Amazon Stock Plunges Following Disappointing Q2 Revenue Projections (AMZN)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon Stock Plunges Following Disappointing Q2 Revenue Projections (AMZN)

Amazon's stock took a significant dive after the e-commerce giant released its Q2 2024 revenue projections, falling short of Wall Street expectations and sparking concerns about the company's future growth. The announcement sent shockwaves through the market, leaving investors scrambling to understand the implications for this tech behemoth. This unexpected downturn raises crucial questions about the health of the broader tech sector and the resilience of consumer spending.

Disappointing Projections Fuel Market Uncertainty

Amazon projected Q2 revenue between $126.5 billion and $131.5 billion, significantly lower than analyst estimates averaging around $133 billion. This shortfall, attributed to a slowdown in online retail sales and a more challenging macroeconomic environment, fueled immediate selling pressure on AMZN stock. The company cited a combination of factors impacting their revenue, including increased competition, lingering inflation, and shifts in consumer behavior.

Beyond the Numbers: Deeper Dive into Amazon's Challenges

The disappointing revenue projections are only part of a larger narrative unfolding at Amazon. Several underlying factors contributed to the market's negative reaction:

-

Increased Competition: Amazon faces increasingly stiff competition from other e-commerce giants and rapidly growing niche players. This competitive landscape is squeezing profit margins and hindering growth.

-

Inflationary Pressures: Persistent inflation continues to impact consumer spending, leading to a reduction in discretionary purchases and affecting Amazon's overall sales volume.

-

AWS Growth Slowdown: While Amazon Web Services (AWS) remains a significant profit driver, its growth rate has also shown signs of slowing down, adding to investor anxieties. This slowdown suggests potential saturation in the cloud computing market or increased competition from other cloud providers.

-

Cost-Cutting Measures: Amazon has recently implemented various cost-cutting measures, including layoffs and a freeze on hiring. These actions, while intended to improve profitability, can signal underlying weaknesses and lack of confidence in future growth prospects.

Market Reaction and Investor Sentiment

The market reacted swiftly and decisively to the news. AMZN stock experienced a sharp decline, wiping billions off the company's market capitalization. Investor sentiment turned decidedly negative, reflecting concerns about the sustainability of Amazon's growth trajectory. Many analysts are now revising their price targets for AMZN stock, reflecting a more pessimistic outlook for the near term.

Looking Ahead: Can Amazon Recover?

Despite the significant setback, Amazon remains a dominant player in e-commerce and cloud computing. The company possesses a vast infrastructure, a loyal customer base, and a strong brand reputation. However, navigating the current economic headwinds and intensifying competition will require strategic adjustments and a renewed focus on innovation. The coming quarters will be crucial in determining whether Amazon can successfully adapt and regain its growth momentum. The company's ability to effectively manage costs, innovate new products and services, and capture market share will be key to its future success. The long-term prospects for AMZN remain uncertain, but the recent plunge highlights the challenges faced by even the most dominant tech companies in a volatile market.

Keywords: Amazon, AMZN, Amazon stock, stock market, Q2 revenue, revenue projections, e-commerce, AWS, cloud computing, tech sector, investor sentiment, market reaction, economic downturn, competition, inflation, consumer spending.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon Stock Plunges Following Disappointing Q2 Revenue Projections (AMZN). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chee Soon Juan Levels Accusations Of Policy Copying Against Pap Ahead Of Ge 2025

