AMZN Stock: Comprehensive Investment Report And Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMZN Stock: A Comprehensive Investment Report and Analysis

Amazon (AMZN) stock has been a rollercoaster ride for investors in recent years, fluctuating wildly amidst economic uncertainty and shifting consumer trends. But is it a buy, sell, or hold? This comprehensive investment report delves into the current state of AMZN stock, providing a detailed analysis to help you make informed investment decisions.

Understanding Amazon's Multifaceted Business Model:

Amazon's success stems from its diverse business model, encompassing several key segments:

-

E-commerce: The undisputed king of online retail, Amazon dominates the market with its vast selection, competitive pricing, and unparalleled convenience. This core segment remains a significant driver of revenue. However, increased competition and changing consumer spending habits are factors to consider.

-

Amazon Web Services (AWS): A powerhouse in cloud computing, AWS provides a wide range of services to businesses globally. This high-margin segment consistently delivers strong growth and is a crucial factor in Amazon's overall profitability. Competition from Microsoft Azure and Google Cloud Platform is intensifying, though AWS maintains a significant market share.

-

Advertising: Amazon's advertising platform is rapidly expanding, leveraging its vast customer base and data to deliver targeted ads. This segment presents significant growth potential and contributes significantly to the company's bottom line.

-

Subscription Services: Amazon Prime, with its free shipping and entertainment benefits, is a cornerstone of customer loyalty and a recurring revenue stream. The success of Prime Video and other subscription services contributes to the company's overall value proposition.

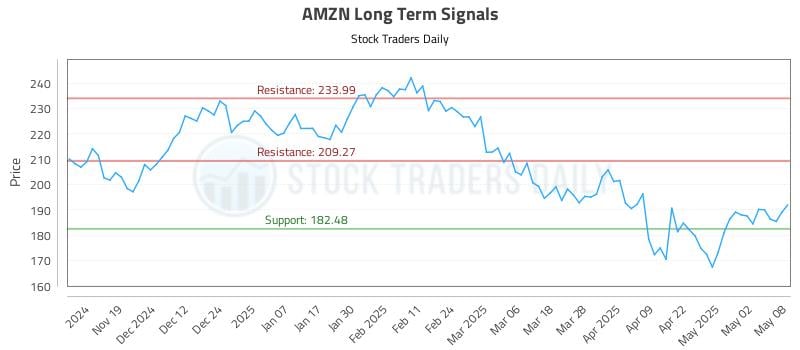

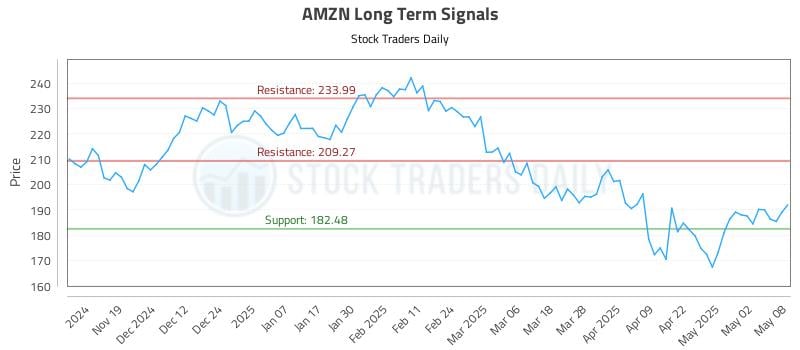

AMZN Stock: Current Market Performance and Future Outlook:

Recent AMZN stock performance has been mixed, reflecting both positive and negative influences. While the company continues to demonstrate strong growth in certain sectors like AWS, overall profitability has faced pressure. Several key factors influence the future outlook:

-

Inflation and Consumer Spending: Economic uncertainty and inflationary pressures affect consumer spending, potentially impacting Amazon's e-commerce sales. The company's ability to adapt to these challenges will be crucial.

-

Competition: Amazon faces stiff competition from established players and emerging rivals across its various business segments. Maintaining a competitive edge will be essential for sustained growth.

-

Technological Innovation: Amazon's commitment to innovation, particularly in areas such as artificial intelligence and logistics, is vital for long-term success. Continued investment in research and development is crucial for staying ahead of the curve.

-

Regulatory Scrutiny: Increased regulatory scrutiny poses potential challenges, particularly concerning antitrust issues and data privacy. Navigating these regulatory landscapes effectively will be important for maintaining a positive market perception.

Key Financial Metrics and Valuation:

Investors should carefully review Amazon's key financial metrics, including revenue growth, profit margins, and earnings per share (EPS), to gauge the company's financial health. Comparative analysis with industry peers and historical performance data is vital for making informed investment decisions. A thorough valuation analysis, considering factors such as discounted cash flow (DCF) and price-to-earnings (P/E) ratios, will help determine if the current stock price reflects the company's intrinsic value.

Investment Recommendation:

Determining whether AMZN stock is a buy, sell, or hold requires a comprehensive assessment of the factors discussed above. While the long-term outlook for Amazon remains generally positive given its diverse business model and strong brand recognition, the current market conditions present both opportunities and risks. Investors should conduct their own thorough due diligence before making any investment decisions. Consulting with a financial advisor is highly recommended.

Disclaimer: This article provides general information and analysis and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money. Always conduct thorough research and consult with a qualified professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMZN Stock: Comprehensive Investment Report And Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Controlling Your Reality The Impact Of Your Thoughts

May 12, 2025

Controlling Your Reality The Impact Of Your Thoughts

May 12, 2025 -

Ai And The Future Of Figma An Interview With Ceo Dylan Field

May 12, 2025

Ai And The Future Of Figma An Interview With Ceo Dylan Field

May 12, 2025 -

Un Committee Issues Dire Warning Palestine Faces Potential Second Nakba

May 12, 2025

Un Committee Issues Dire Warning Palestine Faces Potential Second Nakba

May 12, 2025 -

Virgin Media O2 And Daisy Merge 3 Billion Telecoms Giant Created

May 12, 2025

Virgin Media O2 And Daisy Merge 3 Billion Telecoms Giant Created

May 12, 2025 -

Champions League Hero Cody Gakpo Alan Shearer Hints At Liverpool Move

May 12, 2025

Champions League Hero Cody Gakpo Alan Shearer Hints At Liverpool Move

May 12, 2025

Latest Posts

-

Virat Kohli Retires From Test Cricket The End Of An Era

May 12, 2025

Virat Kohli Retires From Test Cricket The End Of An Era

May 12, 2025 -

South Essex Bypass Long Delays Expected Following Major Collision

May 12, 2025

South Essex Bypass Long Delays Expected Following Major Collision

May 12, 2025 -

Atp Rome Open R3 In Depth Preview And Predictions For Sinner De Jong Mensik And Marozsan

May 12, 2025

Atp Rome Open R3 In Depth Preview And Predictions For Sinner De Jong Mensik And Marozsan

May 12, 2025 -

Serie A Showdown Conte Calls For Calm As Napoli Fight For The Championship

May 12, 2025

Serie A Showdown Conte Calls For Calm As Napoli Fight For The Championship

May 12, 2025 -

Post Game 4 Analysis Thunders Hard Earned Victory Against Denver Nuggets

May 12, 2025

Post Game 4 Analysis Thunders Hard Earned Victory Against Denver Nuggets

May 12, 2025