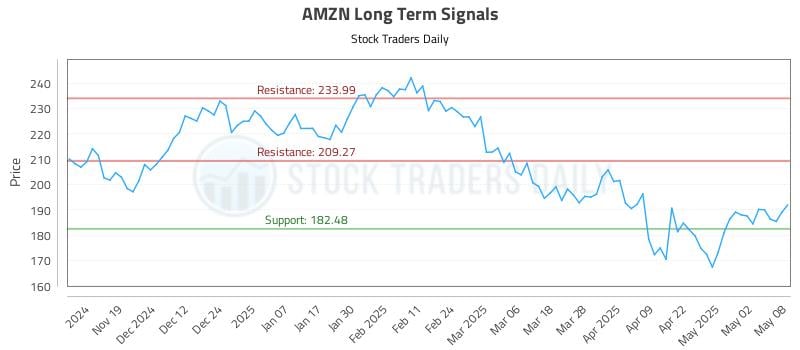

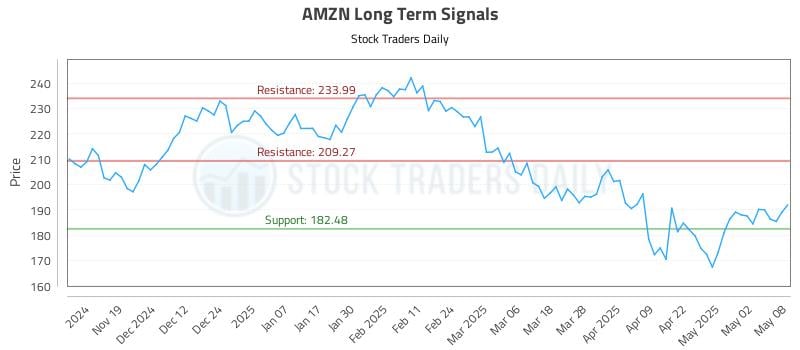

AMZN Investment Report 2024: Trends, Risks, And Opportunities

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMZN Investment Report 2024: Navigating Trends, Risks, and Opportunities in the Amazon Colossus

Amazon (AMZN) remains a behemoth in the e-commerce, cloud computing, and advertising landscapes. However, 2024 presents a complex investment picture, demanding a nuanced understanding of emerging trends, significant risks, and lucrative opportunities. This report delves into the key factors shaping AMZN's trajectory and offers insights for investors.

H2: Key Trends Shaping Amazon's 2024 Outlook

Several significant trends will heavily influence Amazon's performance throughout 2024. These include:

- E-commerce Growth and Competition: While Amazon maintains a dominant market share, increasing competition from established players and agile startups necessitates ongoing innovation and strategic adaptation. Expect continued focus on Prime membership benefits, personalized recommendations, and expanding into new markets.

- AWS Cloud Dominance and Expansion: Amazon Web Services (AWS) remains a leader in cloud computing. However, intensifying rivalry from Microsoft Azure and Google Cloud Platform requires AWS to continuously innovate and offer competitive pricing and services. Growth in emerging cloud technologies like AI and machine learning will be crucial.

- Advertising Revenue Growth: Amazon's advertising business continues to expand, leveraging its vast customer base and detailed purchasing data. This segment is expected to show strong growth, driven by targeted advertising solutions and the increasing adoption of programmatic advertising.

- Supply Chain Resilience and Optimization: Following supply chain disruptions in recent years, Amazon is prioritizing resilience and efficiency. This involves investing in its logistics network, expanding fulfillment centers strategically, and exploring automation technologies.

- Global Expansion and Emerging Markets: International expansion remains a key focus. Growth in emerging markets presents significant opportunities, but also introduces challenges related to regulation, logistics, and cultural adaptation.

H2: Assessing the Risks Faced by Amazon in 2024

Despite its strengths, AMZN faces several significant risks:

- Economic Slowdown: A global economic slowdown could significantly impact consumer spending, affecting Amazon's e-commerce sales and advertising revenue.

- Inflation and Rising Costs: Increased inflation and rising operating costs put pressure on margins and profitability. Managing these challenges efficiently is crucial for maintaining competitiveness.

