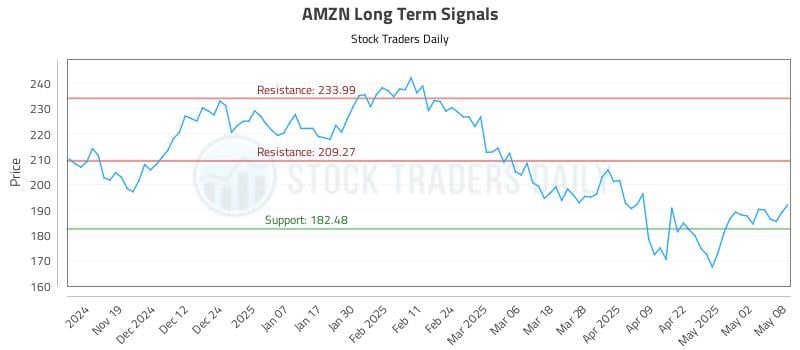

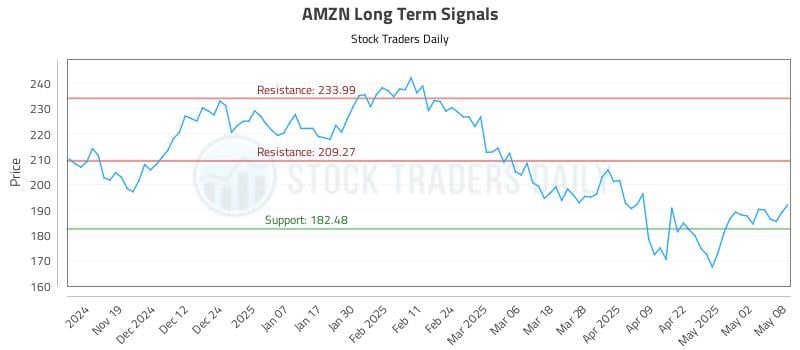

AMZN Stock: A Comprehensive Investment Report For 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMZN Stock: A Comprehensive Investment Report for 2024

Amazon (AMZN) stock. The very name conjures images of online shopping behemoths, cloud computing giants, and innovative technological advancements. But is investing in AMZN stock in 2024 a smart move? This comprehensive report delves into the current market landscape, analyzing the strengths, weaknesses, opportunities, and threats (SWOT) facing Amazon, providing you with the insights you need to make informed investment decisions.

Amazon's 2023 Performance and the Road Ahead

2023 presented a mixed bag for Amazon. While its cloud computing arm, Amazon Web Services (AWS), continued its impressive growth, the e-commerce sector faced headwinds from inflation and shifting consumer spending habits. This volatility makes predicting AMZN's trajectory in 2024 a complex task, requiring careful consideration of several key factors.

Strengths:

- Dominant Market Position: Amazon remains a dominant force in e-commerce, holding significant market share globally. Its vast logistics network, Prime membership program, and extensive product selection provide a strong competitive advantage.

- AWS Growth: Amazon Web Services is a powerhouse in the cloud computing market, consistently delivering strong revenue growth and high profit margins. This segment is a key driver of Amazon's overall profitability.

- Innovation and Expansion: Amazon continuously invests in research and development, expanding into new markets and exploring innovative technologies such as artificial intelligence (AI) and robotics. This commitment to innovation positions the company for future growth.

- Strong Brand Recognition: The Amazon brand enjoys unparalleled global recognition and trust, providing a powerful foundation for future expansion and marketing initiatives.

Weaknesses:

- E-commerce Competition: Increasing competition from other e-commerce giants and smaller, specialized retailers poses a significant challenge to Amazon's market dominance.

- Labor Costs and Logistics: Rising labor costs and potential supply chain disruptions can impact profitability and operational efficiency.

- Regulatory Scrutiny: Amazon faces ongoing regulatory scrutiny concerning antitrust concerns and its labor practices, which could lead to increased compliance costs and potential fines.

- Economic Volatility: Global economic uncertainty and potential recessions can significantly impact consumer spending and, consequently, Amazon's e-commerce revenues.

Opportunities:

- Growth in Emerging Markets: Expanding into and further penetrating emerging markets presents significant growth opportunities for Amazon's e-commerce and AWS businesses.

- AI and Machine Learning: Leveraging AI and machine learning across its various business segments can enhance efficiency, personalize customer experiences, and drive innovation.

- Advertising Revenue Growth: Amazon's advertising business continues to grow rapidly, presenting a significant revenue stream with further expansion potential.

- Subscription Services Expansion: Expanding its suite of subscription services beyond Prime can diversify revenue streams and enhance customer loyalty.

Threats:

- Geopolitical Risks: Global geopolitical instability can disrupt supply chains, impact consumer spending, and negatively affect Amazon's operations in various regions.

- Increased Competition in AWS: Intensifying competition in the cloud computing market from Microsoft Azure and Google Cloud poses a threat to AWS's market share.

- Inflation and Interest Rates: Persistently high inflation and rising interest rates can impact consumer spending and increase borrowing costs for Amazon.

- Cybersecurity Threats: Protecting sensitive customer data and infrastructure from cybersecurity threats is crucial for maintaining consumer trust and business operations.

Investment Considerations for 2024:

AMZN stock presents a compelling investment opportunity for long-term investors with a high risk tolerance. However, the current economic climate and increased competition warrant a cautious approach. Thorough due diligence, diversification of your investment portfolio, and a long-term investment horizon are crucial. Consider consulting a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in stocks involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMZN Stock: A Comprehensive Investment Report For 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Latest Lotto And Super Enalotto Results Your Winning Numbers Here

May 12, 2025

Latest Lotto And Super Enalotto Results Your Winning Numbers Here

May 12, 2025 -

Analyzing The Tesla Stock Downturn Long Term Outlook And Investment Strategies

May 12, 2025

Analyzing The Tesla Stock Downturn Long Term Outlook And Investment Strategies

May 12, 2025 -

Ai And The Future Of Design A Conversation With Figmas Ceo

May 12, 2025

Ai And The Future Of Design A Conversation With Figmas Ceo

May 12, 2025 -

The Sonos Leadership Transition A Conversation With Tom Conrad

May 12, 2025

The Sonos Leadership Transition A Conversation With Tom Conrad

May 12, 2025 -

Us And China Strike Deal Slashing Tariffs By 115

May 12, 2025

Us And China Strike Deal Slashing Tariffs By 115

May 12, 2025

Latest Posts

-

Cricket Legend Virat Kohli Calls Time On Test Career The 269 Announcement

May 13, 2025

Cricket Legend Virat Kohli Calls Time On Test Career The 269 Announcement

May 13, 2025 -

Invista Em Cotas Praia E Campo Com Baixo Investimento Inicial Em Imoveis

May 13, 2025

Invista Em Cotas Praia E Campo Com Baixo Investimento Inicial Em Imoveis

May 13, 2025 -

Deep Dive Ethereums Pectra Upgrade And Its Future

May 13, 2025

Deep Dive Ethereums Pectra Upgrade And Its Future

May 13, 2025 -

Despite Mc Tominays Double Assist Napoli Stumbles Not The Time To Panic

May 13, 2025

Despite Mc Tominays Double Assist Napoli Stumbles Not The Time To Panic

May 13, 2025 -

Analyzing The Raptors Lottery Chances A Path To Higher Ceiling

May 13, 2025

Analyzing The Raptors Lottery Chances A Path To Higher Ceiling

May 13, 2025