investments presents a compelling case, it's crucial to acknowledge potential risks associated with investing in Amazon:

-

Regulatory Scrutiny: Amazon faces increasing regulatory scrutiny regarding antitrust concerns and its market dominance. Potential fines or restrictions could negatively impact its financial performance.

-

Economic Downturn: While AWS provides a cushion, a significant economic downturn could still negatively affect consumer spending, impacting Amazon's core e-commerce business.

-

Competition: Amazon faces intense competition from other tech giants and emerging players in various sectors, which could erode its market share.

-

Valuation: Amazon's current valuation is substantial, and any disappointment in future earnings could trigger a stock price correction.

Conclusion: A Long-Term Perspective

Think Investments' top recommendation for Amazon stock reflects a long-term perspective, focusing on the company's diversified growth potential and market leadership. While potential risks exist, the firm's analysis underscores Amazon's resilience and ability to adapt to changing market dynamics. However, potential investors should carefully consider their risk tolerance and conduct thorough due diligence before making any investment decisions. This is not financial advice; consult a qualified financial advisor before investing in any stock. The information provided is for educational purposes only. Remember to always research and understand the risks involved before investing in the stock market. Keywords: Amazon stock, AMZN, Think Investments, stock analysis, investment recommendation, e-commerce, AWS, cloud computing, tech stocks, stock market analysis, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon (AMZN) Stock: Think Investments' Top Recommendation Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Election 2024 The Fight For The Older Womens Vote On Facebook

Apr 07, 2025

Election 2024 The Fight For The Older Womens Vote On Facebook

Apr 07, 2025 -

Massive Eu Fines For X Apple And Meta Digital Markets Act Enforcement Begins

Apr 07, 2025

Massive Eu Fines For X Apple And Meta Digital Markets Act Enforcement Begins

Apr 07, 2025 -

Defenders Return Boosts Team For Power Clash

Apr 07, 2025

Defenders Return Boosts Team For Power Clash

Apr 07, 2025 -

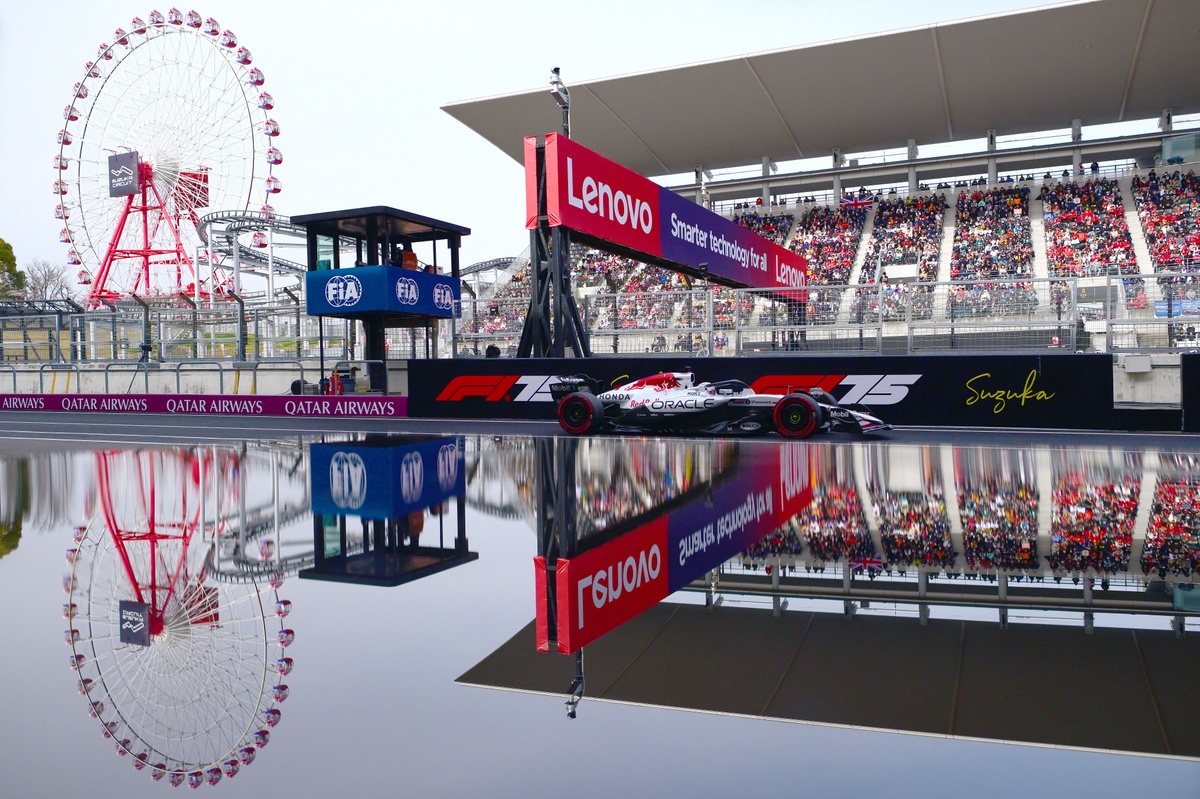

F1 Japanese Grand Prix Race Day Live Updates And Commentary

Apr 07, 2025

F1 Japanese Grand Prix Race Day Live Updates And Commentary

Apr 07, 2025 -

Dow Jones Plunges Nearly 6 Us Stocks Suffer Sharpest Daily Drop In Months

Apr 07, 2025

Dow Jones Plunges Nearly 6 Us Stocks Suffer Sharpest Daily Drop In Months

Apr 07, 2025