AMD: $1.5 Billion Revenue Hit Projected From US China Chip Export Restrictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMD Projects $1.5 Billion Revenue Hit from US-China Chip Export Restrictions

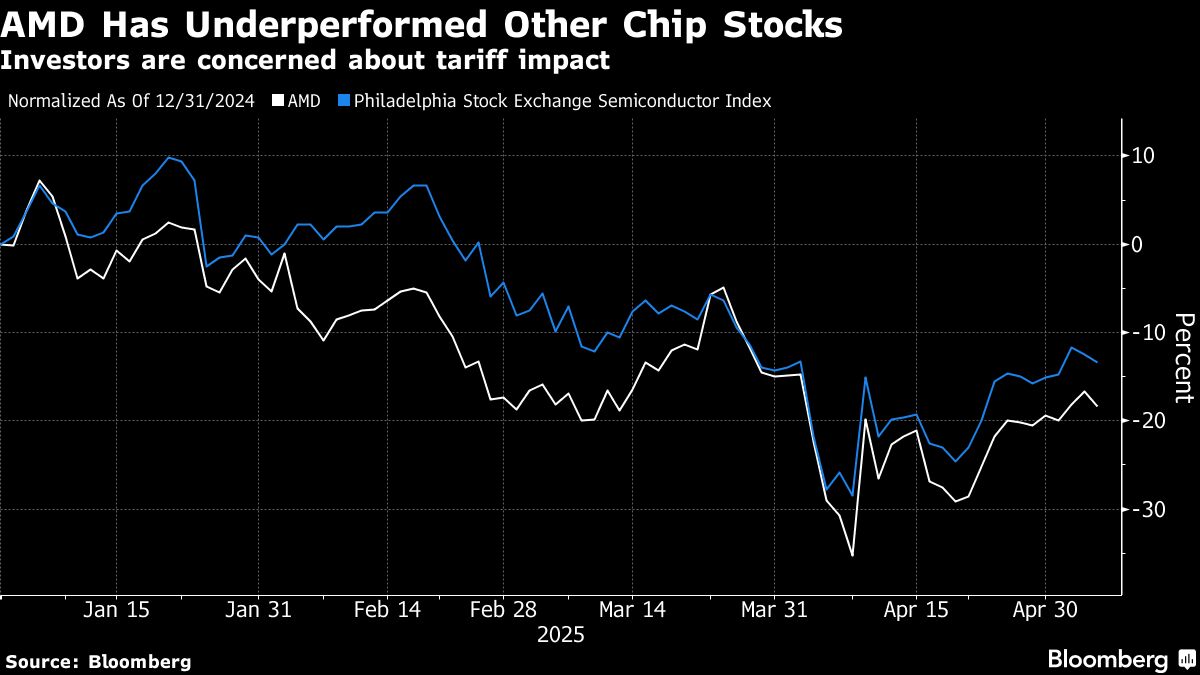

AMD's Q3 earnings reveal a significant blow to the company's bottom line, directly attributed to the escalating US-China tech war and newly implemented export controls. The chip giant has projected a staggering $1.5 billion reduction in revenue, a stark warning of the far-reaching consequences of the increasingly tense geopolitical landscape. This news sends shockwaves through the semiconductor industry, highlighting the vulnerability of global tech giants to rapidly shifting international relations.

The announcement, made alongside AMD's third-quarter earnings report, underscores the substantial impact of the US government's restrictions on the export of advanced chips to China. These restrictions, designed to curb China's technological advancements in areas deemed critical to national security, are severely impacting companies like AMD that rely heavily on the Chinese market.

<h3>A Deep Dive into the Financial Fallout</h3>

AMD CEO Lisa Su explicitly linked the projected revenue shortfall to the export controls, stating that the impact would be most acutely felt in the coming quarters. The company's guidance for the fourth quarter reflects this significant downturn, painting a picture of a challenging road ahead for the semiconductor giant. This isn't just about lost sales; it represents a strategic recalibration for AMD, forcing the company to reassess its long-term growth strategy in a drastically altered market.