- Regulatory Scrutiny and Antitrust Concerns: Amazon faces ongoing scrutiny from regulators worldwide concerning antitrust issues, data privacy, and its market dominance. Negative regulatory outcomes could lead to significant financial and operational challenges.

- Labor Relations and Employee Costs: Maintaining positive labor relations and managing employee costs effectively are critical, given the increasing focus on worker rights and fair labor practices.

- Cybersecurity Threats and Data Breaches: Protecting sensitive customer data and maintaining robust cybersecurity measures are paramount to safeguarding brand reputation and preventing financial losses.

H2: Identifying Opportunities for AMZN Investors in 2024

Despite the risks, several compelling opportunities exist for AMZN investors:

- Investment in AI and Machine Learning: Amazon's continued investment in AI and machine learning presents significant long-term growth potential across its various business segments.

- Expansion into New Technologies: Exploring and investing in promising new technologies like autonomous delivery, drone technology, and further advancements in cloud computing will drive future growth.

- Strategic Acquisitions and Partnerships: Strategic acquisitions and partnerships can provide access to new technologies, markets, and talent, accelerating growth and innovation.

- Focus on Sustainability Initiatives: Increasing consumer and investor focus on environmental, social, and governance (ESG) factors presents an opportunity for Amazon to enhance its brand image and attract environmentally conscious consumers.

- Prime Membership Growth and Expansion: Continued growth and enhancement of the Amazon Prime membership program remains a key driver of customer loyalty and revenue growth.

H2: Conclusion: A Cautious Optimism for AMZN in 2024

Amazon's future success depends on its ability to navigate a complex and dynamic environment. While significant risks exist, the opportunities for long-term growth and innovation remain compelling. Investors should adopt a cautious yet optimistic approach, carefully evaluating the evolving landscape and adapting their investment strategies accordingly. Diversification within a broader portfolio remains a prudent strategy. Regularly monitoring AMZN's financial performance, regulatory updates, and competitive dynamics is essential for making informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMZN Investment Report 2024: Trends, Risks, And Opportunities. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

102 97 Defeat For Warriors Butler Iii And Kuminga Lead The Charge But Timberwolves Prevail

May 12, 2025

102 97 Defeat For Warriors Butler Iii And Kuminga Lead The Charge But Timberwolves Prevail

May 12, 2025 -

Ginny And Georgia Season 3 Official Release Date Announced By Netflix

May 12, 2025

Ginny And Georgia Season 3 Official Release Date Announced By Netflix

May 12, 2025 -

Major Security Breach Averted Bomb Plot Against Lady Gagas Copacabana Performance

May 12, 2025

Major Security Breach Averted Bomb Plot Against Lady Gagas Copacabana Performance

May 12, 2025 -

Automation Anxiety Massive Job Losses At Tech Giants Ibm And Crowd Strike

May 12, 2025

Automation Anxiety Massive Job Losses At Tech Giants Ibm And Crowd Strike

May 12, 2025 -

Unveiling The Fiancee Of Marvels Stars Name Family Life And Fortune

May 12, 2025

Unveiling The Fiancee Of Marvels Stars Name Family Life And Fortune

May 12, 2025

Latest Posts

-

The Legacy Of Lyanna Mormont Bella Ramseys Performance Analyzed

May 12, 2025

The Legacy Of Lyanna Mormont Bella Ramseys Performance Analyzed

May 12, 2025 -

Philippine Midterm Elections Australian Based Filipinos Vote Online

May 12, 2025

Philippine Midterm Elections Australian Based Filipinos Vote Online

May 12, 2025 -

Us And China Reach Historic Agreement On Tariff Reduction

May 12, 2025

Us And China Reach Historic Agreement On Tariff Reduction

May 12, 2025 -

Should You Buy This Ai Stock Now Expert Predicts Massive Future Growth

May 12, 2025

Should You Buy This Ai Stock Now Expert Predicts Massive Future Growth

May 12, 2025 -

Tensions Ease India Pakistan Top Military Officials To Discuss Ceasefire

May 12, 2025

Tensions Ease India Pakistan Top Military Officials To Discuss Ceasefire

May 12, 2025