Amazon Stock And Tariffs: A Guide For Investors Considering The Dip

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon Stock and Tariffs: A Guide for Investors Considering the Dip

Amazon. The behemoth of e-commerce. Its stock price, however, has shown some recent volatility, prompting many investors to consider whether now is the time to buy, sell, or hold. A significant factor contributing to this uncertainty? Tariffs. This guide will delve into the complex relationship between Amazon stock and tariffs, helping you navigate this potentially lucrative – or perilous – investment landscape.

The Impact of Tariffs on Amazon

Tariffs, essentially taxes on imported goods, have created a ripple effect across various sectors, and Amazon is no exception. While Amazon operates globally, a significant portion of its inventory relies on imported goods. Increased tariffs translate directly to higher costs for these products, potentially squeezing profit margins.

This impact isn't uniform across all Amazon's business segments. Its AWS (Amazon Web Services) cloud computing division, for instance, is less directly affected by tariffs than its retail operations. However, even AWS isn't entirely immune, as increased costs for infrastructure and components can trickle down.

How Tariffs Affect Amazon Stock Price

The stock market's reaction to tariff news is often immediate and dramatic. Announcements of new or increased tariffs tend to negatively affect investor sentiment, leading to a dip in Amazon's stock price. This is primarily due to the perceived threat to profitability and the potential for decreased consumer spending due to higher prices.

However, it's crucial to remember that the market's response is often short-term and overreactive. Amazon has demonstrated considerable resilience in the past, adapting to economic headwinds and emerging stronger.

Analyzing the Current Situation: Is it a Buying Opportunity?

The question on every investor's mind: is the current dip in Amazon stock a buying opportunity? The answer is nuanced and depends on several factors:

- Your Investment Horizon: If you're a long-term investor with a horizon of five years or more, a temporary dip caused by tariffs might present a compelling entry point. Amazon's long-term growth prospects remain strong.

- Diversification: Always maintain a diversified portfolio. Don't put all your eggs in one basket, even a seemingly robust one like Amazon.

- Risk Tolerance: Investing in the stock market always involves risk. If you're risk-averse, consider reducing your exposure to Amazon during periods of tariff-related uncertainty.

- Market Analysis: Stay informed about global economic conditions and tariff developments. Understanding the broader economic landscape is crucial for making informed investment decisions.

Strategies for Investors

Here are a few strategies investors might consider:

- Dollar-Cost Averaging (DCA): Instead of investing a lump sum, gradually invest smaller amounts over time. This reduces the impact of market volatility.

- Hedging: Consider hedging strategies to mitigate potential losses if the stock price continues to decline. This could involve options trading or other risk-management techniques. However, this requires a sophisticated understanding of financial markets.

- Consult a Financial Advisor: Seeking advice from a qualified financial advisor is always recommended, especially when dealing with complex market conditions.

Conclusion: Navigating the Uncertainty

The relationship between Amazon stock and tariffs is undeniably complex. While tariffs pose a challenge, Amazon's adaptability and long-term growth potential should not be underestimated. For investors considering the current dip, thorough research, risk assessment, and potentially professional financial advice are crucial before making any investment decisions. Remember, past performance is not indicative of future results. This analysis serves as information and should not be construed as financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon Stock And Tariffs: A Guide For Investors Considering The Dip. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Starlink Approved For Operation In Bangladesh A New Era Of Internet Connectivity

Apr 07, 2025

Starlink Approved For Operation In Bangladesh A New Era Of Internet Connectivity

Apr 07, 2025 -

Yokohama Marinos Resmi Dapatkan Sandy Walsh Detail Transfer Dan Harapan Klub

Apr 07, 2025

Yokohama Marinos Resmi Dapatkan Sandy Walsh Detail Transfer Dan Harapan Klub

Apr 07, 2025 -

European Footballs Elite Eight Champions League Semi Final Showdown Begins

Apr 07, 2025

European Footballs Elite Eight Champions League Semi Final Showdown Begins

Apr 07, 2025 -

New Stock Market Losses Pressure Trump To Address Tariff Related Economic Uncertainty

Apr 07, 2025

New Stock Market Losses Pressure Trump To Address Tariff Related Economic Uncertainty

Apr 07, 2025 -

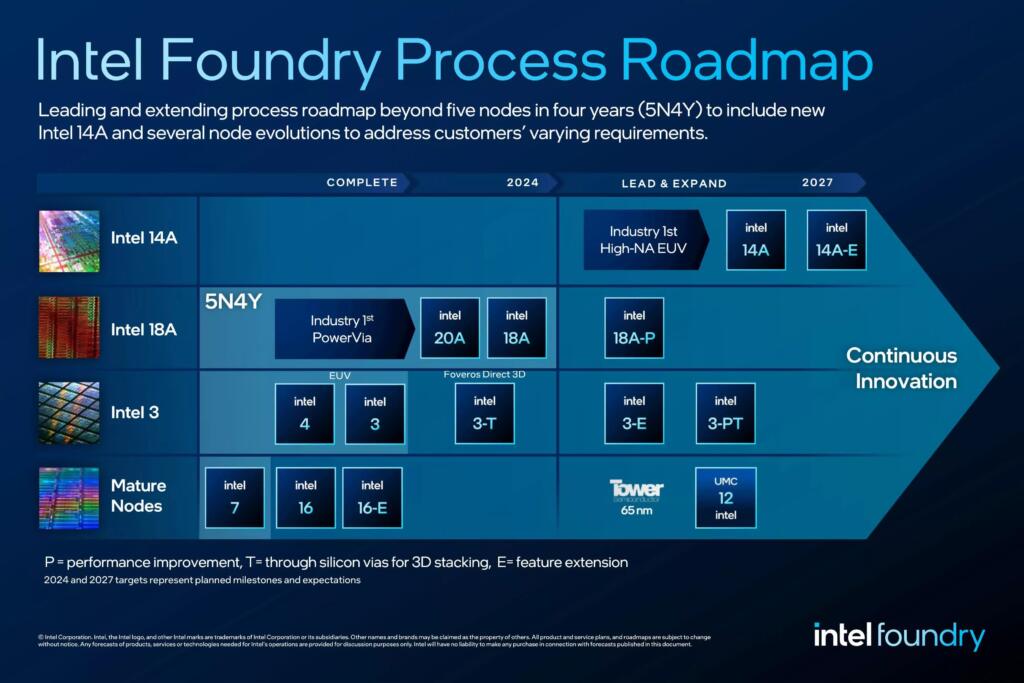

Intels 18 Angstrom Chips Second Half 2025 Production Launch

Apr 07, 2025

Intels 18 Angstrom Chips Second Half 2025 Production Launch

Apr 07, 2025