May 02, 2025

Chee Soon Juan Levels Accusations Of Policy Copying Against Pap Ahead Of Ge 2025

May 02, 2025 -

Ruben Amorims Starting Xi Athletic Club Man Utd Clash Preview

May 02, 2025

Ruben Amorims Starting Xi Athletic Club Man Utd Clash Preview

May 02, 2025 -

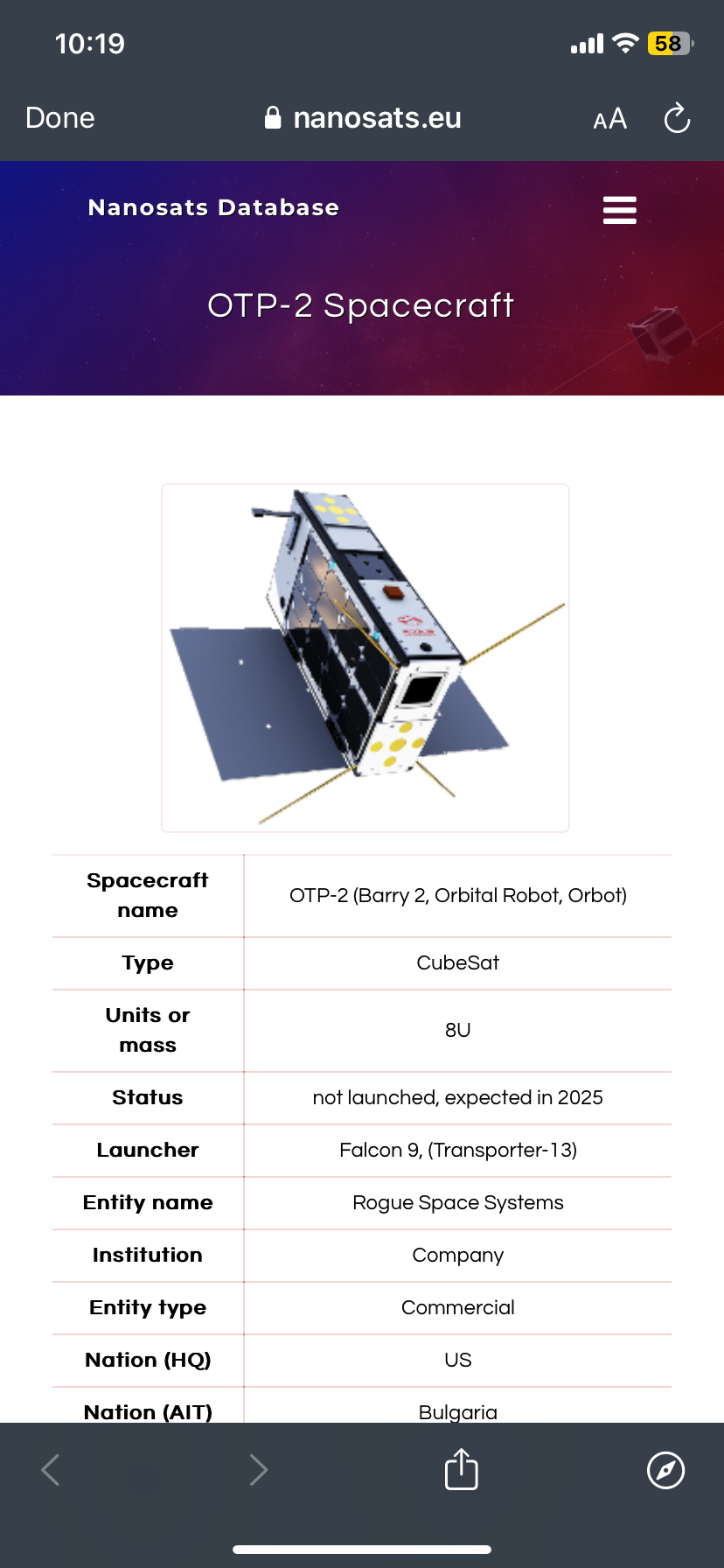

Two Propulsion System Tests On Otp 2 A Detailed Analysis

May 02, 2025

Two Propulsion System Tests On Otp 2 A Detailed Analysis

May 02, 2025 -

Tim Cooks Alleged Actions Exposed Sundar Pichai Testifies Against Apple In Major Case

May 02, 2025

Tim Cooks Alleged Actions Exposed Sundar Pichai Testifies Against Apple In Major Case

May 02, 2025 -

Isuzu Joins Electric Pickup Truck Race The Next Big Ev Battleground

May 02, 2025

Isuzu Joins Electric Pickup Truck Race The Next Big Ev Battleground

May 02, 2025