AMZN Investment Report: Risks And Rewards Of Investing In Amazon

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMZN Investment Report: Risks and Rewards of Investing in Amazon

Amazon (AMZN). The name conjures images of lightning-fast deliveries, a seemingly endless online marketplace, and a technological behemoth reshaping industries. But for investors, the question isn't just about the convenience of Amazon's services; it's about the risks and rewards of investing in AMZN stock. This report delves into the complexities of this tech giant, exploring both its immense potential and the challenges it faces.

Amazon's Strengths: A Juggernaut of E-commerce and Beyond

Amazon's dominance in e-commerce is undeniable. Its market capitalization speaks volumes, cementing its position as a blue-chip stock for many. However, its success extends far beyond online retail. The company boasts a thriving cloud computing division (Amazon Web Services or AWS), a rapidly expanding advertising platform, and ambitious ventures into areas like streaming (Amazon Prime Video), smart home devices (Alexa), and grocery (Whole Foods Market).

- AWS Dominance: AWS is a cash cow, generating substantial revenue and significant profits for Amazon. Its cloud infrastructure services power countless businesses, providing a stable and recurring revenue stream.

- E-commerce Leadership: Amazon's prime position in the e-commerce market offers a significant competitive advantage, with its vast network, logistical prowess, and loyal customer base.

- Diversification: Amazon's diversification into various sectors mitigates risk. If one area experiences a downturn, others can offset the losses.

- Innovation: Amazon consistently invests heavily in research and development, driving innovation and maintaining its competitive edge.

Navigating the Risks: Challenges Facing Amazon's Future

Despite its strengths, investing in Amazon isn't without risks. Several factors could impact the company's future performance:

- Increased Competition: The e-commerce landscape is increasingly competitive, with rivals like Walmart, Target, and Shopify vying for market share.

- Regulatory Scrutiny: Amazon faces growing regulatory scrutiny concerning antitrust concerns, labor practices, and data privacy. Potential fines and regulations could significantly impact profitability.

- Economic Slowdowns: Recessions can negatively affect consumer spending, potentially impacting Amazon's sales and growth.

- Supply Chain Issues: Global supply chain disruptions can affect Amazon's ability to fulfill orders efficiently and maintain its reputation for timely deliveries.

- Labor Relations: Amazon's labor practices have faced considerable criticism, leading to potential legal battles and reputational damage.

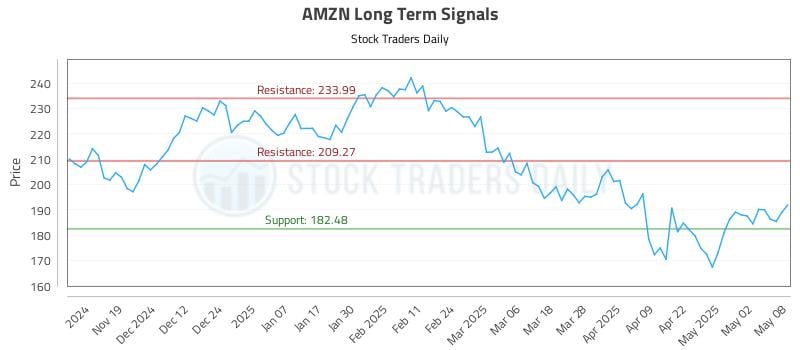

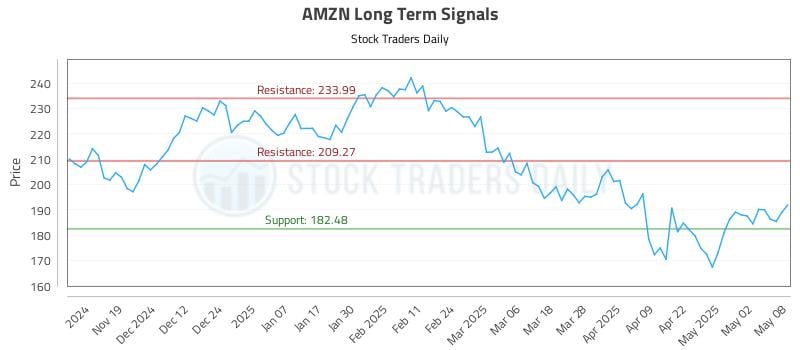

Amazon Stock (AMZN): A Long-Term Investment Perspective?

Investing in AMZN requires a long-term outlook. While short-term fluctuations are inevitable, Amazon's underlying strength and diversification make it an attractive option for long-term investors with a higher risk tolerance. However, it's crucial to conduct thorough due diligence and consider your individual investment goals and risk tolerance before investing.

Analyzing AMZN: Key Metrics to Consider

Before making any investment decisions, analyze key financial metrics such as:

- Revenue Growth: Monitor Amazon's year-over-year revenue growth to assess its overall performance.

- Profit Margins: Analyze Amazon's profit margins to understand its profitability and efficiency.

- Earnings Per Share (EPS): Track EPS to evaluate the company's profitability on a per-share basis.

- Debt Levels: Assess Amazon's debt levels to understand its financial health.

- Cash Flow: Examine Amazon's cash flow to determine its ability to generate cash and fund future growth.

Conclusion: Weighing the Potential and the Pitfalls

Investing in Amazon presents both substantial opportunities and significant risks. The company's dominance in multiple sectors and commitment to innovation are compelling reasons for optimism. However, growing competition, regulatory pressure, and economic uncertainties must be carefully considered. Thorough research, diversification within your investment portfolio, and a long-term perspective are essential for navigating the complexities of investing in AMZN. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMZN Investment Report: Risks And Rewards Of Investing In Amazon. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Naomi Osaka Vs Peyton Stearns Betting Odds Prediction And Match Preview Italian Open 2025

May 13, 2025

Naomi Osaka Vs Peyton Stearns Betting Odds Prediction And Match Preview Italian Open 2025

May 13, 2025 -

Warren Buffett Recorta Su Participacion En Apple En Un 13 Analisis De La Decision

May 13, 2025

Warren Buffett Recorta Su Participacion En Apple En Un 13 Analisis De La Decision

May 13, 2025 -

West Broms Next Manager Swansea Citys Ex Boss Ruled Out

May 13, 2025

West Broms Next Manager Swansea Citys Ex Boss Ruled Out

May 13, 2025 -

Taylan Mays Road To Recovery Nrl Comeback Nears Completion

May 13, 2025

Taylan Mays Road To Recovery Nrl Comeback Nears Completion

May 13, 2025 -

Kanyes Post Mothers Death Struggles A Former Collaborator Speaks Out

May 13, 2025

Kanyes Post Mothers Death Struggles A Former Collaborator Speaks Out

May 13, 2025

Latest Posts

-

Artificial Intelligence And The Naming Of Pope Leo Xiv

May 13, 2025

Artificial Intelligence And The Naming Of Pope Leo Xiv

May 13, 2025 -

Post May 28th Outlook Ai Semiconductor Stock Investment Opportunities

May 13, 2025

Post May 28th Outlook Ai Semiconductor Stock Investment Opportunities

May 13, 2025 -

Queensland Politics Labor Mp Expelled Following Domestic Violence Claims

May 13, 2025

Queensland Politics Labor Mp Expelled Following Domestic Violence Claims

May 13, 2025 -

Where Will Nvda Stock Be In 5 Years Expert Analysis

May 13, 2025

Where Will Nvda Stock Be In 5 Years Expert Analysis

May 13, 2025 -

Eva Longorias Bold Statement Does It Rule Out A Desperate Housewives Reunion

May 13, 2025

Eva Longorias Bold Statement Does It Rule Out A Desperate Housewives Reunion

May 13, 2025