- Significant Revenue Decline: The $1.5 billion hit represents a substantial portion of AMD's projected revenue, impacting both its data center and client segments. Analysts are already revising their forecasts for AMD's performance, reflecting the uncertainty caused by these geopolitical headwinds.

- Impact on Data Center Sales: The restrictions particularly affect AMD's data center business, a key driver of growth in recent years. The restrictions limit the sale of high-performance computing chips crucial for artificial intelligence and other advanced applications, a market where China is a major player.

- Long-Term Strategic Implications: This situation compels AMD to rethink its China strategy and diversify its markets to mitigate future risks. The company may need to invest more heavily in regions less impacted by the US-China trade tensions.

<h3>The Broader Implications for the Semiconductor Industry</h3>

AMD's predicament is not an isolated incident. The US-China chip export restrictions are creating significant uncertainty and disruption across the entire semiconductor industry. Other companies are grappling with similar challenges, forcing a reassessment of supply chains and market strategies. This situation highlights the increasing interconnectedness of the global economy and the profound geopolitical risks faced by multinational corporations.

<h3>Looking Ahead: Navigating Uncertainty</h3>

The future remains uncertain. The ongoing trade tensions between the US and China suggest that further restrictions or retaliatory measures could be implemented. AMD, along with the rest of the semiconductor industry, will need to navigate this complex landscape with agility and resilience. This situation underlines the need for diversification, innovation, and proactive risk management in an increasingly volatile global environment. The company’s ability to adapt and innovate will be key to mitigating the long-term effects of these restrictions. The evolving geopolitical climate will undoubtedly continue to shape the future of the semiconductor industry, requiring constant adaptation and strategic re-evaluation from industry leaders.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMD: $1.5 Billion Revenue Hit Projected From US China Chip Export Restrictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amd Sales Surge But China Concerns Cast A Shadow

May 07, 2025

Amd Sales Surge But China Concerns Cast A Shadow

May 07, 2025 -

The Okc Thunder And The Nba Playoffs Analyzing The Advantage Of A Larger Gap In The Schedule

May 07, 2025

The Okc Thunder And The Nba Playoffs Analyzing The Advantage Of A Larger Gap In The Schedule

May 07, 2025 -

Pat Spencer The Lacrosse Record Holder Who Conquered The Nbas Golden State Warriors

May 07, 2025

Pat Spencer The Lacrosse Record Holder Who Conquered The Nbas Golden State Warriors

May 07, 2025 -

Analysis Trumps Rambling Statement And The Gretzky Reference

May 07, 2025

Analysis Trumps Rambling Statement And The Gretzky Reference

May 07, 2025 -

Game 2 Update Garland Mobley And Hunter Out For Cavaliers Vs Pacers

May 07, 2025

Game 2 Update Garland Mobley And Hunter Out For Cavaliers Vs Pacers

May 07, 2025

Latest Posts

-

Western Australia Welcomes 18th Nrl Team After Arlc Government Agreement

May 08, 2025

Western Australia Welcomes 18th Nrl Team After Arlc Government Agreement

May 08, 2025 -

Hallucinations In Chat Gpt A Growing Concern As Intelligence Improves

May 08, 2025

Hallucinations In Chat Gpt A Growing Concern As Intelligence Improves

May 08, 2025 -

The Future Of Ai Connecting Ai Agents To All Saa S Platforms

May 08, 2025

The Future Of Ai Connecting Ai Agents To All Saa S Platforms

May 08, 2025 -

Stunning Nba Playoffs Nuggets And Knicks Score Opening Round Victories

May 08, 2025

Stunning Nba Playoffs Nuggets And Knicks Score Opening Round Victories

May 08, 2025 -

Crypto Market Update Stellar Xlm Faces Downward Pressure Support At Risk

May 08, 2025

Crypto Market Update Stellar Xlm Faces Downward Pressure Support At Risk

May 08, 2025