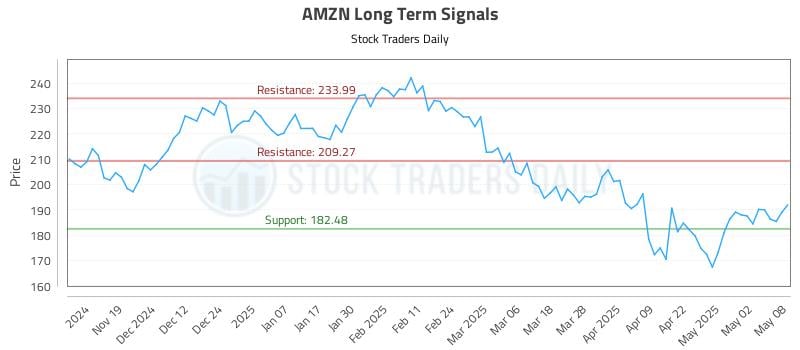

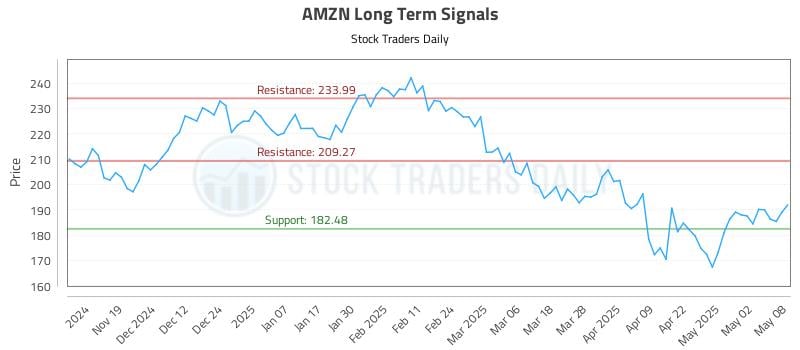

AMZN Investment Report 2024: Key Trends And Financial Projections

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMZN Investment Report 2024: Navigating Key Trends and Financial Projections

Amazon (AMZN) continues to be a titan in the e-commerce and cloud computing landscapes, but 2024 presents a complex investment picture. This report delves into the key trends shaping AMZN's performance and offers financial projections for the coming year, helping investors navigate the uncertainties ahead.

Navigating the Shifting Sands of E-commerce

Amazon's dominance in online retail remains undeniable, but the sector is far from static. Key trends influencing AMZN's e-commerce performance in 2024 include:

- Inflationary Pressures: Persistent inflation impacts consumer spending, potentially squeezing AMZN's margins and sales growth. Investors should carefully monitor consumer discretionary spending data for clues about future performance.

- Competition Intensifies: Competition from established players like Walmart and burgeoning e-commerce platforms continues to heat up. AMZN's ability to maintain market share will be crucial for sustained growth.

- Supply Chain Resilience: AMZN's success hinges on a robust and efficient supply chain. Any disruptions, whether due to geopolitical instability or unforeseen logistical challenges, could significantly impact profitability.

- Prime Membership Retention: The Prime membership program is a cornerstone of AMZN's success. Maintaining and growing this subscriber base is vital, requiring continuous innovation and value-added services.

AWS: The Engine of Growth?

Amazon Web Services (AWS) remains a significant driver of AMZN's profitability. However, the cloud computing market is becoming increasingly competitive, with Microsoft Azure and Google Cloud Platform nipping at its heels. Key factors to watch in 2024 include:

- Enterprise Spending: Fluctuations in enterprise IT spending directly impact AWS revenue. Economic downturns could lead to reduced cloud adoption, impacting AMZN's growth trajectory.

- Innovation and New Services: AWS's ability to innovate and introduce new cloud services is paramount to maintain its competitive edge. Investors should closely follow announcements of new products and features.

- Pricing Strategies: Competitive pricing pressures might necessitate adjustments to AWS's pricing models, potentially affecting margins.

Financial Projections for AMZN in 2024 (Estimates):

These projections are based on current market trends and expert analyses and should be considered speculative:

- Revenue Growth: A moderate revenue growth of 10-15% is anticipated, reflecting a slowdown compared to previous years. This reflects the ongoing economic uncertainties and increased competition.

- Earnings Per Share (EPS): EPS growth is expected to be in the range of 5-10%, constrained by inflationary pressures and increased operating expenses.

- Profit Margins: Profit margins are likely to remain under pressure due to increased competition and rising operational costs. AMZN will need to focus on efficiency gains to offset these pressures.

Investment Outlook and Considerations:

Investing in AMZN in 2024 requires a nuanced approach. While the company remains a dominant force in its core markets, several headwinds pose significant challenges. Investors should:

- Diversify Portfolios: Don't over-concentrate investments in a single stock, especially in a volatile market.

- Monitor Key Metrics: Closely monitor AMZN's quarterly earnings reports, paying close attention to revenue growth, EPS, and profit margins.

- Stay Informed: Keep abreast of industry trends, competitive dynamics, and macroeconomic factors affecting AMZN's performance.

Disclaimer: This report provides an analysis of AMZN's potential performance in 2024 and is not intended as financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMZN Investment Report 2024: Key Trends And Financial Projections. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Growing Fears Of A New Nakba In Palestine Un Committee Issues Urgent Warning

May 12, 2025

Growing Fears Of A New Nakba In Palestine Un Committee Issues Urgent Warning

May 12, 2025 -

Muhammad Vs Della Maddalena Complete Ufc 315 Fight Scorecards

May 12, 2025

Muhammad Vs Della Maddalena Complete Ufc 315 Fight Scorecards

May 12, 2025 -

Godzilla X Kong The New Empire Production Begins Sequel Teaser And Title Confirmed

May 12, 2025

Godzilla X Kong The New Empire Production Begins Sequel Teaser And Title Confirmed

May 12, 2025 -

India And Pakistan Claim Victory Following Ceasefire Agreement

May 12, 2025

India And Pakistan Claim Victory Following Ceasefire Agreement

May 12, 2025 -

Not The Time To Panic Mc Tominays Post Match Message To Napoli After Serie A Stumble

May 12, 2025

Not The Time To Panic Mc Tominays Post Match Message To Napoli After Serie A Stumble

May 12, 2025

Latest Posts

-

Taylan May Injury Closer To Nrl Return Than Ever Before

May 12, 2025

Taylan May Injury Closer To Nrl Return Than Ever Before

May 12, 2025 -

Show Some Respect Beckhams Response To Minnesota Uniteds Social Media Goading

May 12, 2025

Show Some Respect Beckhams Response To Minnesota Uniteds Social Media Goading

May 12, 2025 -

Fan Fury Netflix Defends Season 3 Renewal Of Critically Panned Drama Series

May 12, 2025

Fan Fury Netflix Defends Season 3 Renewal Of Critically Panned Drama Series

May 12, 2025 -

Figmas Ceo Unveils Innovative Ai Approach For Design

May 12, 2025

Figmas Ceo Unveils Innovative Ai Approach For Design

May 12, 2025 -

Gmas Breakfast In Bed Surprise For A Beloved Mom And Teacher

May 12, 2025

Gmas Breakfast In Bed Surprise For A Beloved Mom And Teacher

May 12, 2025